Ethereum (ETH) Primed for 40% Surge—Key Ratio Signals ATH Breakout Imminent

Ethereum's gearing up for a heavyweight rally—and the charts aren't being subtle about it.

The breakout metric nobody's ignoring

A critical ratio—watched like a hawk by institutional traders—flashes the clearest buy signal since ETH's last bull run. The 40% upside target? Just a pit stop before all-time highs get demolished.

Why fundamentals won't matter (until they do)

Network upgrades? Fee reductions? Please—this is crypto. Price moves first, narratives catch up later. Though if you're into poetic justice, Ethereum's deflationary tokenomics are finally doing their job better than the Fed's inflation targets.

The cynical take

Wall Street's still 'discovering' ETH while degens front-run them—some things never change. But when the ratio says jump, even suits ask how high.

Dormant ETH Stays Quiet While Institutions Buy Aggressively

Over the last two weeks, Ethereum’s Age Consumed metric has collapsed from a spike of 795 million on July 10 to just 12.47 million today; a drop of more than 98%. This metric tracks how much ETH is being moved from old wallets that haven’t transacted in a long time.

When it drops sharply, it usually means long-term holders are holding their coins, not selling them into rallies.

In simple terms, ethereum is making new local highs, and the oldest holders aren’t blinking. That’s a strong signal of conviction for the ETH price; the kind of behavior you don’t typically see near market tops.

Age Consumed measures how much dormant ETH, coins that haven’t moved in a long time, suddenly become active, often used to track whether long-term holders are exiting or holding strong.

At the same time, institutional accumulation is heating up. One of the standout examples is SharpLink Gaming, which has added 19,084 ETH to its reserves in a single move, worth over $67.5 million.

SharpLink Gaming (@SharpLinkGaming) has added 19,084 $ETH, worth $67.52M, to its $ETH strategy reserve.

They now hold a total of 345,158 $ETH, valued at $1.22 billion.

Address: 0x0b26c05866e6353e46f4a7e2d10cb42d4b583e57 https://t.co/Mdb74Ghimx pic.twitter.com/Epylgr6m7O

Combined with previous buys, SharpLink holds 345,158 ETH, at press time, valued at over $1.22 billion. So while older ETH isn’t moving, major buyers are quietly loading up.

ETH/BTC Ratio Is Repeating Its All-Time High Setup

Since June 2025, the ETH/BTC ratio has climbed from 0.021 to 0.031, marking a 50% MOVE in Ethereum’s strength against Bitcoin. Ethereum’s current price of $3,753 is also nearly identical to where it stood in October 2021, right before the ratio climbed another 30% over five weeks; a move that carried ETH price to its all-time high of $4,878.

Back then, a 30% ratio (ETH/BTC) increase coincided with ETH rising from $3,800 to $4,870, a price gain of nearly 28%. If the ratio now follows that same path from its current level, a similar 28% move from $3,753 would put Ethereum near $4,800–$4,900, lining up almost exactly with the previous ATH breakout zone.

And if the psychological resistance level (the previous all-time high) is broken, there might not be a lot of resistance to the next key price discovery level of above $5,000.

The ETH/BTC ratio tracks how Ethereum is performing relative to Bitcoin and often signals when ETH is gaining market share ahead of major rallies. Meanwhile, ETH/BTC has already surged over 50% since June and continues to flash strong momentum via multi-EMA golden crossovers.

Ethereum Price Structure Projects A 40% Rally

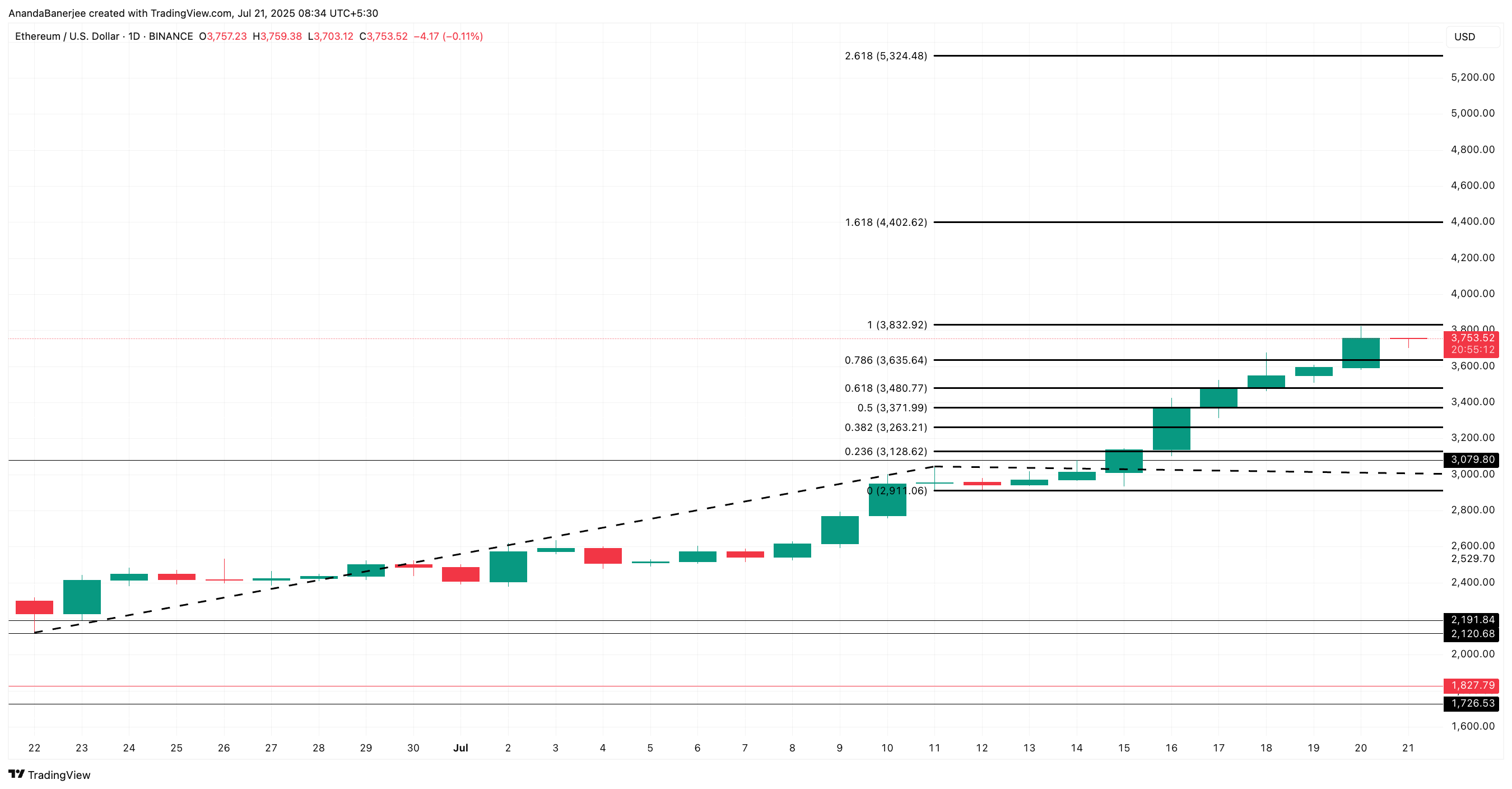

Ethereum’s price action is following a familiar roadmap, now moving in tandem with on-chain conviction and relative strength against Bitcoin. After reclaiming key resistance NEAR $3,635 (0.786 Fib level), the asset is consolidating just under the $3,832 zone. From here, the previous all-time high serves as a psychological barrier.

But first, ETH price needs to cross above $4,402 — the next key resistance.

In 2021, Ethereum rallied nearly 28% from this same zone as the ETH/BTC ratio climbed 30% in just over five weeks. Based on current levels, a similar move from $3,753 WOULD once again put Ethereum near its current all-time high.

But this time, with long-term holders inactive and ETH gaining dominance, there’s a clear case for price discovery to extend beyond that mark. If the previous high is broken with conviction, the structure suggests a continuation toward $5,324, representing a 41.86% move from the current price.

However, a breakdown below $3,128 would invalidate this structure and suggest that the rally has failed to carry through, making it the key support level to watch.