Coinbase Soars to All-Time High as Wall Street Bets Big on Crypto’s Breakout Week

Wall Street finally gets what it wanted—a reason to love crypto again. Coinbase stock just ripped past its previous peak, riding the wave of institutional FOMO after a flawless seven days for digital assets.

The rally nobody saw coming

Traders who dismissed crypto as 'dead money' last quarter are now scrambling for exposure. Coinbase's surge mirrors bitcoin's relentless climb—proving once again that this market dies hard.

Short sellers got steamrolled

Those betting against crypto's comeback got crushed. The stock's 30% monthly gain turned bearish thesis into confetti—just in time for bonus season.

Bonus jab: Some hedge funds will now claim they 'always believed' in blockchain—right after liquidating their positions at the 2024 lows.

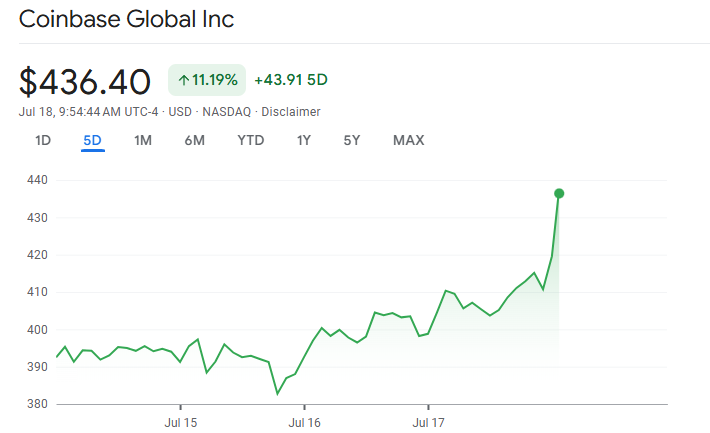

Coinbase Stock Hits All-Time High. Source: Google Finance

Coinbase Stock Hits All-Time High. Source: Google Finance

Investors responded swiftly. Coinbase, the largest US-listed crypto exchange, saw increased trading volume and renewed investor confidence.

Coinbase Shares jumped over 6% at the open, pushing the stock to, its highest price since listing on the Nasdaq in 2021.

Market analysts say the legislative momentum validates crypto’s long-term role in US finance. Regulatory clarity could pave the way for new products, listings, and institutional inflows.

Coinbase has long advocated for clear rules. With these bills advancing, it stands to benefit from increased stablecoin issuance and exchange activity.

Other crypto-related equities also gained. Robinhood, Riot, and Marathon Digital opened higher as traders digested the historic developments.