Trump Dynasty, Hut 8 & Tether Turbocharge Bitcoin Mining’s Hyper-Scale Future

The crypto-industrial complex just got a power surge. A unlikely alliance of political royalty, mining giants, and stablecoin titans is rewriting the rules of Bitcoin extraction—faster, bigger, and with Wall Street-level swagger.

Mining goes mega

Forget mom-and-pop rigs. We're talking about industrial-scale hashing operations that make traditional data centers look like dial-up internet. The players? A trifecta that'd make Satoshi blink: the Trump family's political machine, Hut 8's mining muscle, and Tether's bottomless liquidity.

The new mining playbook

No more begging for utility approvals or hunting for loose megawatts. This coalition cuts through red tape like a laser through butter—securing energy deals, land rights, and regulatory nods before the competition finishes their morning coffee. Meanwhile, institutional investors suddenly remember they 'always believed' in crypto fundamentals.

Hyper-scale or bust

The mining arms race just entered its ICBM phase. We're witnessing the corporate takeover of decentralization—complete with nine-figure equipment orders, power purchase agreements thicker than a Bitcoin whitepaper, and enough financial engineering to make a Goldman Sachs quant blush. Welcome to Bitcoin mining 3.0: where the hash rate's hot, the profits are volatile, and the energy bills could fund small nations.

Bitcoin Mining Will Hit New Heights in 2025

In the latest development, Tether CEO Paolo Ardoino has declared plans to deploy 450 MW of mining capacity by year-end, targeting 1% of the global hashrate. This goal is supported by the financial foundation of USDT, with a market cap of 157 billion USD. Previously, the company had planned to release its bitcoin Mining OS (MOS) as open-source software by Q4 2025.

“Also lots of small/mid sized businesses that produce their electricity (solar, …) will soon start mining with the excess. MOS will make their life easier.” Paolo Ardoino shared.

Tether’s announcement comes as Bitcoin’s hashrate sank to an 8-month low of 684.48 EH/s, the lowest since October 2024, with mining difficulty expected to decrease by 9.5% from 126.41T to 114.40T on June 29, 2025, according to CoinWarz. The disruption in Bitcoin mining coincides with US military actions in Iran.

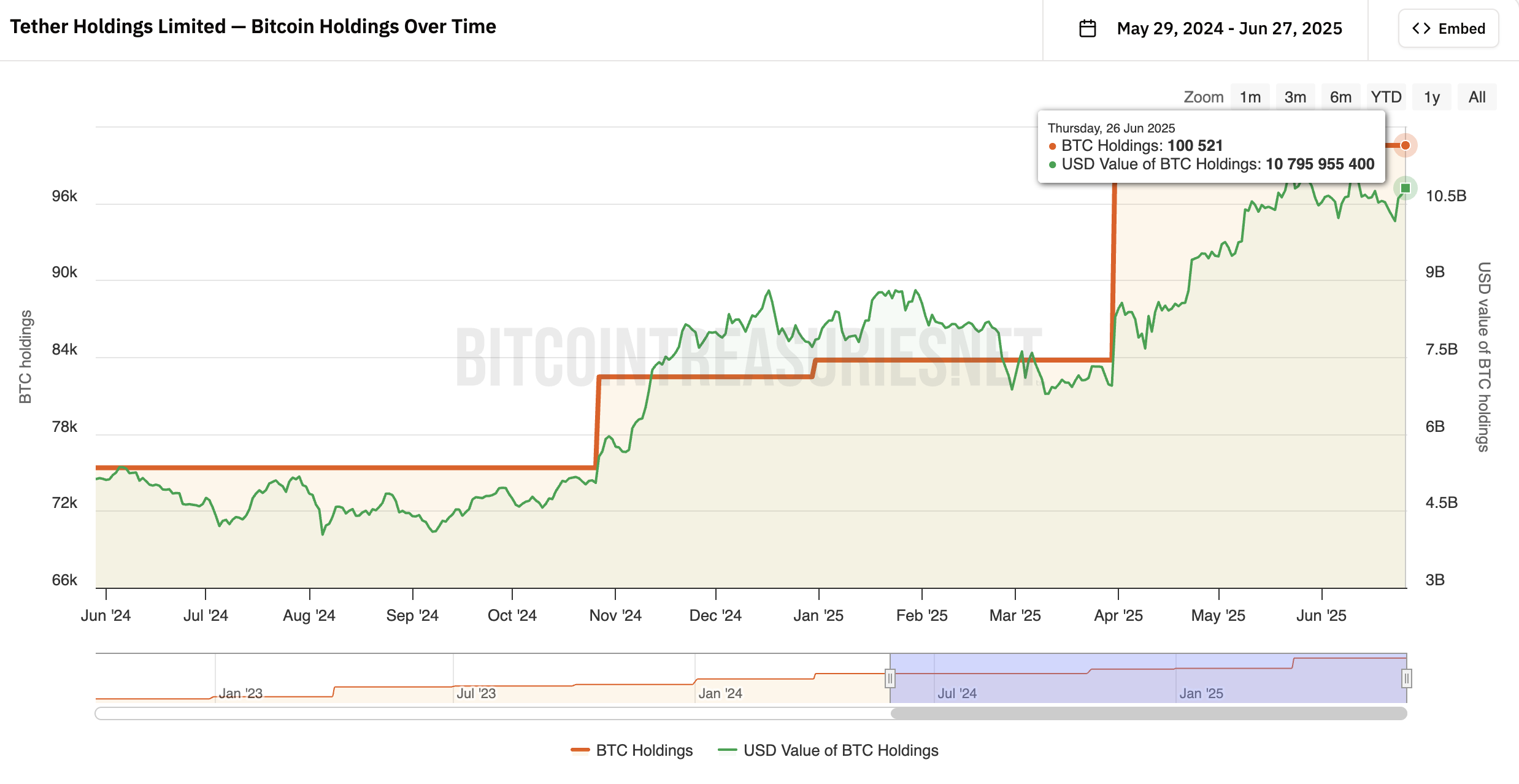

According to data from Bitcoin Treasuries, Tether currently holds over 100,000 Bitcoin (BTC), which is valued at approximately $10.8 billion. This is sparking fierce competition, accelerating the centralization trend as large companies outpace individual miners.

As a result, Bitcoin miners are selling off stocks to maintain upward momentum amid rising market instability, as reported by BeInCrypto.

Earlier, on March 31, 2025, Hut 8, a leading infrastructure mining company, partnered with American Bitcoin, co-founded by Donald TRUMP Jr. and Eric Trump, to leverage Donald Trump’s public support for cryptocurrencies.

This collaboration brings new capital and technology, potentially adding 5-10 EH/s to the global hashrate, which is crucial as mining costs have risen over 34% in Q2/2025 due to soaring electricity prices, as previously reported by BeInCrypto.

Advantages and Challenges

Technically, the involvement of Hut 8 and Tether could slow the difficulty reduction if hashrate recovers quickly, thanks to advanced technologies like Hut 8’s optimized cooling systems that reduce energy costs.

Simultaneously, crypto-friendly policies that Trump might push if re-elected, including tax incentives, could support this growth. Tether is also investing $1 billion in green mining infrastructure in El Salvador, aligning with global sustainability trends.

However, according to the EIA, challenges remain significant as industrial electricity demand in the US rises, which puts pressure on miners, benefiting large-scale operators like Hut 8 and Tether due to economies of scale.

With Bitcoin stable at $105,000 and the US stock market declining, the mining industry faces a major opportunity, but success hinges on cost management and regulatory compliance.