Grayscale Eyes 20 New Altcoins for Q3 Expansion—Here’s What It Means for Crypto

Grayscale just dropped a bombshell—20 fresh altcoins are now on its radar for Q3. The crypto giant’s 'Assets Under Consideration' list just got a major upgrade, signaling another aggressive push into the altcoin market.

Why it matters: When Grayscale sneezes, the crypto market catches a cold. Its moves often foreshadow institutional interest—or expose another round of speculative frenzy dressed up as 'due diligence.'

The fine print: No official confirmations yet, but history shows Grayscale’s 'consideration' phase often precedes full-blown product launches. Traders are already front-running the news—because nothing says 'healthy market' like betting on a fund manager’s maybe-list.

Bottom line: Brace for volatility. Whether this is smart diversification or just yield-chasing in a bull market depends on who you ask (and whether your bags are already packed).

Grayscale’s Newest Top 20 List

Grayscale Research periodically makes lists like this, updating its “Top 20” alongside “Assets Under Consideration” and other sector-specific assessments.

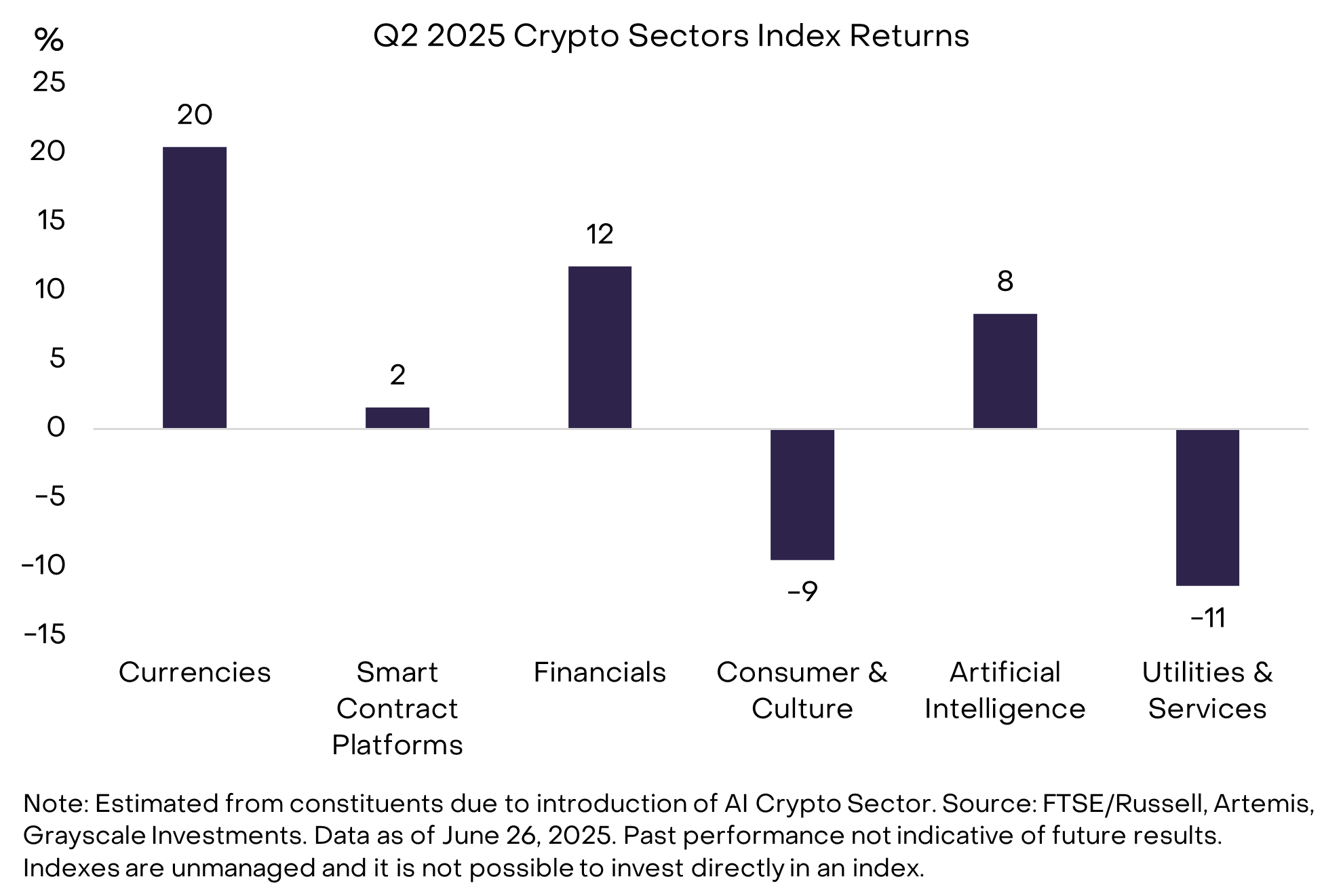

The firm uses a diverse set of criteria to assess its preferred altcoins, tracking which market sectors perform better than others. Today, Grayscale released its new recommendations for Q3 2025:

We have updated the Grayscale Research Top 20. The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. This quarter's new assets are Avalanche $AVAX and Morpho $MORPHO. All the assets in our Top 20… pic.twitter.com/gqy0NBLsE1

— Grayscale (@Grayscale) June 26, 2025Grayscale used a complicated metric to compile this list; for example, it added and removed altcoins from the same market category.

It categorized LDAO under “Utilities & Services,” which was the lowest performer, and replaced it with MORPHO, from the second-highest “Financials.”

However, AVAX and OP are both smart contract protocols, and Grayscale assessed that this sector didn’t grow or shrink much. In other words, Avalanche’s business developments must account for its place in Grayscale’s list.

In Q2 alone, new partnerships gave the blockchain a surge in on-chain activity, whereas Optimism suffered a 54% drop in ETH reserves.

Grayscale further clarified that Ethereum’s new focus on interoperability could make an L-2 like Optimism redundant. AVAX’s organic growth stands out in contrast, making it a clear choice for Grayscale’s list.

The firm expressed similar concerns for LDAO, as the SEC might approve ETF staking soon, removing the blockchain’s main market appeal.

MORPHO grew significantly in the last year, but that isn’t why Grayscale put it on the Top 20 list. Instead, the research firm was highly optimistic about its potential to outperform competitors in its own market sector:

“This past month, Morpho announced Morpho V2, designed to bring DeFi to traditional financial institutions. Grayscale Research is optimistic about the future of on-chain lending activity, and Morpho seems well positioned to potentially capture a meaningful share of that growth,” Grayscale claimed.

Grayscale’s findings and commentary are insightful, but it’s important to remember that it’s a research firm, not a market mover. It cautioned potential investors that all 20 of these tokens are very volatile.

In fact, all four of these assets slightly decreased in value since Grayscale released this list, even the ones it was optimistic about.