US Futures Smash Records—Bitcoin Primed for New All-Time High, Say Analysts

Wall Street's record run just handed Bitcoin bulls a golden ticket.

As US equity futures hit unprecedented levels, crypto analysts are flashing the green light for Bitcoin's next leg up. The correlation between traditional market euphoria and crypto rallies isn't just holding—it's getting stronger by the quarter.

When the suits win, the degens feast.

This isn't 2021's reckless speculation. Institutional flows are now the jet fuel for crypto's ascent, with Bitcoin's supply crunch creating a perfect storm. The halving's effects are kicking in right as traditional markets go vertical—because nothing says 'healthy financial system' like every asset mooning simultaneously.

Will this finally be the cycle where Bitcoin decouples? Don't hold your breath. For now, ride the wave—just remember who's really pulling the strings (hint: it's still the Fed).

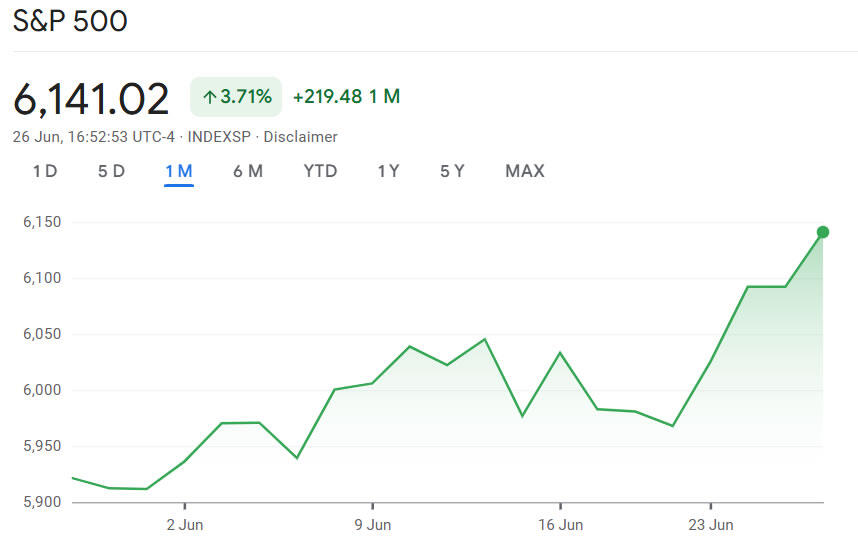

S&P 500 performance over the past month. Source: Google Finance

Will Bitcoin follow stock market gains?

Analysts have been weighing in on the prospect of bitcoin following stocks to a new all-time high.

“US stock futures nearing all-time highs, fueled by geopolitical easing and Fed rate-cut expectations, are bolstering investor risk appetite as Bitcoin’s recent rebound increased speculation of a new record high in the NEAR future,” Nick Ruck, director at LVRG Research, told Cointelegraph.

He added that sustained equity momentum and institutional inflows “could propel BTC past its $109,000 resistance into a new price discovery phase” if the Fed rate cut happens “in the coming months.”

Bitcoin ripe for all-time highs

Jeff Mei, chief operations officer at crypto exchange BTSE, told Cointelegraph that “conditions are ripe for Bitcoin to surpass its previous all-time high of about $112,000, especially given that the Iran-Israel conflict seems to be over for the time being.”

Meanwhile, BitMEX founder Arthur Hayes posted to X on Thursday that Bitcoin all-time highs “are coming,” and pointed to the passage of stablecoin regulations in the US and the easing tensions in the Middle East.

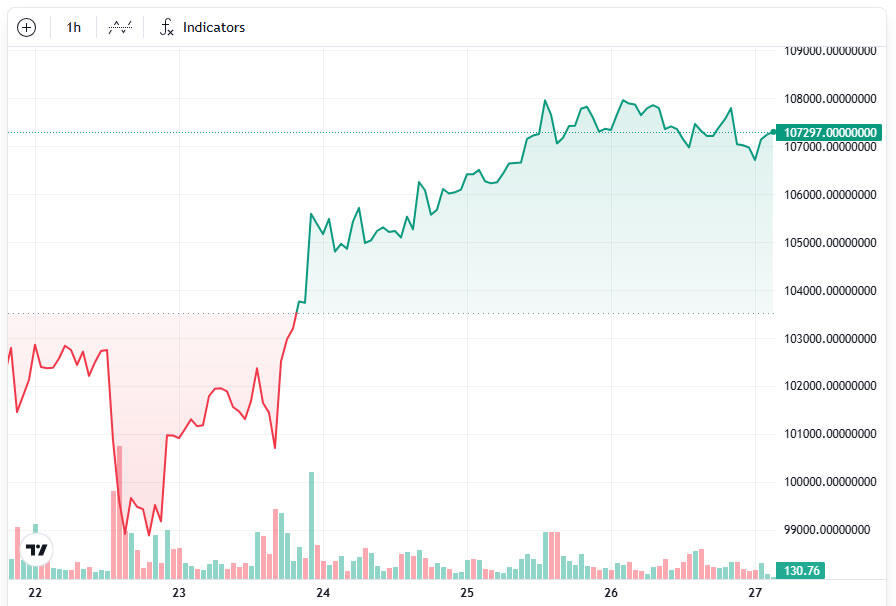

Bitcoin cools from resistance

Bitcoin has failed to break resistance above $108,000 at least three times this week and has declined from its last attempt on Thursday to trade at $107,400.

10x Research head of research Markus Thielen told Cointelegraph that a “notable dovish shift is emerging” among Fed leadership, but the market remains constrained.

“Many traders have written covered calls against their BTC holdings, which is suppressing both price momentum and volatility.”

BTC struggles at $108,000 resistance. Source: BTC

The Fed on Friday will release its preferred inflation gauge, called the Personal Consumption Expenditures (PCE) report, which could induce more market volatility.