XRP Plunges 5% as Whales Move Millions—Yet Selling Pressure Spikes

XRP bulls got a gut punch today as the asset nosedived 5%—despite whale wallets shuffling heavy stacks. Here's why the market isn't buying the optimism.

Whale Watching vs. Retail Panic

Blockchain trackers spotted eight-figure XRP transfers between undisclosed wallets this morning. Normally, that'd spark rally chatter. Instead, retail traders dumped positions like expired stablecoins.

The Institutional Paradox

Market makers are playing both sides: accumulating at key support levels while quietly offloading through OTC desks. Classic 'buy the rumor, sell the news' behavior—if the 'news' is another delay in Ripple's endless SEC saga.

Technical Breakdown

The 5% drop sliced through the 50-day MA like a hot knife through institutional FUD. Next support? A grim retest of June 2025 lows at $0.42—unless those whale transfers actually signal accumulation (spoiler: they never do).

Closing Thought

Another day in crypto: big money moves in silence while retail traders pay the price. At least the SEC's lawyers are getting rich.

News Background

- Market sentiment improved slightly after former U.S. President Donald Trump reportedly helped broker a ceasefire between Iran and Israel, calming some investor fears.

- Despite that, XRP struggled to hold recent gains as traders reacted to large on-chain movements. Ripple transferred $439 million worth of XRP to an unknown wallet, and other whale wallets moved another $58 million to centralized exchanges — raising questions about potential distribution or internal reshuffling.

- Although these events drew attention, the token’s inability to reclaim $2.14 resistance signals underlying bearish momentum.

- Technical analysts continue to monitor XRP’s descending channel pattern, with expectations for a breakout or breakdown between July and September. For now, the $2.08-$2.09 zone remains a critical level to hold.

Price Action

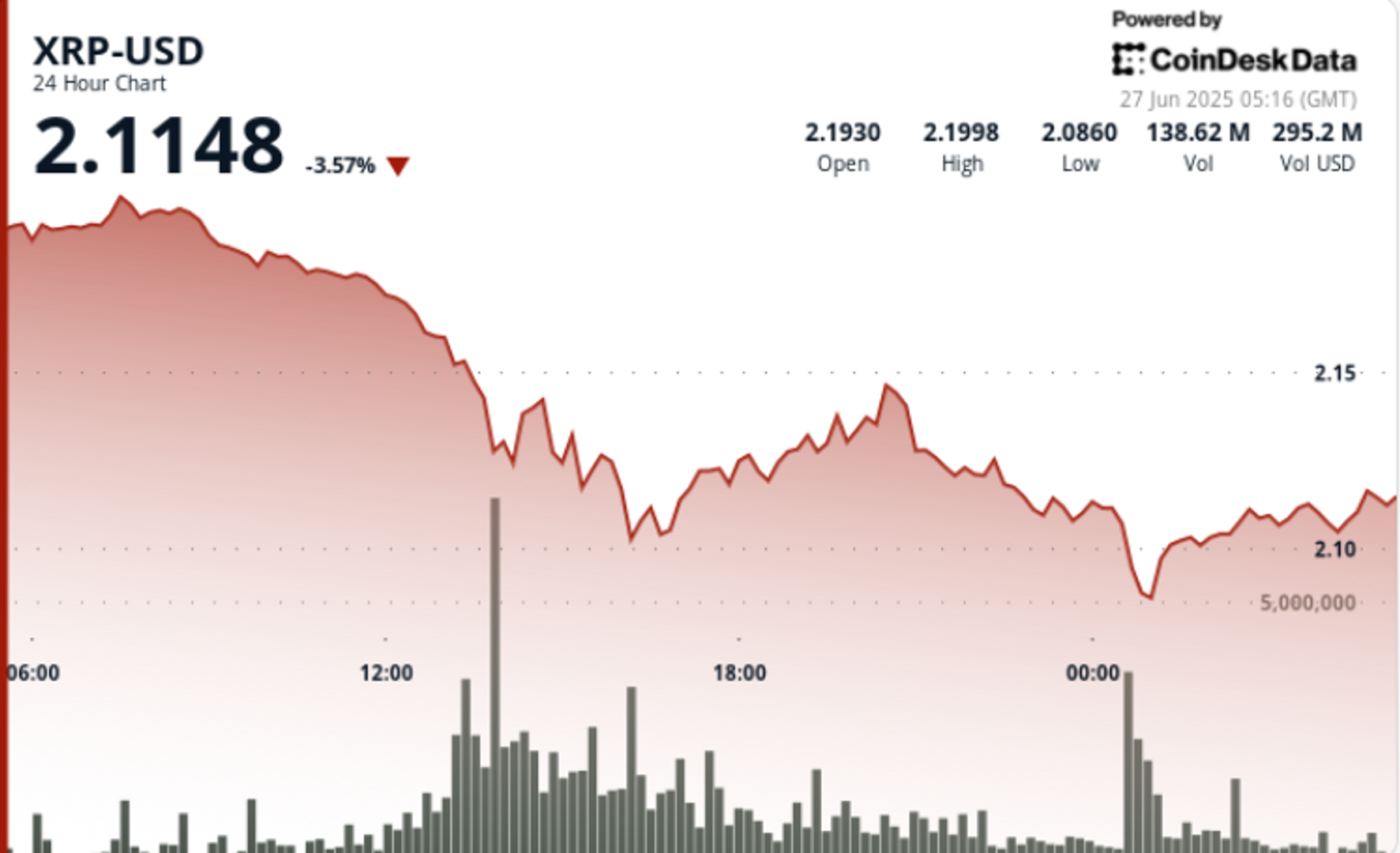

XRP dropped from $2.21 to $2.10 over the 24-hour period, marking a 5.3% decline within a $0.13 range. The steepest selloff occurred between 12:00 and 16:00 UTC on June 26, with back-to-back hourly volume surges above 99 million XRP as price fell to $2.10. Resistance formed clearly at $2.17, with multiple rejection wicks above $2.12 later in the session.

By midnight UTC, XRP had revisited its session low of $2.08. A modest bounce followed in the final hour of the session, as price climbed from $2.09 to $2.10, with short-lived momentum topping at $2.105. A drop in volume late in the session suggests buyer fatigue, though the $2.08 support zone held firm.

Technical Analysis Recap

• XRP declined 5.3% from $2.21 to $2.10, with a total intraday range of $0.13

• Heaviest selling occurred from 12:00–16:00 UTC on volume over 114M and 99M XRP

• Strong resistance formed at $2.17; key support tested at $2.08–$2.09

• Recovery attempts failed at $2.14 and $2.12 before settling around $2.10

• Final hour showed modest 0.54% gain from $2.09 to $2.10, with volume spiking to 930K XRP during 01:42–01:45

• Consolidation NEAR $2.10 in final 15 minutes suggests short-term stabilization