3 Must-Watch US Crypto Stocks Dominating the Market in 2025

Crypto's wild ride isn't over—these three US stocks are rewriting the rules of digital finance. Buckle up.

Wall Street's playing catch-up as blockchain eats traditional finance. Here's who's winning.

#1: The Miner Defying Gravity

While gold bugs sulk, this chip-powered operation keeps printing Bitcoin like the Fed prints dollars—just with actual scarcity.

#2: The Exchange Outmaneuvering Regulators

SEC lawsuits? Compliance headaches? This platform treats regulations like minor speed bumps on its revenue highway.

#3: The Institutional Gateway

Big money wants crypto exposure without the wallet headaches. Cue this firm's 300% institutional client growth—Wall Street's FOMO is their bottom line.

Bottom line: The 'crypto winter' narrative froze out weak hands. These players? They're building igloos with profit margins—and inviting hedge funds inside.

Coinbase (COIN)

Coinbase’s COIN is one of the crypto stocks gaining momentum in pre-market trading today. This comes as the stock receives attention after the exchange announced that it secured a MiCA license in Luxembourg, granting it the legal authority to offer crypto services across all 27 EU member states.

By choosing Luxembourg, Coinbase positions itself at the center of the EU’s digital asset ecosystem.

This development has bolstered COIN’s price, up 4% in pre-market trading. As of this writing, its Chaikin Money FLOW (CMF) is at 0.17 and in an uptrend, highlighting the demand for COIN.

If buying pressure climbs, the stock’s value could rise toward $316.06 as the day’s trading progresses.

Circle Internet Group (CRCL)

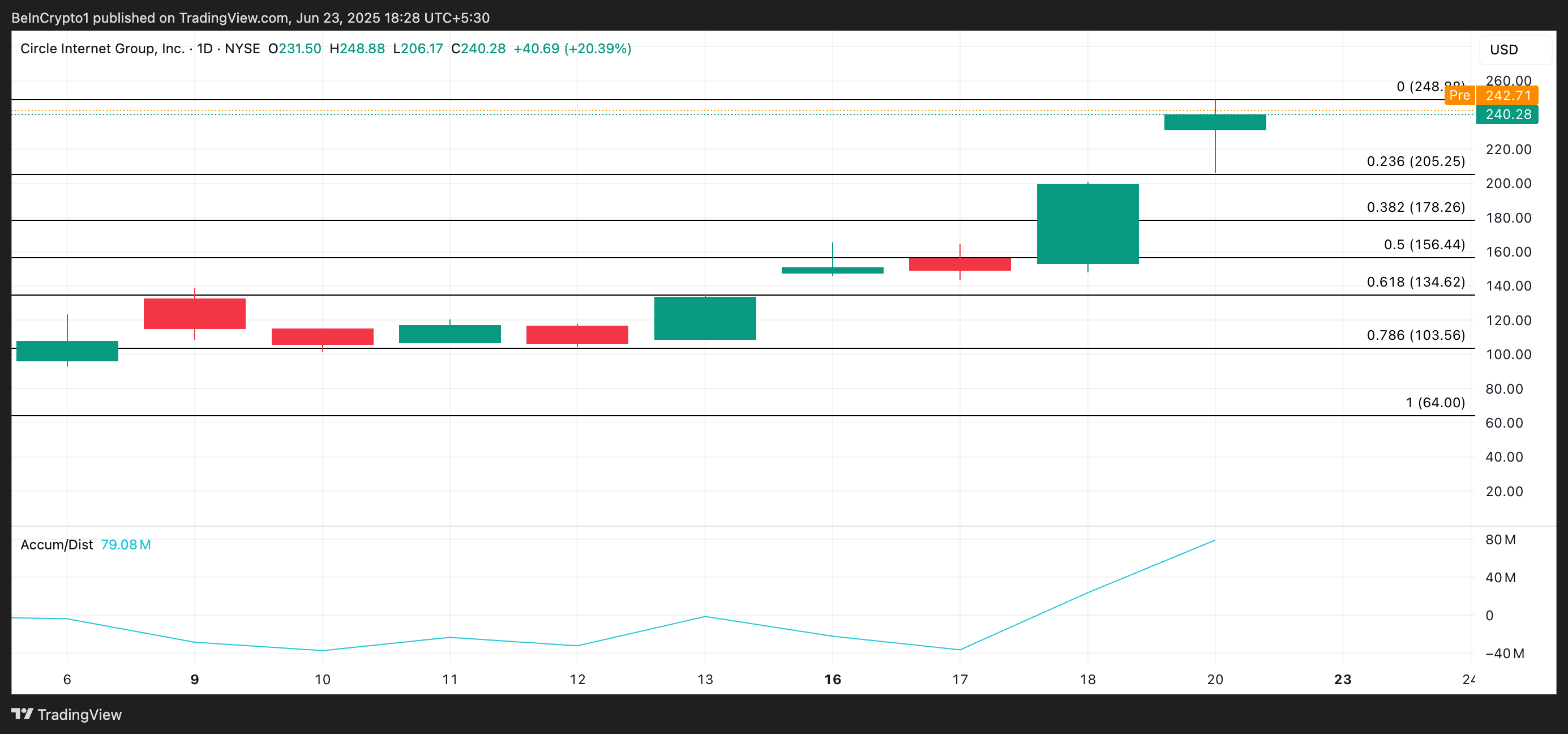

Circle shares are up 10.16% in pre-market trading on Monday, following a strong close last Friday, when the stock surged by 20.39%. The stablecoin issuer continues to benefit from growing institutional interest in the USDC stablecoin and renewed Optimism around the company’s recent IPO.

On the daily chart, the stock’s Accumulation/ Distribution (A/D) Line is at 79 million, climbing over 220% over the past day.

The A/D Line measures money Flow into or out of an asset by combining price and volume data. When the A/D Line climbs, it indicates that buying pressure outweighs selling pressure, suggesting a potential for a price increase.

If demand for the stock continues to rise, CRCL could extend its gains toward a new all-time high.

On the other hand, if buying pressure leans, the stock’s value could dip toward $205.25.

IREN

IREN is up 6%, continuing its upward momentum following IREN Limited’s successful closing of a $550 million offering of 3.50% convertible senior notes due 2029. The offering was oversubscribed and upsized from an initial $450 million, showing strong interest and confidence from institutional investors.

As of this writing, the stock’s Relative Strength Index (RSI) is at 65.59 and rising, indicating the demand for the altcoin.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

IREN’s RSI readings indicate market participants prefer accumulation over distribution. If this trend continues, the stock’s price could rally toward $11.72.

On the other hand, if demand falls, the stock’s value could break below $10.46 and fall toward $9.52.