Max Keiser Torches ’Genius Act’ as Modern-Day Fiat Slavery – Crypto Rebels Cheer

Bitcoin bull Max Keiser just dropped a Molotov cocktail on Washington's latest financial 'innovation.' The so-called Genius Act? Nothing more than fiat chains dressed up as progress.

Wall Street's pet politicians are at it again—creating solutions for problems that only exist in their spreadsheet-addled minds. Meanwhile, Bitcoin's decentralized revolution keeps chugging along while the old guard tries to legislate their relevance.

Funny how these 'genius' policies always seem to benefit the same too-big-to-fail banks that just happen to fund political campaigns. A coincidence, surely.

Crypto News of the Day: Max Keiser Warns of Anti-Bitcoin Agenda Behind US Stablecoin Bill

In a statement shared with BeInCrypto, bitcoin advocate Max Keiser has launched a blistering attack on stablecoins.

He warns that stablecoins undermine Bitcoin’s Core purpose by reinforcing fiat dominance and supporting the traditional banking system.

His remarks come as debate intensifies over the proposed GENIUS Act, a US bill that aims to regulate the stablecoin market. The proposed US law will create a regulatory framework for dollar-backed stablecoins.

“For those who hate state-backed, inflationary, fiat money, you’re going to really hate stablecoins,” Keiser told BeInCrypto.

The Bitcoin pioneer argues that stablecoins, often presented as a stepping stone into crypto, actually serve a very different master.

“As I’ve been saying, stablecoins are not an on-ramp to Bitcoin. They’re designed to be an on-ramp to the US Dollar; empowering politicians & issuers, who are working with the legacy banks to fight self-custodied Bitcoin and freedom from fiat slavery,” he added.

Keiser’s comments align with growing concern that stablecoins, particularly those pegged to the US dollar, are being co-opted to prop up the existing financial order.

In a recent US crypto News publication, Max Keiser highlighted a growing trend among stablecoin issuers using US treasuries to buy Bitcoin for free. As BeInCrypto reported, Keiser said these actions could undermine government reserves and lead to financial instability.

The emergence of the GENIUS Act has brought this tension into sharper focus. Critics argue that the bill is heavily skewed in favor of banking interests.

One of the most contentious aspects is a reported ban on stablecoin issuers passing interest income to users.

“The GENIUS Act draws a brutal line: No permitted or foreign stablecoin issuer may offer any yield, interest, or reward for holding the token. That means staking, lending, farming, or “rebasing” stablecoins = illegal. The goal? Regulators want to separate “digital dollars” from bank-like products. Stablecoins are now cash equivalents — not investment vehicles. No more ‘savings accounts on-chain.’ No more magic APY,” DeFi researcher Pumpius said in a post.

Some analysts say that the GENIUS Act could commoditize stablecoin offerings, forcing competition on yield distribution.

The MOVE allegedly intends to keep traditional banks competitive by preventing high-yield stablecoins from becoming a viable savings alternative. Some see this as a direct attempt to neutralize decentralized finance’s (DeFi) disruptive potential.

They claim the bill aims to entrench the power of regulated financial entities rather than encourage innovation and economic sovereignty.

These narratives suggest that the debate over the role of stablecoins in the crypto ecosystem is heating up. For Keiser, stablecoins are “fiat in disguise.” Those truly seeking monetary freedom should steer toward Bitcoin, not digital dollars.

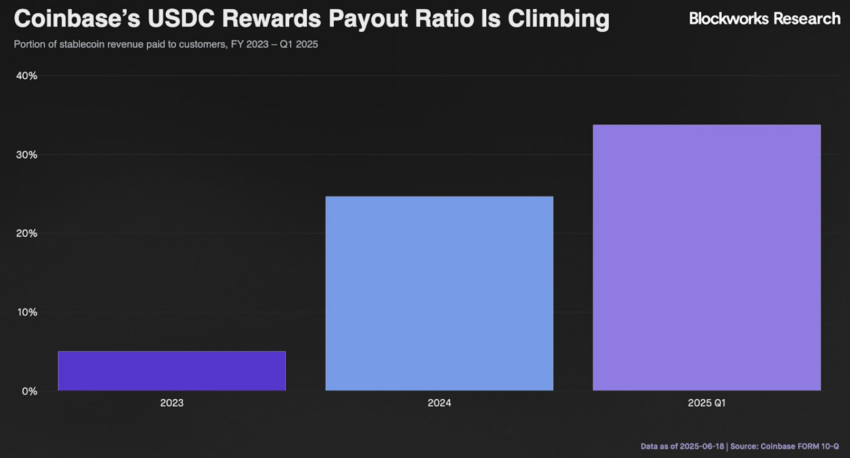

Chart of the Day

While the Act prohibits issuers from paying yield directly, this chart shows that distributors like Coinbase can offer yield as “marketing rebates.”

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto inflows extended a 10-week streak to $1.2 billion despite geopolitical tensions.

- OKX is exploring an IPO in the US, following its recent reentry into the market with a new headquarters and leadership.

- Jerome Powell’s testimony on June 24 could impact Bitcoin volatility depending on the Fed’s stance on inflation and interest rates.

- Cardone Capital has added roughly 1,000 BTC to its corporate balance sheet. Meanwhile, Metaplanet now holds over 11,000 BTC, accelerating its crypto-backed treasury policy.

- Spot Bitcoin ETFs saw $1.02 billion in inflows last week, down 29% from last week, amid cooling investor appetite.

- Analysts like Raoul Pal and Arthur Hayes point to macro trends and monetary policy as key bullish indicators for BTC.

- Iran’s potential retaliation against the US, including closing the Strait of Hormuz recently, could cause a significant drop in Bitcoin’s price. Analysts predict a 20% fall.

- Crypto whales see major wins and losses as Israel-Iran tensions shake the market.

- Pi2Day on June 28 could reveal major developments, including a potential link between Pi Network and GenAI, increasing community excitement.

- Analysts expect Bitcoin’s dominance to peak near 71%, which may precede another sharp correction in altcoins, as seen in February 2025.

Crypto Equities Pre-Market Overview

| Company | At the Close of June 20 | Pre-Market Overview |

| Strategy (MSTR) | $369.70 | $363.70 (-1.62%) |

| Coinbase Global (COIN) | $308.38 | $300.71 (-2.49%) |

| Galaxy Digital Holdings (GLXY) | $18.86 | $18.95 (+0.48%) |

| MARA Holdings (MARA) | $14.32 | $14.04 (-1.96%) |

| Riot Platforms (RIOT) | $9.56 | $9.41 (-1.56%) |

| Core Scientific (CORZ) | $11.86 | $11.84 (-0.17%) |