XRP Futures See Surging Sell Pressure—Is a Crash Below $2 Imminent?

XRP futures markets are flashing red as sell orders pile up—traders are bracing for potential turbulence ahead. Could the digital asset nosedive below its psychological $2 support level?

Bearish bets mount while bulls scramble. The derivatives data paints a grim picture: a wave of leveraged shorts threatens to drag XRP into sub-$2 territory for the first time since its last hype cycle.

Meanwhile, crypto ’experts’ on social media remain divided—half preaching ’buy the dip’ gospel, the other half quietly liquidating their bags. Classic Wall Street playbook, just with more memes and less regulation.

XRP Futures Traders Position for Decline

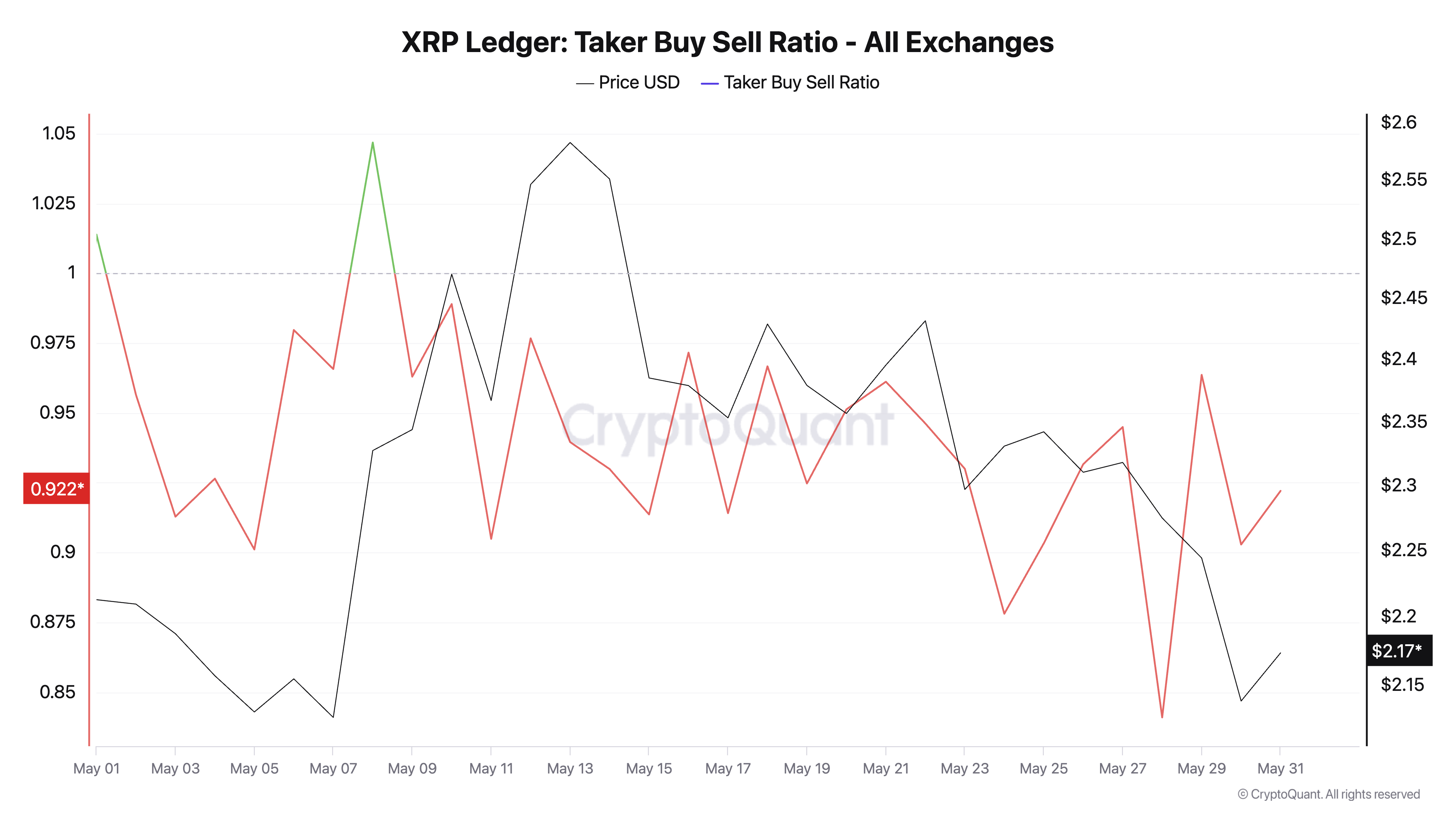

The bearish tone in the XRP market is evident in the token’s taker buy/sell ratio, which has consistently posted negative values for the past two weeks.

This indicates that sell orders dominate buy orders across the XRP futures market. At press time, this stands at 0.92, per CryptoQuant.

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The sustained decline in XRP’s taker buy/sell ratio over the past few weeks points to a mounting sell-off among futures traders, many of whom are increasing their exposure to short positions.

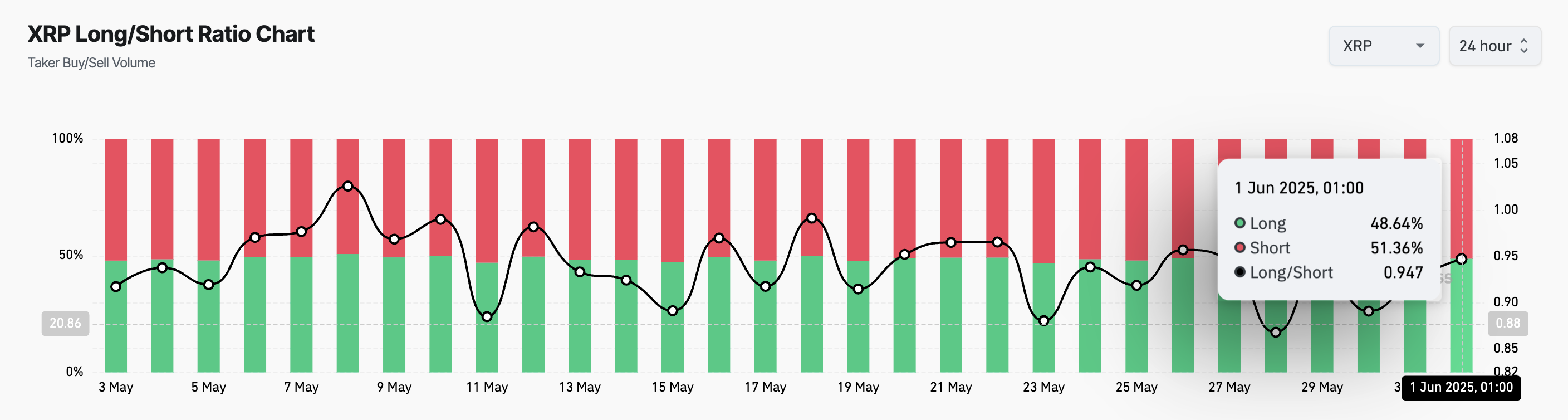

This is reflected by the token’s long/short ratio, which currently stands at 0.94.

For context, this metric has remained below one since May 8, highlighting that traders have been positioning for a downside MOVE for nearly a month.

The extended demand for short positions suggests that XRP’s price dip is not just a reaction to short-term volatility. It also shows a broader bearish tilt increasingly driven by expectations of lower prices.

Will XRP Hold the $2 Support?

At press time, XRP trades at $2.13. If bearish pressure gains momentum, the token risks slipping below the psychological $2 mark. A breach of this key support line could deepen the ongoing correction and cause XRP to trade below $1.99.

However, a resurgence in new demand for the altcoin could invalidate this bearish outlook. If buying surges, the XRP token could witness a bullish correction and climb to $2.29.