BTC Price Prediction 2025: Technical Strength Meets Fundamental Tailwinds for Q4 Rally

- What Do the Technical Indicators Say About BTC's Current Position?

- How Is Institutional Activity Impacting Bitcoin's Fundamentals?

- What Role Is the Fed Playing in BTC's Current Trajectory?

- How Are Supply Dynamics Influencing Bitcoin's Price?

- What Are the Political Developments Affecting Bitcoin?

- Is History Repeating Itself for Bitcoin?

- What Risks Should Investors Consider?

- BTC Price Prediction: What's the Q4 Outlook?

- Is Bitcoin a Good Investment in Q4 2025?

- Frequently Asked Questions

As we approach Q4 2025, bitcoin presents a compelling investment case with its price currently trading at $116,607, comfortably above key moving averages. The convergence of strong technical indicators, record institutional adoption, and tightening supply dynamics creates a perfect storm for potential upside. This analysis dives deep into the current BTC landscape, examining everything from Bollinger Band positioning to the recent surge in corporate treasury allocations. With the Fed's rate decision looming and historical patterns suggesting bullish Q4 performance, we explore whether this is the setup for Bitcoin's next major rally.

What Do the Technical Indicators Say About BTC's Current Position?

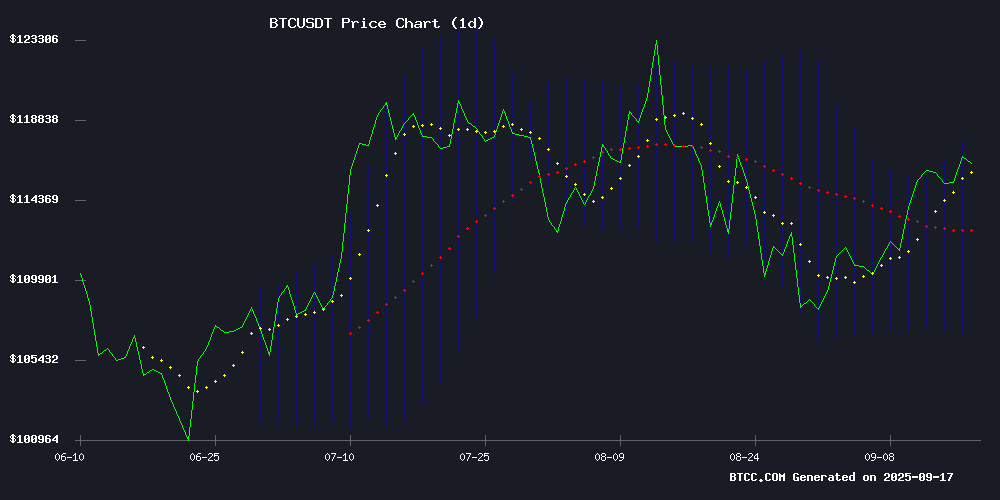

Bitcoin's technical setup paints an interesting picture as of September 2025. The cryptocurrency is currently trading at $116,607, which puts it 3.68% above its 20-day moving average of $112,468 - a classic bullish signal. The MACD, while still negative at -2581.56, shows improving momentum with its histogram at -1746.82. Price action is flirting with the upper Bollinger Band at $118,169, suggesting potential resistance ahead, while maintaining strong support at the lower band of $106,766.

According to TradingView data, this technical configuration resembles patterns seen before previous breakout rallies. The Relative Strength Index (RSI) sits at 62, comfortably in the "growth" zone without being overbought. Volume patterns show consolidation rather than decisive momentum, which in my experience often precedes significant moves once a direction is established.

How Is Institutional Activity Impacting Bitcoin's Fundamentals?

The institutional floodgates have truly opened in 2025, with a record 75 companies adding BTC to their balance sheets this year alone. This brings total corporate holdings to nearly 1 million BTC - a staggering figure that's reshaping market dynamics. European investment firm Capital B recently joined the treasury movement, becoming Europe's first dedicated BTC treasury company.

What's fascinating is how this institutional adoption is creating a supply squeeze. The Bitcoin Scarcity Index on Binance has spiked to levels not seen since June, indicating either large-scale withdrawals or a dramatic reduction in sell orders. CryptoQuant data shows this typically precedes major price advances, as we saw in early 2024.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | +3.68% above | Bullish |

| Bollinger Position | Upper band proximity | Neutral/Bullish |

| Institutional Adoption | 75 new firms in 2025 | Very Bullish |

| Scarcity Index | Surge pattern | Bullish |

What Role Is the Fed Playing in BTC's Current Trajectory?

The Federal Reserve's upcoming rate decision has the entire crypto market on edge. Futures markets are overwhelmingly pricing in a 25-basis-point cut, creating what analysts call "asymmetric risk" - meaning any deviation from expectations could trigger volatility. Santiment data shows retail optimism at 64% bullishness, the highest since July, which historically has been a contrarian indicator.

There's an eerie parallel to December 2024 when BTC peaked at $108K before collapsing 20% post-Fed decision. The Fear & Greed Index's current neutral 50 reading reflects this market paralysis. Glassnode's STH NUPL metric hovering NEAR danger zones adds to the tension - when it last turned negative in 2024, it triggered a 12-week bear cycle.

How Are Supply Dynamics Influencing Bitcoin's Price?

The supply side tells perhaps the most bullish story. Binance's Scarcity Index surge suggests either institutional accumulation or aggressive whale buying. On-chain analyst Maartunn observed 7,547 BTC dormant for 3-5 years recently changing hands - such movements typically precede significant price reactions.

Miners appear to be accumulating rather than selling, despite a 150% spike in the Miners' Position Index. At 0.10, the MPI remains well below levels indicating significant selling pressure. Exchange inflows show moderate activity, with a 3.17% rise in Coin Days Destroyed suggesting some long-term holders may be taking profits, but nothing resembling panic selling.

What Are the Political Developments Affecting Bitcoin?

Washington has taken notice of Bitcoin's growing prominence. Michael Saylor and other industry leaders recently convened with Senator Cynthia Lummis to push for a U.S. strategic Bitcoin reserve bill. The proposal would mandate acquiring 1 million BTC over five years, potentially using seized assets - a framework echoing a prior TRUMP administration executive order.

This political momentum coincides with Congress advancing its first major crypto legislation on stablecoins, signaling broader regulatory acceptance. While currently backed only by Republican lawmakers, efforts are underway to secure bipartisan support ahead of committee hearings.

Is History Repeating Itself for Bitcoin?

The current setup bears striking similarities to previous cycles. Bitcoin's NVT Golden Cross holds steady at 0.3, signaling neither overheating nor undervaluation - historically a precursor to price expansion. The metric's current reading suggests healthy upward momentum without immediate speculative excess.

Market capitalization across digital assets surged 4.8% this week, adding $180 billion. On-chain data reveals accumulating behavior near the $107,500 support zone, mirroring accumulation patterns seen before the 2024 rally. The question isn't whether history rhymes, but whether it will repeat with the same vigor.

What Risks Should Investors Consider?

For all the bullish signals, cautionary notes exist. The DFAS darknet takedown in France, resulting in 6 BTC seized, reminds us of Bitcoin's continued illicit use despite institutional adoption. More concerning is the potential for a Fed policy surprise - the market has priced in near-certain rate cuts, leaving little room for error.

The Blockchain Group's stock retreat from its 1,820% peak to +443% suggests some speculative froth may be leaving the market. While healthy long-term, it could mean near-term volatility as positions readjust.

BTC Price Prediction: What's the Q4 Outlook?

Given the technical strength, fundamental tailwinds, and historical Q4 seasonality, Bitcoin appears well-positioned for potential upside. Key levels to watch:

- Immediate resistance: $118,169 (upper Bollinger Band)

- Major resistance: $124,000 (all-time high)

- Support: $112,468 (20-day MA) then $106,766 (lower Bollinger Band)

The convergence of institutional adoption, supply scarcity, and potential monetary easing creates a fundamentally supportive environment. However, traders should remain vigilant around the Fed decision and monitor STH NUPL for signs of stress.

Is Bitcoin a Good Investment in Q4 2025?

Based on current indicators, Bitcoin presents a compelling case for portfolio allocation. The technical setup suggests consolidation with upward bias, while fundamentals have never been stronger. That said, the Fed decision could be a make-or-break moment - I've learned to never underestimate their power to surprise markets.

For investors with appropriate risk tolerance, accumulating at current levels with strict risk management makes sense. Just remember - in crypto, the only certainty is volatility. This article does not constitute investment advice.

Frequently Asked Questions

What is Bitcoin's current price and technical position?

As of September 17, 2025, Bitcoin trades at $116,607, 3.68% above its 20-day moving average with MACD showing improving momentum despite remaining negative.

How significant is the institutional adoption of Bitcoin?

Extremely significant - 75 companies added BTC to treasuries in 2025 alone, bringing total corporate holdings to nearly 1 million BTC and creating supply pressure.

What impact could the Fed rate decision have?

Markets expect a 25-basis-point cut - any deviation could cause volatility, similar to December 2024 when BTC fell 20% post-decision.

Why is the Scarcity Index important?

Binance's Scarcity Index surge indicates tightening supply, often preceding major price advances as seen in early 2024.

What are key price levels to watch?

Watch $118,169 (resistance), $124,000 (ATH), with support at $112,468 (20-day MA) and $106,766 (lower Bollinger Band).

Are miners selling their Bitcoin?

Data suggests accumulation rather than selling, with MPI at 0.10 well below levels indicating significant selling pressure.