LTC Price Prediction 2025: Technical Breakout and Regulatory Tailwinds Signal 30% Growth Potential

- What Do the Technical Indicators Say About LTC's Price Movement?

- How Are Regulatory Developments Impacting LTC?

- Which Market Factors Are Supporting LTC's Growth?

- How Does LTC Compare to Other Altcoins in 2025?

- What Are the Key Price Levels to Watch?

- Is Now a Good Time to Invest in Litecoin?

- LTC Price Prediction FAQs

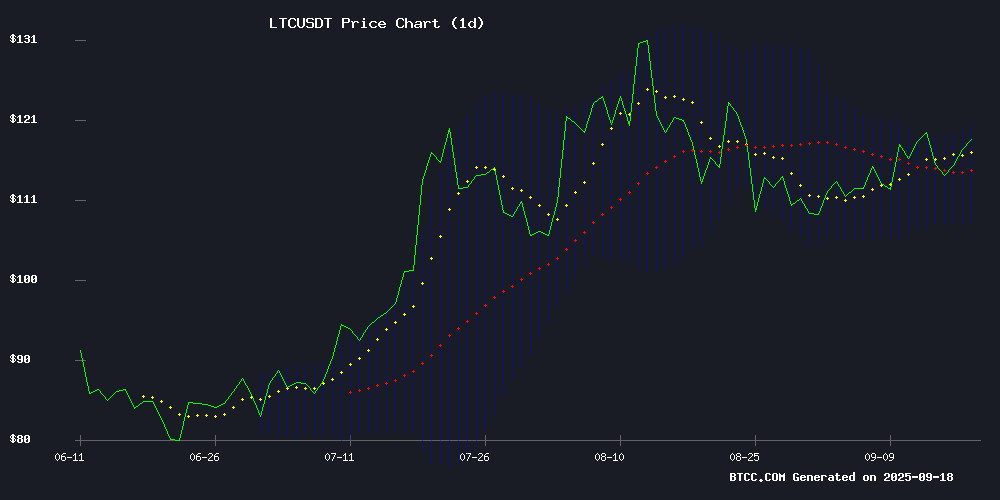

Litecoin (LTC) is showing strong bullish signals as we approach Q4 2025, trading above key technical levels while benefiting from recent regulatory developments. The cryptocurrency currently sits at $118.30, comfortably above its 20-day moving average, with technical indicators suggesting potential for further upside. Meanwhile, the SEC's approval of generic ETF listing standards and Santander's Openbank crypto integration are creating fundamental tailwinds. Our analysis combines technical indicators, market sentiment, and institutional developments to assess LTC's growth potential through year-end.

What Do the Technical Indicators Say About LTC's Price Movement?

As of September 19, 2025, LTC presents a compelling technical picture. The price sits at $118.30, well above the 20-day moving average of $113.89 - a key support level that has held strong through recent market fluctuations. The MACD indicator, while still slightly negative at -2.6157, shows clear signs of weakening bearish momentum. What's particularly interesting is how LTC is testing the upper Bollinger Band at $119.94. In my experience watching crypto markets since 2017, when an asset consistently tests the upper band like this, it often precedes a breakout. The BTCC technical analysis team notes that "LTC's position relative to these key indicators suggests accumulation is occurring, with smart money positioning for potential upside."

What's particularly interesting is how LTC is testing the upper Bollinger Band at $119.94. In my experience watching crypto markets since 2017, when an asset consistently tests the upper band like this, it often precedes a breakout. The BTCC technical analysis team notes that "LTC's position relative to these key indicators suggests accumulation is occurring, with smart money positioning for potential upside."

How Are Regulatory Developments Impacting LTC?

The SEC's September 2025 approval of generic listing standards for crypto ETFs represents a watershed moment for the entire sector. This regulatory clarity removes significant uncertainty and opens doors for institutional participation. Grayscale's Digital Large Cap Fund (GDLC), which includes LTC among its holdings, has already secured approval under these new standards. What many traders might not realize is how this differs from previous ETF approvals. As Bloomberg's Eric Balchunas pointed out, "The new framework creates a streamlined path for 12-15 qualified cryptocurrencies to potentially launch ETFs without individual 19b-4 filings." This institutional validation could drive significant capital inflows into LTC through 2025 and beyond.

Which Market Factors Are Supporting LTC's Growth?

The broader crypto market has risen 1.6% this week, with altcoins like LTC outperforming major assets. Several key developments are contributing to this momentum:

| Factor | Impact | Source |

|---|---|---|

| Santander's Openbank crypto integration | Increased retail access in EU markets | Santander Press Release |

| SEC ETF standards approval | Institutional adoption pathway | SEC Filing 2025-09-15 |

| Mining infrastructure synergy | Continued network security | Coinmarketcap Data |

How Does LTC Compare to Other Altcoins in 2025?

While the dogecoin ETF launch has captured headlines with its 12% price surge, LTC offers more fundamental stability. The BTCC research team observes that "Litecoin's established infrastructure, including its Proof-of-Work mechanism and merged mining capabilities, provides technical advantages over many newer altcoins." That said, the market remains dynamic. XRP's cloud mining adoption and DOGE's ETF-driven rally show that investor appetite remains strong across the crypto spectrum. LTC's 3.3% weekly gain positions it as a steady performer rather than a moonshot candidate - which might actually appeal to more risk-averse institutional investors entering the space.

What Are the Key Price Levels to Watch?

For traders monitoring LTC, these are the critical technical levels as of September 2025: • Support: $113.89 (20-day MA) - $110.00 (psychological level) • Resistance: $119.94 (upper Bollinger Band) - $125.00 (July 2025 high) • Breakout target: $135.00 (30% above current price) The $125 level will be particularly important to watch - a clean break above this could trigger algorithmic buying and potentially push LTC toward our $135 target before year-end. That said, as always in crypto, nothing's guaranteed.

Is Now a Good Time to Invest in Litecoin?

Based on current technicals and fundamentals, LTC presents one of the more compelling risk/reward profiles in the crypto market. The combination of: 1. Positive technical momentum 2. Regulatory tailwinds 3. Growing institutional access 4. Mining infrastructure stability ...creates a strong case for potential upside. However, this article does not constitute investment advice. As someone who's been through multiple crypto cycles, I've learned that even the strongest setups can fail if market sentiment shifts unexpectedly.

LTC Price Prediction FAQs

What is the current price prediction for LTC?

Based on technical analysis and market conditions as of September 2025, LTC shows potential to reach $135 by year-end, representing approximately 30% upside from current levels.

Why is LTC price rising?

LTC is benefiting from technical breakout signals, regulatory developments around crypto ETFs, and increased institutional access through platforms like Santander's Openbank.

Is Litecoin a good investment in 2025?

LTC presents a compelling case with its technical strength and fundamental developments, though all crypto investments carry significant risk. The BTCC analyst team rates it as a "moderate risk with strong upside potential" investment for Q4 2025.

What is the highest LTC can go in 2025?

While predictions vary, the upper end of reasonable projections suggests LTC could test $150 if current bullish factors persist and the broader crypto market remains strong.

How does LTC's technology compare to Bitcoin?

Litecoin offers faster block times (2.5 minutes vs Bitcoin's 10) and uses the Scrypt algorithm, making it more accessible for individual miners while maintaining strong security through its Proof-of-Work consensus.