Ethereum Price Prediction 2025: Technical Breakout and Whale Activity Signal $5,000 Rally

- Why Is Ethereum Gaining Momentum in September 2025?

- Institutional Players Are Betting Big on ETH

- The Technical Setup: What Charts Tell Us

- The Supply Squeeze: Why Outflows Matter

- ETF Inflows Add Fuel to the Rally

- Staking Dynamics: The $12B Rotation

- Ethereum's AI Pivot: The dAI Team Initiative

- Analyst Perspectives: Bullish but Cautious

- Ethereum Price Prediction FAQ

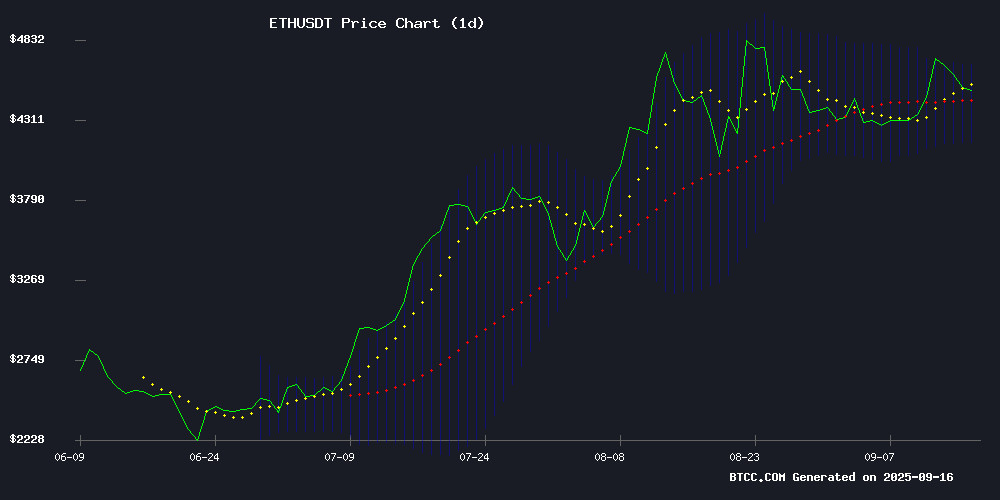

Ethereum (ETH) is showing all the signs of a major breakout in September 2025, trading at $4,528 with strong technical indicators and institutional backing. The cryptocurrency has formed a bullish pattern above its 20-day moving average ($4,418), while massive ETH outflows from exchanges (55K daily) create a supply squeeze that could propel prices toward $5,000. Our analysis combines on-chain data, technical patterns, and institutional activity to explain why ETH might be entering its next major growth phase.

Why Is Ethereum Gaining Momentum in September 2025?

Ethereum's current rally stands out because it's happening during typically bearish September conditions. The price action suggests we're seeing a perfect storm of technical factors and fundamental demand. The Bollinger Bands show ETH trading in the upper portion of its range with resistance NEAR $4,676, while the MACD (-3.51) shows some near-term bearish divergence despite the positive histogram reading of 59.86. What's particularly interesting is how this mirrors ETH's 2018 ascending trajectory - back then, similar patterns preceded a 300% quarterly gain.

Institutional Players Are Betting Big on ETH

The real story here is the institutional accumulation. Bitmine Immersion Technology Inc. has acquired 276,800 ETH ($1.3B) in just two weeks - that's the kind of MOVE that suggests they see much higher prices ahead. We're also seeing consecutive eight-figure withdrawals from major exchanges, including a $24.7M move from Binance and Bitget this week. These whale activities mirror patterns seen before Ethereum's 2020 DeFi summer rally.

The Technical Setup: What Charts Tell Us

From a technical standpoint, ETH is testing critical resistance at $4,800-$4,880 - a zone that's repeatedly capped rallies since 2021. A daily close above $4,880 WOULD confirm the first major breakout in three years, potentially triggering algorithmic buying programs. The 20-day MA at $4,418 now serves as strong support, while the Bollinger Upper Band at $4,676 presents the next immediate resistance.

| Indicator | Value | Signal |

|---|---|---|

| Price | $4,528.50 | Bullish (Above MA) |

| 20-Day MA | $4,418.64 | Support Level |

| Bollinger Upper | $4,676.31 | Near-term Resistance |

| MACD | -3.51 | Watch for Crossover |

The Supply Squeeze: Why Outflows Matter

Exchange data reveals a sustained supply squeeze that's creating perfect conditions for price appreciation. Cryptoquant reports negative netflows since July, with 55K ETH leaving exchanges daily - a trend last observed during bear markets. Recent spikes saw single-day outflows exceeding 400K ETH. Even after ETH's plunge from $4,000 to $1,500, withdrawals have dominated exchange activity. This unbroken outflow streak suggests mounting pressure for a price breakout.

ETF Inflows Add Fuel to the Rally

Spot ETF inflows have surged, with $638 million net inflows recorded between September 8-12, 2025. Fidelity's FETH led the charge with $381 million, marking the fourth consecutive week of gains and pushing cumulative ETF inflows above $13.3 billion. While these flows are smaller than Bitcoin's, each dollar appears to exert disproportionate price impact on ETH due to its tighter supply conditions.

Staking Dynamics: The $12B Rotation

Ethereum's proof-of-stake network is experiencing its most significant staking withdrawal since the Merge, with 150,000 ETH exiting validator contracts this week. The exit queue ballooned to 2.63 million ETH ($12.3B) - a 327% weekly surge. This isn't necessarily bearish though - analysts attribute the movement to yield-seeking behavior as staking APR compresses to 2.84%, with validators reallocating toward higher-yielding DeFi opportunities.

Ethereum's AI Pivot: The dAI Team Initiative

The ethereum Foundation's new dAI Team aims to position ETH as the premier settlement layer for AI agents. Led by research scientist Davide Crapis, this initiative focuses on enabling trustless coordination and payments for autonomous AI systems. This strategic pivot toward AI integration could open new use cases for Ethereum, similar to how DeFi drove adoption in previous cycles.

Analyst Perspectives: Bullish but Cautious

Citigroup maintains a year-end target of $4,300, below current levels, citing concerns about value accrual from Layer-2 networks. However, Tom Lee of BitMine Immersion argues Ethereum is entering a "supercycle." The BTCC research team notes that while technicals look strong, September's historical profit-taking risks warrant caution. Their base case sees ETH testing $5,000 by year-end if current momentum holds.

Ethereum Price Prediction FAQ

What is the current Ethereum price prediction for 2025?

As of September 16, 2025, Ethereum is trading at $4,528 with analysts predicting a potential rally to $5,000+ if current momentum continues. Technical indicators suggest strong support at $4,418 (20-day MA) with resistance at $4,676 (Bollinger Upper Band).

Why is Ethereum price rising in September 2025?

The rally is driven by three key factors: 1) Massive institutional accumulation (like Bitmine's $1.3B ETH purchase), 2) Supply squeeze from exchange outflows (55K ETH daily), and 3) Strong ETF inflows ($638M in early September).

What are the key resistance levels for ETH?

The immediate resistance is $4,676 (Bollinger Upper Band), followed by the critical $4,800-$4,880 zone. A daily close above $4,880 would confirm a major breakout that could trigger significant upside.

How does staking activity affect ETH price?

While $12B in ETH is exiting staking contracts, this appears to be capital rotation rather than bearish sentiment. Validators are moving funds from low-yield staking (2.84% APR) to higher-yielding DeFi opportunities.

What's the long-term outlook for Ethereum?

The combination of institutional adoption, Layer-2 scaling, and new use cases like AI settlement positions ETH well for long-term growth. However, short-term volatility is expected as the market digests September's typical profit-taking pressure.