Fed Cuts Crypto Red Tape—Banks Get Green Light to Dive Into Digital Assets

The Federal Reserve just bulldozed regulatory barriers holding banks back from crypto. No more tiptoeing—Wall Street can now custody, trade, and (inevitably) overleverage Bitcoin like the rest of us degens.

What changed? The Fed’s old ’hands-off’ guidance—which treated crypto like a radioactive briefcase—got quietly shelved. Now banks can explore blockchain services without waiting for a permission slip. Expect a gold rush of ’institutional-grade’ crypto products (read: higher fees).

The catch? Banks still need to ’manage risks.’ Translation: They’ll probably ban retail from yield farming while running their own shoddy version in-house. TradFi gonna TradFi.

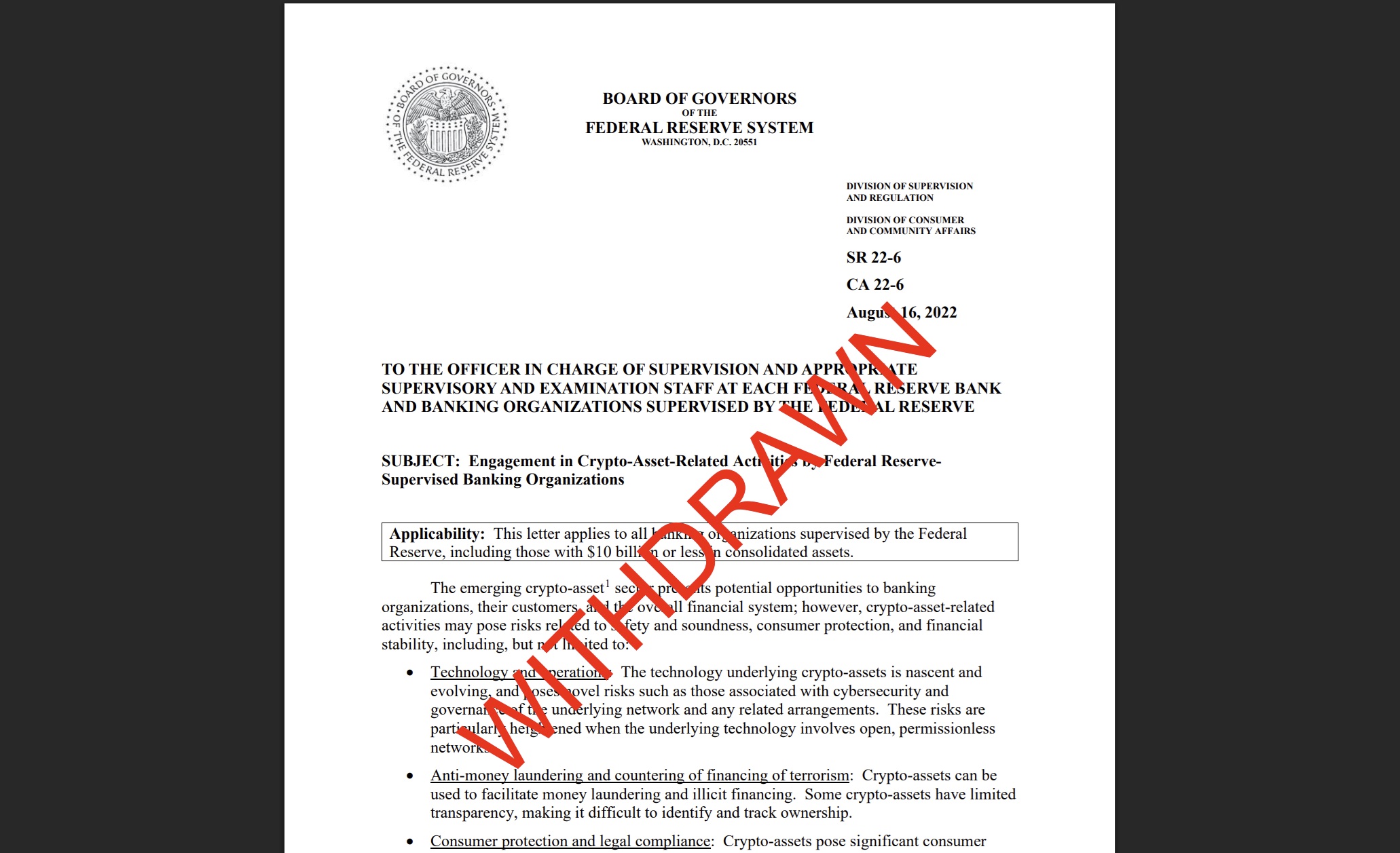

Crypto guidance for banks released in 2022 and 2023 by the Federal Reserve has now been withdrawn. Source: Federal Reserve

Crypto guidance for banks released in 2022 and 2023 by the Federal Reserve has now been withdrawn. Source: Federal Reserve

Back in 2022 and 2023, the Fed had rolled out strict supervisory letters, largely as a reaction to the chaos unfolding across the crypto world. Big firms were collapsing, liquidity was drying up, and regulators were trying to plug holes in real time. Those letters required banks to get what’s called a “supervisory non-objection.” Basically, a thumbs-up from the Fed, before getting involved with digital assets.

Now those letters are in the shredder.

What This Means for Banks

So what changes for banks? Quite a bit, actually.

Banks supervised by the Fed can now move into crypto or stablecoin services without asking for pre-approval. That doesn’t mean they can act recklessly; they’re still expected to operate within the Fed’s broader oversight system, but the red tape is thinner now.

The Federal Reserve just rescinded its regressive guidance that forced banks to beg for permission before using crypto tech. pic.twitter.com/TxsRZYBxlN

The Federal Reserve just rescinded its regressive guidance that forced banks to beg for permission before using crypto tech. pic.twitter.com/TxsRZYBxlN

— CryptoLaw.avax (@RussellKlein) April 24, 2025

(@RussellKlein) April 24, 2025

Instead of needing a formal OK before doing anything crypto-related, banks will be reviewed through normal supervisory channels, just like they would for other financial products. It’s a shift from “ask first” to “we’ll keep an eye on you.”

The Fed also said it wants to work with other agencies to figure out whether more modern guidance is needed to support innovation. Translation: they’re not against crypto, they just want to make sure they’re not flying blind.

The Crypto Industry’s Response

Crypto circles didn’t waste any time reacting. Most in the industry welcomed the change, seeing it as a positive signal that traditional finance might finally be softening its stance on digital assets.

Still, there are some caveats. Pulling back the old rules doesn’t mean banks can suddenly tap into everything the Fed offers. For example, if a crypto-friendly bank wants access to a Fed master account. The kind that connects directly to central payment rails, they still have to go through a separate application process.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right NowAnd just because the Fed isn’t demanding upfront notice anymore doesn’t mean banks are off the hook. They’re still expected to manage risk properly, especially in a market as unpredictable as crypto.

Looking Forward

All in all, this is a meaningful shift. The Fed is loosening its grip, signaling a more open, though still cautious, attitude toward the banking sector’s involvement in crypto. With fewer roadblocks in place, banks now have a clearer path to experiment with digital assets — and the rest of us get a front-row seat to see how they handle it.

- The U.S. Federal Reserve has scrapped its prior requirement for banks to seek special approval before engaging in crypto or stablecoin activity.

- This move aligns the Fed with the FDIC and OCC, signaling a more unified and flexible regulatory approach to digital assets.

- Banks can now offer crypto services without pre-approval, though they remain under the Fed’s general oversight framework.

- The change is seen as a positive shift by the crypto industry, though access to Fed master accounts still requires a separate process.

- The Fed is open to updating guidance in collaboration with other regulators to support innovation while ensuring risk management.