ARK Invest’s Bombshell Prediction: Bitcoin Could Hit $2.4M Before 2030

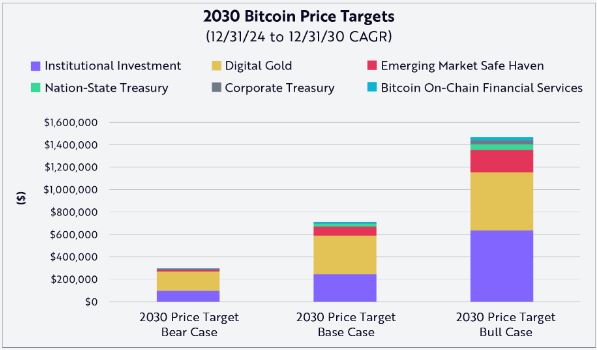

Wall Street’s crypto true believers just dropped a jaw-dropper—ARK Invest’s latest model suggests Bitcoin could moon to $2.4 million per coin by 2030. That’s not a typo.

Why this matters: The forecast assumes Bitcoin captures 20% of the global monetary gold market—a big if, but one that’d make today’s $60K price look like pocket change. Cue the institutional FOMO.

The fine print: ARK’s models have been right before (they called BTC’s 2021 bull run), but even they admit this requires "massive asset rotation" from boomer gold ETFs into crypto. Good luck with that, Cathie.

Bottom line: Whether this prediction lands or crashes harder than a Terra stablecoin, one thing’s certain—the crypto volatility rollercoaster isn’t stopping anytime soon. Buckle up.

Source ARK Invest

Source ARK Invest

Emerging markets also play a key role in ARK’s vision. In countries where currencies are unstable and inflation runs high, Bitcoin is increasingly being seen as a safer way to hold value. ARK says this use case could make up about 13.5% of Bitcoin’s potential price in their most optimistic scenario.

Beyond that, ARK also looked at nation-states and corporations holding Bitcoin as part of their reserves. In addition to that, the growing ecosystem of Bitcoin-based financial services, like Layer 2 networks and tokenized versions of Bitcoin (like WBTC) — has made the picture even more bullish.

What’s interesting is that ARK didn’t just look at total supply. They adjusted for “active” Bitcoin, removing coins that are lost or haven’t moved in years. Based on that more realistic supply number, they believe the $2.4 million price tag actually makes more sense than it seems on the surface.

If Bitcoin really were to hit $2.4 million, it would mean a total market cap of about $49 trillion — nearly the size of the combined GDP of the U.S. and China today. It would also make Bitcoin the most valuable asset in the world, even ahead of gold.

Of course, even ARK’s lower-end targets require serious growth. The $500,000 bear case would mean an annual return of 32% from now until 2030. The base case of $1.2 million implies a 53% yearly gain. That kind of growth is rare for any asset — especially one that’s already worth over a trillion dollars.

Still, the timing of this updated forecast is notable. Bitcoin recently bounced back from a low of around $75,000 earlier this year and is now trading NEAR $94,000. On top of that, the U.S. has just created a Strategic Bitcoin Reserve under the Trump administration — another sign that Bitcoin is being taken more seriously at the highest levels.

In short, ARK is betting big on Bitcoin’s future. Whether it hits $2.4 million or not, the takeaway is clear: Wall Street and beyond are starting to treat Bitcoin as more than just a bet — they’re treating it as a foundation for the future of finance.

Also Read: ARK Invest Takes First Direct Stake in Solana via ETF