Revolut’s Crypto Bet Pays Off: 72% Revenue Surge Fueled by Digital Asset Trading Boom

Fintech disruptor Revolut just posted a staggering 72% revenue jump—and guess who gets the credit? Crypto traders stacking sats between coffee breaks.

The neobank’s Q1 2025 report shows digital assets now account for over a third of trading revenue, proving once again that where traditional banks see risk, fintechs see ATMs.

While legacy institutions still debate ’blockchain potential,’ Revolut’s users are busy turning memecoin volatility into corporate profit margins. The irony? These gains come from the same asset class Wall Street swore was ’just for drug dealers’ five years ago.

:

“2024 was another landmark year for Revolut, with continued growth across all key business areas,” said Revolut founder and CEO Nik Storonsky

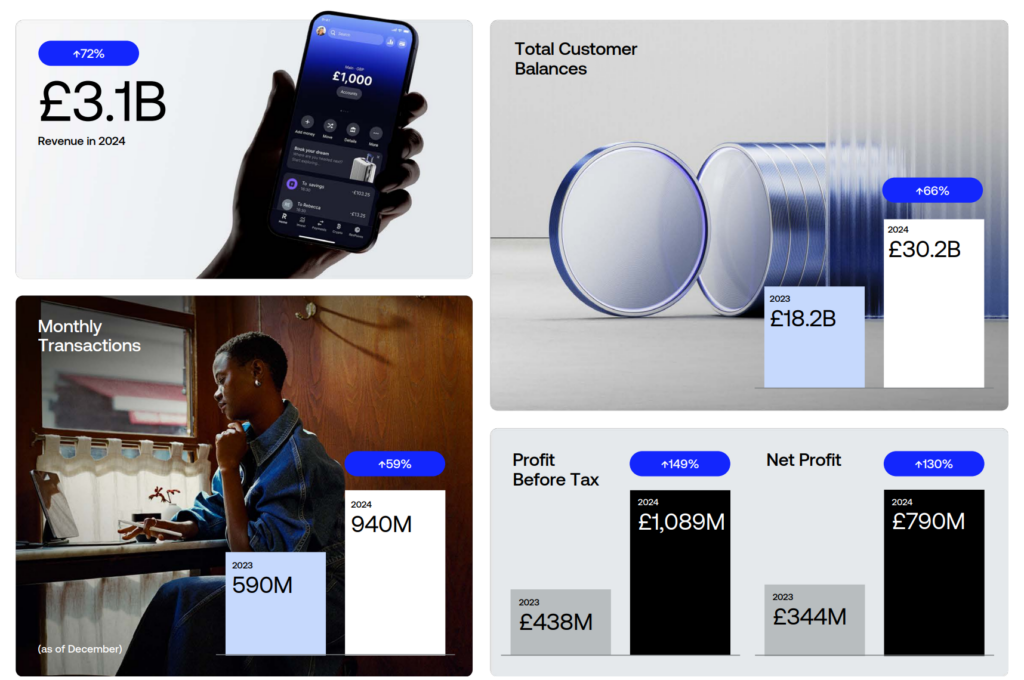

Revolut more than doubled its profits to £1B in 2024 as crypto trading surged and customer numbers hit 50M+.

Revenue jumped to £3.1B, up from £1.8B in 2023.

Its wealth division, including crypto, brought in £506M – nearly 4x last year.#Revolut #CryptoTrading pic.twitter.com/g80fumBLUP

— Satoshi Talks (@Satoshi_Talks) April 24, 2025

By November 2024, Revolut expanded its crypto exchange services across 30 new European Economic Area (EEA) markets, including Belgium, Cyprus, and Denmark. This expansion strategy has allowed the company to capitalize on growing interest in digital assets across Europe.

“Against the backdrop of strong business performance, we executed a secondary sale transaction at an implied $45 billion valuation to provide liquidity opportunities to employees, alumni, and early shareholders, establishing Revolut as the most valuable private technology company in Europe,” said Stinga. “Through this process, we welcomed on board a number of new investors known for their thought leadership in our industry including: Coatue, Durable Capital Partners, Dragoneer, Fidelity Management & Research Company, Baillie Gifford, Growth Equity at Goldman Sachs Alternatives, D1 Capital Partners, Mubadala, and Affinity Partners, among others. We are grateful for their trust and are looking forward to their support.

“We have observed positive trends across all revenue streams, driven by customer base expansion on one hand and deepening engagement across all our products on the other,” said the CFO.

Did the crypto market’s resurgence played a pivotal role in the bank’s growth?

Throughout 2024, Revolut strategically enhanced its crypto offerings, positioning itself as a user-friendly gateway to digital assets for retail investors.

Revolut’s strategy extends beyond retail banking and cryptocurrency trading. For cryptocurrency enthusiasts and investors, Revolut’s results offer further evidence that digital assets are becoming increasingly mainstream, with regulated financial institutions now playing a significant role in facilitating market access and growth. Furthermore, the company has been actively diversifying its revenue sources, with notable success in premium subscriptions and business services. Revenue from paid plans climbed 74% year-over-year to £423 million.

Key Takeaways

-

“2024 was another landmark year for Revolut, with continued growth across all key business areas,” said founder and CEO Nik Storonsky.

-

By November 2024, Revolut had expanded its crypto exchange services across 30 new markets in the European Economic Area (EEA), including Belgium, Cyprus, and Denmark.