Zen 7 Leaks Trigger AMD Stock Slide - What Tech Investors Need to Know

AMD shares take a hit as confidential Zen 7 specifications surface prematurely—just another day in tech's leak-happy ecosystem.

Market Reaction

Traders dumped AMD positions faster than a hot GPU at MSRP. The stock dipped alongside the unauthorized data release, proving once again that Wall Street treats tech IP like classified documents—until it's not.

Speculation Runs Wild

Industry watchers scrambled to parse the leaked benchmarks. Performance metrics suggest significant gains, but without official validation, it's all just silicon fantasy for now.

Damage Control Mode

AMD's comms team likely shifted into overdrive—because nothing says 'strategic roadmap' like unverified specs circulating on enthusiast forums. Because who needs controlled announcements when you've got anonymous leakers doing your marketing for free?

Finance folks remain predictably skittish—because nothing terrifies traditional investors more than actual innovation disrupting their precious spreadsheets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These latest AMD Zen 7 processor rumors come from YouTuber Moore’s Law is Dead, a prominent tech leaker. He claimed that recent documentation showed AMD intends to continue to use the AM5 platform, despite previous plans to switch to the AM6 socket. Moore’s Law is Dead compared this to development of AMD’s Zen 3 CPUs, which were originally slated to be AM5 processors, but were switched to AM4 late in development.

There are advantages and disadvantages to AMD sticking with the AM5 socket. A positive is that this will make its next generation of CPUs compatible with motherboards already owned by a large customer base. This could allow for strong sales, as users won’t have to pay as much to upgrade their PCs. However, it also means AMD will miss out on sales to customers who want to upgrade to the latest DDR6 RAM. It’s a tricky situation for AMD, but the company has likely already weighed these pros and cons for Zen 7.

AMD Stock Movement Today

AMD stock was down 3.19% on Tuesday, but remained up 41.15% year-to-date. The shares have also rallied 12.62% over the past 12 months. Some of the pressure AMD stock has seen today could be related to a U.S. investment in rival processor Maker Intel (INTC). The U.S. government has considered a 10% stake in the company, which comes alongside SoftBank’s (SFTBY) purchase of $2 billion worth of INTC stock.

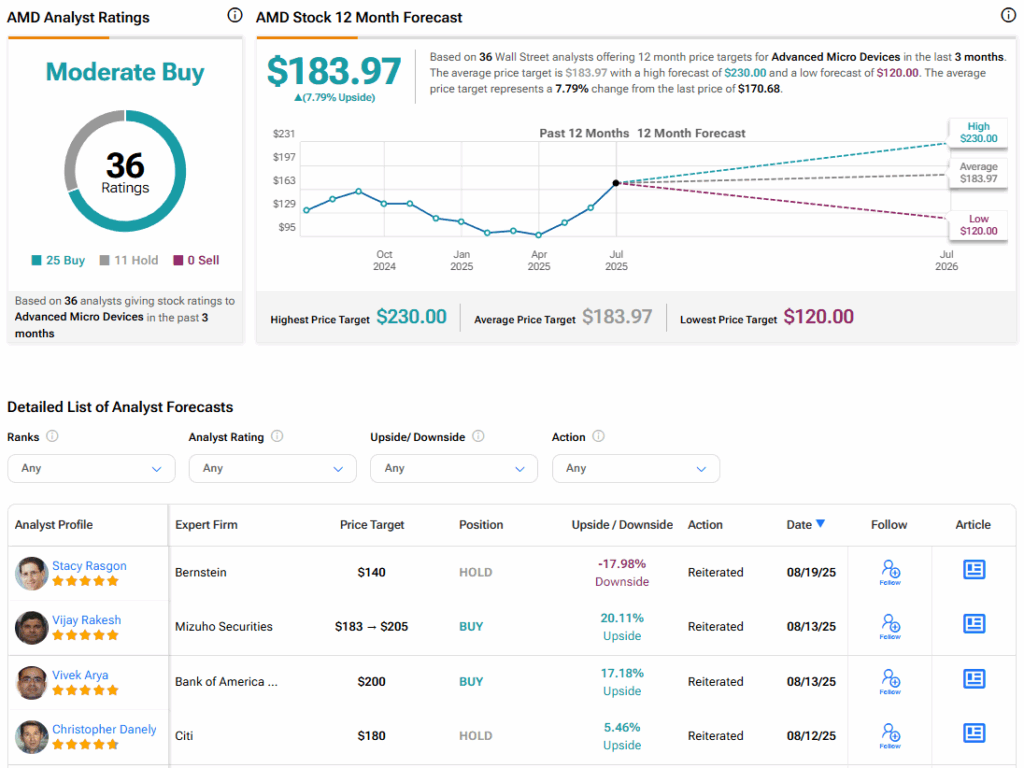

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 25 Buy and 11 Hold ratings over the past three months. With that comes an average AMD stock price target of $183.97, representing a potential 7.79% upside for the shares.