Forget Costco? This Unstoppable Growth Stock Just Became Your Smartest Portfolio Move

Wall Street's obsession with retail giants just got disrupted—and your portfolio might thank you.

While big-box retailers chase incremental gains, one sector is delivering exponential returns that make traditional retail look like a savings account. The digital asset revolution isn't coming—it's already rewriting wealth creation rules.

Growth That Defies Gravity

Traditional metrics can't capture this momentum. Where legacy stocks measure success in single-digit percentages, digital assets routinely deliver triple-digit surges that leave analysts scrambling. The underlying technology? Blockchain doesn't just track inventory—it rebuilds entire financial systems from the ground up.

Zero Overhead, Maximum Disruption

No physical stores. No supply chain headaches. No seasonal fluctuations. Pure digital infrastructure generates returns while traditional retailers sleep—liquidity that never closes, innovation that never stops, and gains that compound while Costco counts receipts.

The Final Word

Smart money already moved beyond brick-and-mortar nostalgia plays. While mainstream investors debate price-to-earnings ratios, forward-thinking portfolios leverage technology that actually earns its multiples—proving once again that yesterday's blue chips can't compete with tomorrow's protocols. Sometimes the best growth strategy involves forgetting what worked in the past.

Image source: Getty Images.

Costco is a great company

Costco's customers pay for the privilege of shopping at its stores. The membership fees the retailer collects create an annuity-like income stream thanks to a roughly 90% customer retention rate. That gives Costco a huge amount of business flexibility, effectively allowing it to offer the lowest prices while also providing great service, thanks to strong employee relations.

And Costco is performing very well right now, even as some of its retail peers are struggling. For example, Costco's fiscal third-quarter 2025 same-store sales ROSE a strong 5.7% with traffic at its stores up 5.2%. Clearly, customers are very happy to shop at Costco. The problem is that Wall Street is aware of how good a business Costco runs, which is what Benjamin Graham's warning is all about.

Costco's price-to-sales ratio, price-to-earnings ratio, and price-to-book-value ratio are all well above their five-year averages. Its dividend yield is a tiny 0.5%, which is NEAR the low end of the historical yield range.

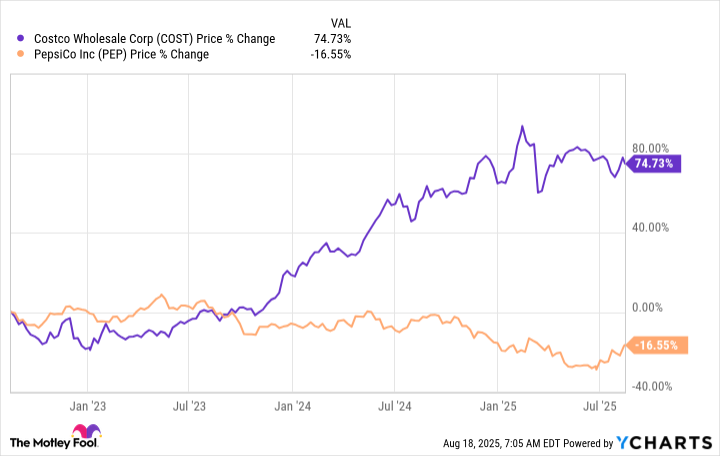

Data by YCharts

It is entirely possible that Costco's business could grow into that valuation, but that WOULD mean a static stock price. It is more likely that investors realize that Costco is too dearly priced and the stock falls. Buffett likes to buy great companies, but taking his mentor's advice, he prefers to buy them when they are attractively priced. Costco doesn't pass that test right now.

PepsiCo is on sale despite an incredible history

A better option for value-conscious investors today is likely to be(PEP 1.75%). PepsiCo's 3.8% dividend yield is near the highest levels in recent history. The company's P/S and P/B ratios are both below their five-year averages, while the P/E is slightly above that mark, thanks to near-term headwinds the company is facing. Simply put, where Costco looks expensive, PepsiCo looks cheap.

But PepsiCo has been growing its diversified consumer staples business for decades. It is easily one of the largest and best-run food makers on the planet, competing well with all of its branded peers. It has the scale to be an industry consolidator. It also has the marketing, distribution, and research and development (R&D) strength to stand toe to toe with any company in the beverage, snack, and packaged food niches in which it competes. But even good companies go through hard times, which is often the best time to buy them. Right now is a hard time for PepsiCo, which is why its stock has underperformed strongly executing Costco.

This time could be different. For example, the "bad news" that is dragging PepsiCo's stock down is likely to lead to a slight increase in organic sales in 2025 and flat earnings. Despite the big share price drop, that's really not such a bad financial performance. It is just worse than other companies in the consumer staples space, including Costco.

But history suggests that PepsiCo will muddle through, noting that it is a Dividend King with over five decades of annual increases under its belt. A record like that can't be built by accident. It requires a strong business model that gets executed well in both good markets and bad ones. Notably, PepsiCo has been buying brands so that it can keep pace with consumer trends. It has done the same thing many times before, helping it to continue growing its business over the long term. The playbook hasn't changed, and there's no reason to believe the results will be different this time around, either.

Think long-term and buy PepsiCo

Buying Costco while it is doing well is easy to justify. However, you have to consider the price you are paying. Simply put, it is expensive. Buying PepsiCo when it is struggling is harder to justify, but it could be the better choice in the consumer staples space.

PepsiCo is still working on growing its business, just like it has for over 50 years. But investors are focused on the next quarter when they should be focused on the next decade. And, thus, PepsiCo has been put on the sale rack. If you think long-term you'll likely be happy if you pick up this bargain growth stock while others are selling it.