Rocket Lab Stock Skyrockets 1,000% Since 2023—Time to Buy or Time to Bail?

Rocket Lab's stock isn't just climbing—it's staging a full-blown lunar escape from gravity. Up 1,000% since January 2023, the space-tech darling now faces the ultimate investor dilemma: chase the rally or dodge the speculative debris?

The Bull Case: More Than Just Hype

With launch cadence accelerating and contracts stacking up, Rocket Lab’s revenue trajectory mirrors its rockets—vertical. The company’s vertical integration—from satellite manufacturing to reusable boosters—gives it SpaceX-like potential without Elon’s tweet-risk.

The Bear Trap: Valuation Meets Vacuum

At these altitudes, even minor guidance cuts could trigger a re-entry burn. Analysts whisper ‘overbought’ while retail traders pile in—classic ‘greater fool theory’ with extra G-forces. Remember: 1,000% gains often precede 80% crashes (ask any crypto veteran).

The Bottom Line

This isn’t investing anymore—it’s momentum trading with orbital mechanics. If you buy now, pack a parachute. Or just wait—Wall Street will mint a space ETF soon enough to dilute the whole sector.

Growing launch capabilities with the Neutron

After beginning its journey as a rocket launch company with a small payload provider called the Electron, Rocket Lab is currently in testing to develop the next phase of its business. This is through a rocket type called the Neutron, which can deliver payload capacities much greater than the Electron system. While the Electron is a solid business that is now on pace to do over 20 launches a year, it will always remain a niche service from a revenue perspective due to its small size. Larger payloads equate to more revenue potential per launch, which is why the Neutron is vital for the company.

The Neutron can deliver payloads equivalent to SpaceX's Falcon 9, which charges over $50 million per flight. For reference, Rocket Lab's total revenue over the last 12 months was $500 million. By the end of this year, Rocket Lab expects to make its first test flight with the Neutron, and then plans for commercialized trips in 2026. Once ready, Neutron will be the first direct competitor SpaceX has ever had in the medium launch market.

Not only will the Neutron enable Rocket Lab to get more launch revenue, it will open up contracts through its vertical integration strategy in what it calls Space Systems revenue. These are capabilities it has acquired or built itself where the company builds items for its launch customers. These could include satellites, solar arrays, telecommunication systems, virtually anything a company (or the U.S. government and its allies) want to have in orbit. Vertically integrating the services space customers want should help Rocket Lab win new customer contracts. Combining Space Systems together with the Neutron is a multibillion-dollar opportunity for the company and a competitive advantage against its peers.

Image source: Getty Images.

Expanding contract opportunities

Commercial opportunities for satellite launches should continue en masse in the NEAR future. Companies want to launch tens of thousands of satellites into orbit for services such as satellite internet at's Project Kuiper, among other opportunities. Rocket Lab's current backlog is only $1 billion and hasn't moved higher in a few quarters, but management had a good explanation for this stagnation on the recent earnings conference call. Customers are waiting until the Neutron rocket is fully operational to commit orders. Again, this shows how vital the Neutron development is for the business.

Government contracts could be even more lucrative over the long term. Rocket Lab is vying for contracts such as the Golden Dome, a United States satellite-based defense system with a budget of $175 billion. Rocket Lab is one of the few defense contractors with the capabilities to quickly build these defense systems, as long as the Neutron is fully operational.

Combine the commercial and government opportunities and Rocket Lab's revenue should keep growing at a rapid clip over the next decade. It wouldn't be shocking if its current $500 million in revenue grew by 10x to $5 billion within a decade.

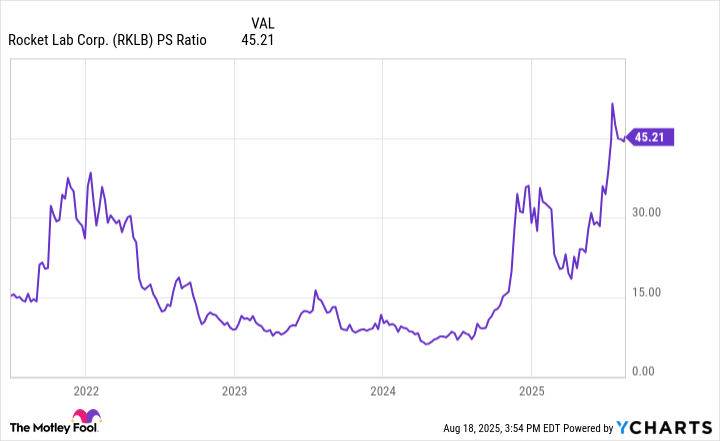

RKLB PS Ratio data by YCharts

Is Rocket Lab stock a buy?

Rocket Lab is a fast-growing company, so it is no surprise that investors have bid up the stock to monstrous levels. The stock currently has a market cap of over $20 billion and a price-to-sales ratio (P/S) of 45, which is significantly higher than the average stock. Rocket Lab is growing much faster than the average company, but these are high expectations for future growth nonetheless.

The business does not have extremely high profit margins, either. Its gross margin is slightly above 30% and guidance calls for progression to 40% or higher, but this is not a software business. Margin expansion will be limited, and bottom-line net income margin will likely not expand to much higher than 10% or 15% once the business matures.

A 10% profit margin on $5 billion in future revenue -- which is 10 times today's level -- equates to $500 million in earnings. That WOULD bring Rocket Lab's price-to-earnings ratio (P/E) down to about 20, or around the market average. But how long will it take Rocket Lab to scale to this level of earnings? I think it could take 10 years. This makes Rocket Lab's stock expensive despite its massive growth potential, meaning that investors should avoid buying shares unless the stock takes a significant dip from current levels.