General Mills (GIS) Stock Stumbles After Q4 Earnings Miss and Weak Outlook – Breakfast Isn’t the Only Thing Getting Soggy

General Mills served up a lukewarm quarter—and investors aren’t biting. The packaged food giant’s Q4 earnings landed with a thud, missing expectations as inflation-weary consumers push back on price hikes. Shares dropped pre-market as guidance failed to impress.

The Numbers Don’t Lie (But Management Might)

Revenue barely cleared the bar while margins got squeezed tighter than a Cap’n Crunch factory tour. The ‘adjusted’ earnings beat? A classic case of kitchen-sink accounting—toss in enough exclusions and anything looks appetizing.

2025 Outlook: More Bland Than Plain Oatmeal

Next year’s forecast suggests growth will slow to a crawl, proving even comfort food isn’t recession-proof. Maybe they should start accepting SNAP benefits on Wall Street.

The cereal king’s crown is looking shaky as store brands gain traction. When your bull case relies on Lucky Charms nostalgia, you’re one step away from trading like a meme stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The revenue miss came despite General Mills’ adjusted earnings per share of 74 cents, which was above analysts’ estimate of 71 cents. Even so, investors weren’t pleased that the company’s adjusted EPS dropped 27% year-over-year from $1.10.

General Mills also reported Fiscal 2025 adjusted EPS of $4.21 alongside revenue of $19.49 billion. For comparison, Wall Street expected adjusted EPS of $4.18 on revenue of $19.5 billion. Investors will also note that 2025 adjusted EPS and revenue were down 7% and 2% compared to Fiscal 2024.

General Mills Fiscal 2026 Outlook

Investors also weren’t happy about General Mills’ outlook for its next fiscal year. The company expects adjusted EPS for the period to drop 10% to 15% year-over-year. It also estimates that organic net sales will come in between a 1% decrease and a 1% increase.

The latest General Mills earnings didn’t help GIS stock today. Shares were down 2.45% this morning, extending the company’s 14.53% drop year-to-date. GIS stock was also down 16.77% over the past 12 months.

Is General Mills Stock a Buy, Sell, or Hold?

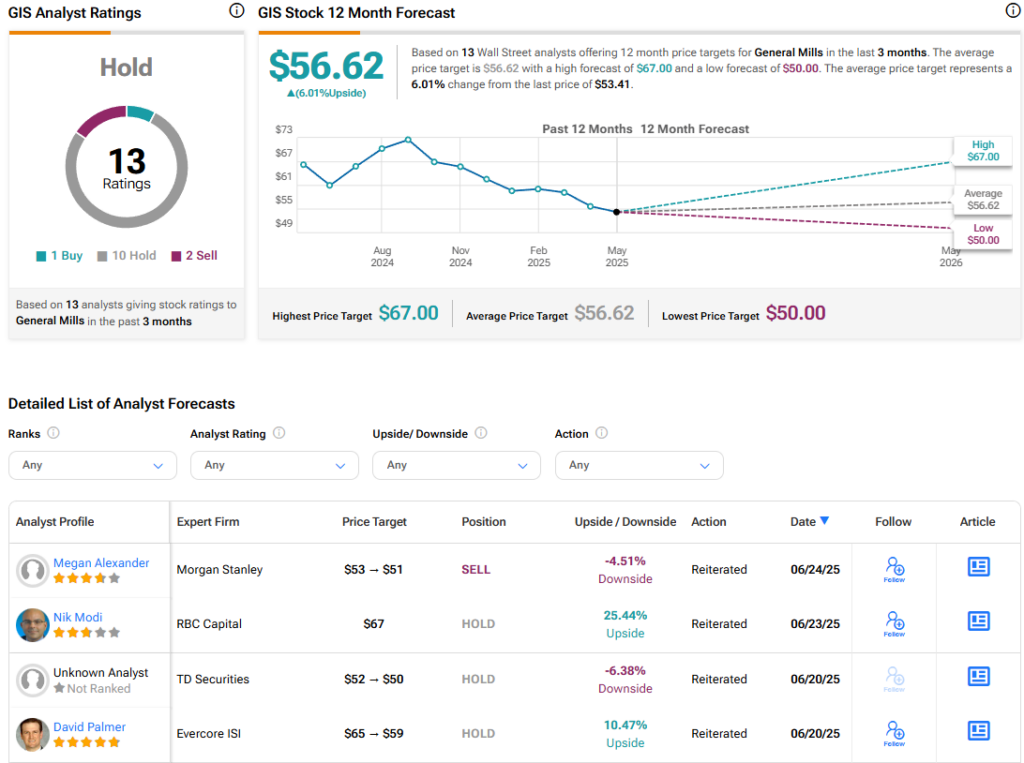

Turning to Wall Street, the analysts’ consensus rating for General Mills is Hold, based on one Buy, 10 Hold, and two Sell ratings over the past three months. With that comes an average GIS stock price target of $56.62, representing a potential 6.01% upside for the shares. These ratings and price targets will likely change as analysts update their coverage of the company after its earnings report.