HOOD Soars 7% as Robinhood Rolls Out Crypto Deposit Match—Wall Street Scrambles to Keep Up

Robinhood just lit a rocket under its stock—and crypto traders are grabbing the matches.

The trading platform's shares (HOOD) surged 7% today after launching a deposit-matching program for digital assets. Suddenly, that 'dumb money' app looks downright clever.

Free money (kinda): New users get 1% of their crypto deposits matched in BTC—a classic growth hack from the playbook that made Web2 giants fat. The twist? They're betting crypto's next bull run will mint millionaires faster than their clearinghouse can process margin calls.

Market makers hate this one trick: While legacy brokers nickel-and-dime clients with PDT rules, Robinhood's going full degens-welcome. Volatile? Yes. Regulatory gray area? Possibly. A masterstroke in customer acquisition? Absolutely.

One hedge fund analyst (who definitely didn't cover HOOD at $80) quipped: 'Nothing boosts engagement like the dopamine hit of free crypto—except maybe realizing you should've bought Bitcoin in 2015.'

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Specifically, Robinhood now offers customers a 1% match on their crypto net deposits. According to the announcement, if a total of $500 million or more worth of cryptocurrencies such as Bitcoin (BTC) and ethereum (ETH) are placed with Robinhood, the match will increase from 1% to 2%. The promotion is limited, however, and runs through July 7.

Despite its limited run, investors are responding positively to the crypto deposit match program. This is the latest effort by Robinhood to push further into cryptocurrencies and diversify its offerings from stock trading and into new areas of the market.

Other Enhancements

In addition to the crypto match program, Robinhood also announced several new platform features. Among the new features is a new artificial intelligence (AI) tool called “Cortex’s Digest” that provides “timely insights” to investors and traders. The brokerage is also expanding its mobile app, including providing advanced charting features.

Robinhood management said they plan to streamline the trading process by reducing the steps needed to execute trades and making options trading more accessible to individual retail investors. Additionally, Robinhood’s trading platform will now offer simulated potential returns on stocks. HOOD stock is up 120% this year.

Is HOOD Stock a Buy?

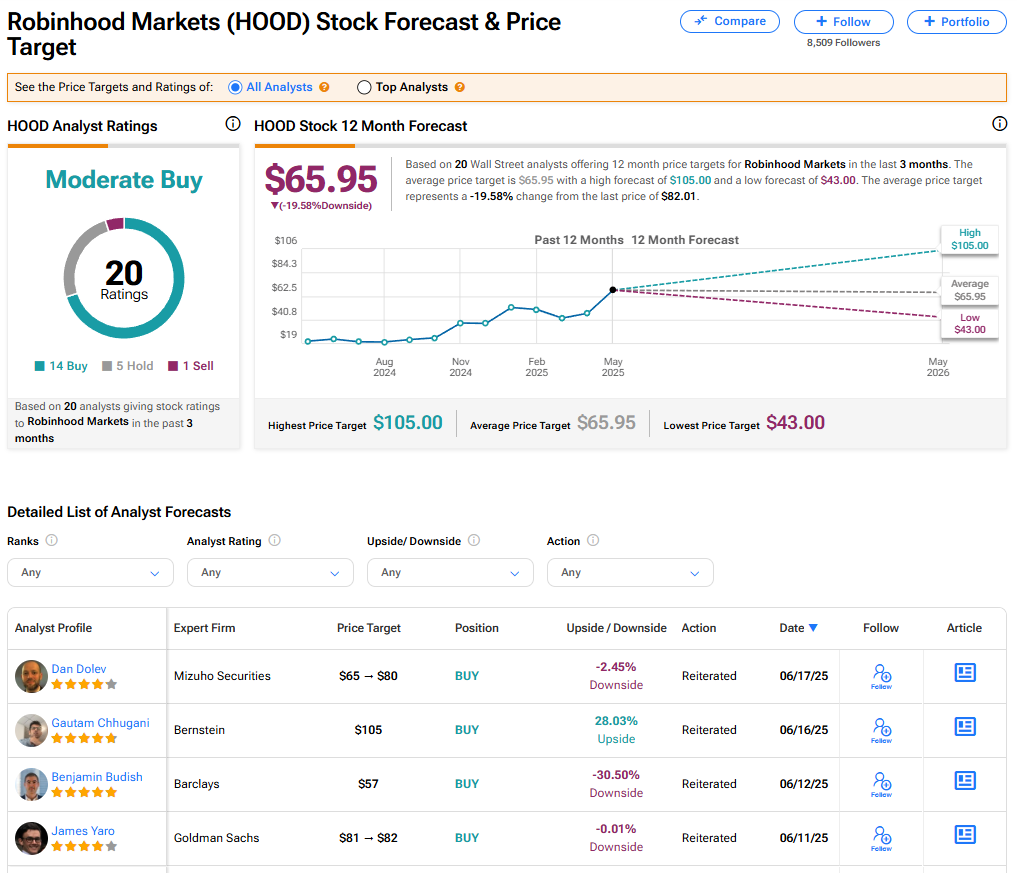

The stock of Robinhood Markets has a consensus Moderate Buy rating among 20 Wall Street analysts. That rating is based on 14 Buy, five Hold, and one Sell recommendations issued in the last three months. The average HOOD price target of $65.95 implies 19.58% downside risk from current levels.