🚀 Intel Stock (NASDAQ:INTC) Soars After Axing Automotive Division – What’s Next?

Intel just slammed the brakes on its automotive ambitions—and investors are flooring the gas.

### Chipzilla Pivots (Again)

The semiconductor giant’s stock ripped higher after quietly euthanizing its automotive chip business. Because nothing says 'strategic focus' like abruptly abandoning a sector you hyped for years.

### Wall Street’s Verdict: Sell the Hype, Buy the Retreat

Turns out dumping capital-intensive moonshots pleases shareholders more than actually delivering on them. Who knew? *[Cue cynical laughter from crypto traders watching legacy tech play musical chairs.]*

### The Bottom Line

Intel’s latest sharp turn proves even dinosaurs can moonwalk when survival’s at stake. Meanwhile, decentralized compute networks keep eating their lunch—no corporate boardrooms required.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Intel never had much of a hand in automotive, reports noted, but Intel could certainly count a hefty slug of business to its credit. Around 50 million vehicles, Intel noted, currently turn to Intel processors. Despite this, Intel still plans to fold up the division, planning to “…fulfill existing commitments…,” and, once that is complete, most of the employees in the automotive group will be shown the door.

This is a part of Intel’s larger mission right now, to get smaller. Or at least more narrow in focus, instead prioritizing its data center and “core client” operations. Interestingly, Intel’s majority stake in Mobileye (MBLY) will not be impacted by this move, reports note, despite clearly being an automotive function. The cost cutting is certainly putting Intel in a good position as far as its balance sheets go, but the question remains if Intel will still be able to do much after it closes all these divisions.

Better Performance, But At What Cost?

For current Intel processor users, a new report emerged suggesting that substantial benefits could be had, though at an uncertain cost. Reports note that users that disable Intel Graphics Security Mitigations will see performance increase by around 20%. That is a benefit that is hard to pass up, but some may want to do just that.

That particular hack, reports noted, comes with an “…unknown security risk.” But these are somewhat questionable, as, apparently, the Ubuntu kernel involved has the same security projections on the CPU as Intel has for its GPU. This renders the GPU mitigations “…almost redundant,” one report noted. But then, there is the matter of “unknown unknowns” to consider. We simply do not know all that we do not know, and there may be a heretofore unconsidered security risk involved in cutting off those protections.

Is Intel a Buy, Hold or Sell?

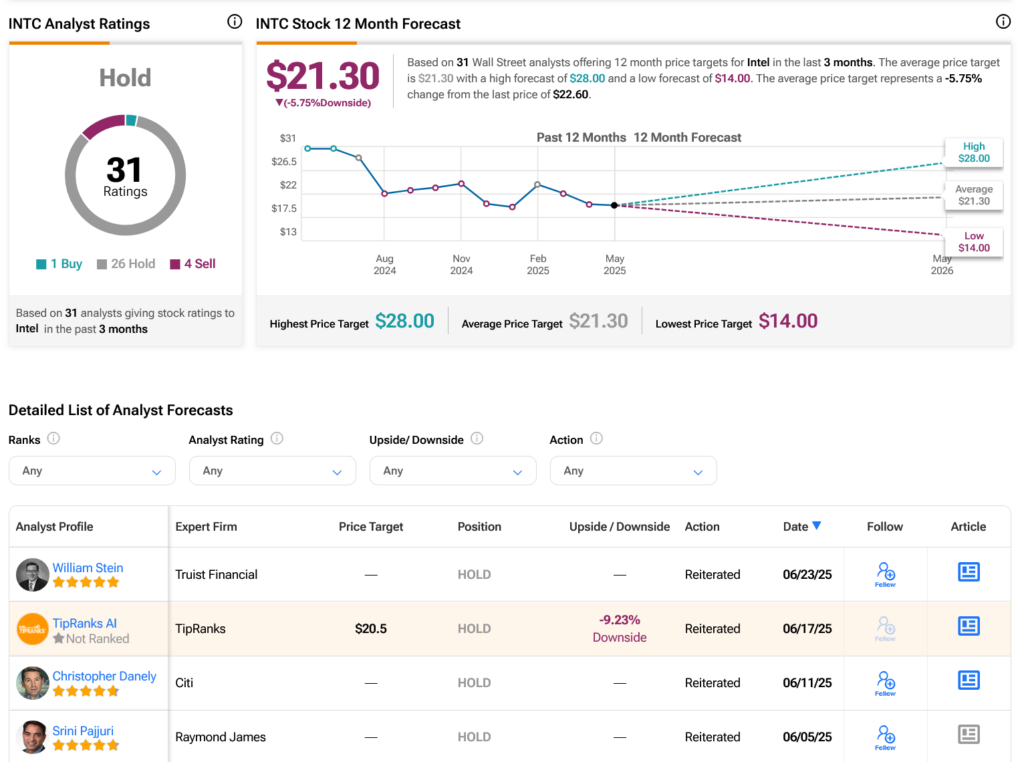

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 31.07% loss in its share price over the past year, the average INTC price target of $21.30 per share implies 5.75% downside risk.

Disclosure