Ambarella (AMBA) Stock Rockets 30% on Buyout Buzz—Who’s Snatching the AI Chip Gem?

Rumors of a potential sale send Ambarella shares into the stratosphere—because nothing juices a stock like Wall Street's favorite three-letter word: M&A.

The AI chip designer's 30% surge proves even semi conductors aren't immune to takeover fever. Cue the bidding war between tech titans and private equity vultures.

Funny how 'exploring strategic alternatives' always means 'please inflate our valuation before earnings.' But hey, when the buyout music plays, nobody wants to be the last bagholder.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is worth noting that the company makes semiconductors that are used in things like security cameras and self-driving cars. Although it hasn’t posted a full-year profit since 2017, analysts expect Ambarella’s revenue to grow by 28% in 2025. The company credits this growth to the rising demand for “edge AI” products, which are chips that run AI-powered video recognition close to where the video is recorded. These products now make up about 75% of the firm’s sales and have helped it enter new areas like industrial automation, video conferencing, and 360-degree consumer cameras.

Interestingly, the chip industry has seen a rise in deal-making recently, which may be influencing Ambarella’s strategy. Notable transactions include SoftBank’s (SFTBF) $6.5 billion acquisition of Ampere Computing in March and Intel’s (INTC) sale of a majority stake in Altera to Silver Lake in April. While Ambarella is gaining momentum in AI-related markets, one concern is that it is heavily dependent on a single customer, Taiwan-based WT Microelectronics, which distributes its products and accounts for more than 60% of its total revenue.

Is AMBA Stock a Good Buy?

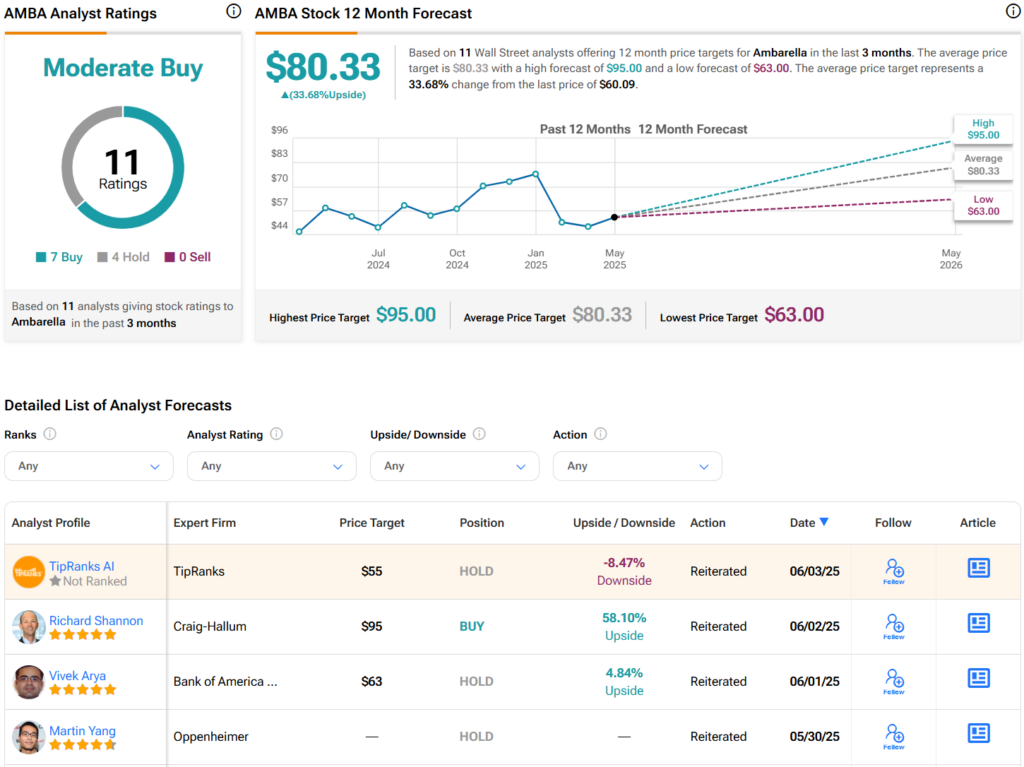

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMBA stock based on seven Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMBA price target of $80.33 per share implies 33.7% upside potential.