Coinbase Sparks Market Frenzy with NOM Listing – Traders Eye Next Crypto Gem

Coinbase just dropped a bombshell—NOM coin is live on its platform, and the crypto crowd is buzzing.

Why it matters: Listings like these often trigger violent price swings as speculators pile in. Will NOM follow the classic 'pump-and-dump' playbook, or is this the real deal? Only your portfolio knows for sure.

Pro tip: Watch the order books closely. The first 72 hours after a major exchange listing tend to separate the diamond hands from the bagholders.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The implied move suggests investors are uncertain about how the company’s streaming, parks, and media businesses WOULD have performed in the quarter. Also, they are looking for insights into Disney’s turnaround efforts under CEO Bob Iger, who returned with a focus on improving profitability and content quality.

What to Watch in DIS’ Q4 Report

Wall Street is expecting DIS to report Q4 earnings of $1.05 per share, compared with $1.14 in the same period last year. Also, analysts project revenues of $22.76 billion, up from $22.45 billion in the year-ago quarter.

At the upcoming results, investors are looking for Disney’s progress in cutting losses from its streaming segment, which has been a drag on earnings. Also, the company’s theme parks have been a bright spot in recent quarters. Strong attendance and consumer spending could help balance out weaker segments.

At the same time, cost-cutting and restructuring efforts are also under scrutiny, as news about savings or layoffs could affect market sentiment. Lastly, Disney’s content strategy is under the spotlight amid fewer big hits and tougher competition.

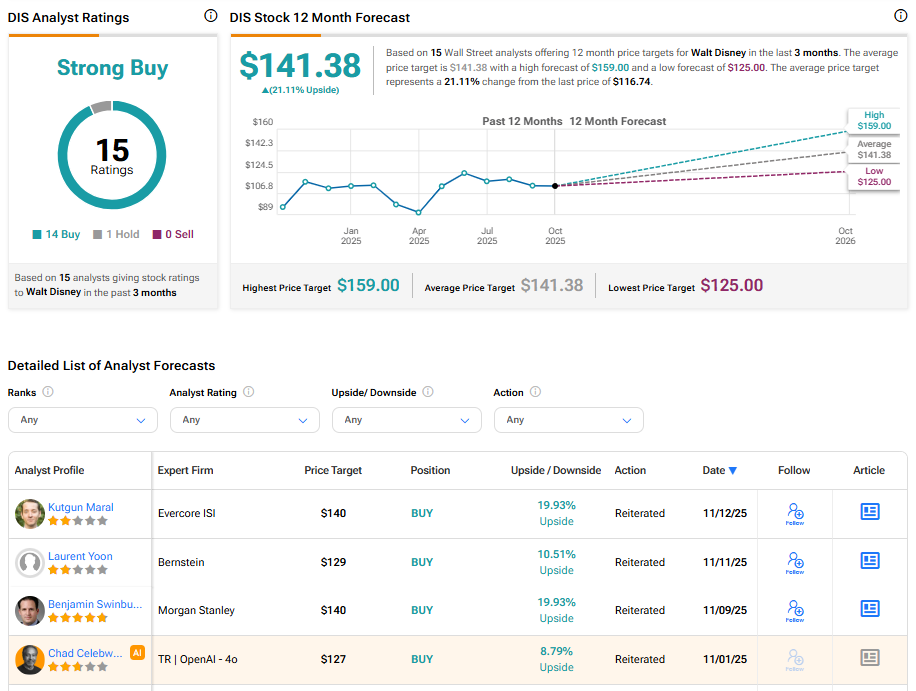

Is Walt Disney a Buy or Sell?

Turning to Wall Street, DIS stock has a Strong Buy consensus rating based on 14 Buys and one Hold assigned in the last three months. At $141.38, the average Walt Disney stock price target implies a 21.17% upside potential.