Breaking: France Pushes EU to Hike Tariffs on Small Chinese Parcels – E-Commerce Shakeup Ahead

Paris turns up the heat on Brussels with a bold protectionist move targeting China's e-commerce dominance.

French officials argue current tariffs create an unfair advantage for Chinese sellers flooding EU markets with cheap goods.

The proposed measures could force platforms like AliExpress and Temu to rethink their ultra-low-price strategies.

Meanwhile, logistics companies are already calculating how to bypass the new barriers – because where there's a tariff wall, there's always a financial ladder.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

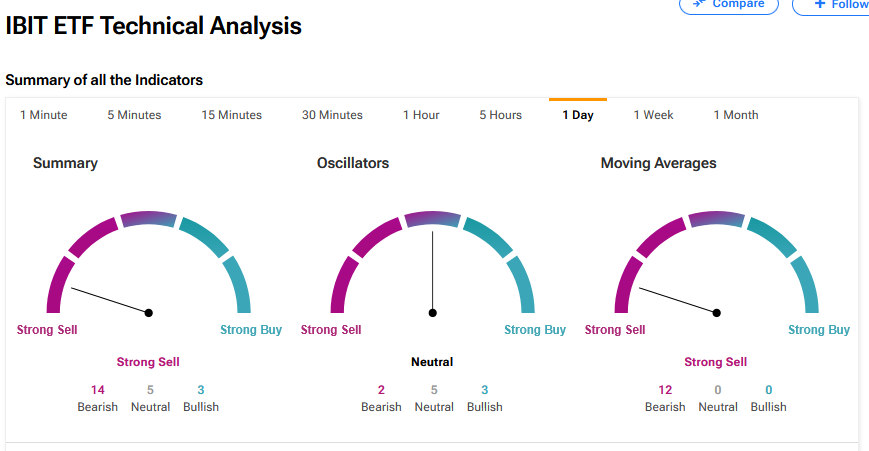

According to TipRanks’ technical analysis, the IBIT is now at a Strong Sell consensus based on 14 Bearish, 5 Neutral and 3 Bullish ratings.

Based on the activity of 827,514 investors in the recent quarter, it has scored sector-average neutral sentiment. Those investors aged between 35 and 55 have been the most active buyers.

In total, 1.9% of all portfolios hold IBIT.

Today’s IBIT Performance

Today, the IBIT was down 1.54% at $57.45. The main drag was the price of Bitcoin, which dropped 1.68% to $101,288.42.

It’s mainly down to investors unsure whether to buy or sell bitcoin in the current political environment as the U.S. government shutdown starts to ease or the fragile economic environment. Analyst believe some are sitting on the fence waiting on more certainty around Federal Reserve rate cuts next month.

According to the Wall Street Journal the central bank is facing an internal divide, with policymakers split over whether the greater risk now is persistent inflation or a softening labor market. That division has left a rate cut being a “toss up.”