3 AI-Selected ETFs Poised to Outperform the Market in 2025

Wall Street's algorithms are doubling down on these high-conviction plays.

Forget human stock-pickers—these ETF picks come straight from the machine learning models crunching billions of data points. And no, they didn't recommend your financial advisor's favorite underperforming mutual fund.

Here's where the smart money (literally) is flowing:

1. Quantum Computing ETF (QTUM) - Because legacy tech is so 2020

2. Blockchain Innovators Fund (BLCN) - The only Wall Street-approved way to pretend you understand crypto

3. AI Disruption Basket (AIDB) - When in doubt, bet on the machines replacing your job

All selections feature expense ratios under 0.30%—which is more than we can say for most actively managed funds delivering mediocre returns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

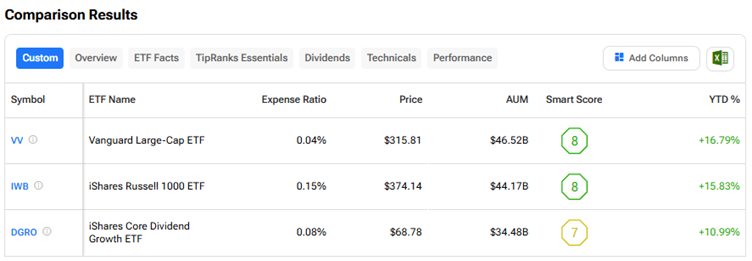

Below are three ETFs that TipRanks’ AI Analyst is bullish on. These ETFs have an Outperform rating and offer at least 10% upside. With the help of TipRanks’ ETF Comparison Tool, here’s how the three funds compare.

(VV)The VV ETF tracks the performance of the CRSP U.S. Large Cap Index. It is a compelling option for investors seeking resilience and long-term growth potential of large, well-capitalized companies. The VV ETF has an expense ratio of 0.04%.

TipRanks’ AI Analyst has an Outperform rating on the VV ETF with a price target of $349, indicating an upside potential of 10.51%. The AI Analyst’s bullish stance on VV ETF is based on its solid portfolio of major U.S. companies, with Nvidia (NVDA) and Microsoft (MSFT) contributing significantly to the fund’s performance due to their impressive financial growth and strategic focus on AI and cloud services. However, weakness in holdings like Tesla (TSLA) and Berkshire Hathaway (BRK.A) (BRK.B), with valuation concerns and mixed technical indicators, modestly weigh on the ETF’s overall rating.

(IWB)The IWB ETF tracks the Russell 1000 Index, which comprises the largest 1,000 U.S. companies by market capitalization. Interestingly, the IWB ETF spans across multiple sectors, including technology, financials, and health care, reducing dependence on any single industry. The IWB ETF has an expense ratio of 0.15%.

TipRanks’ AI Analyst has assigned an Outperform rating to the IWB ETF with a price target of $414, implying about 10.65% upside potential. The AI Analyst highlighted that the IWB ETF gains from top holdings such as tech giants Nvidia and Microsoft. However, the ETF’s overall score is moderated by holdings like Berkshire Hathaway, which has mixed technical indicators.

(DGRO)The DGRO ETF tracks the performance of an index composed of U.S. equities with a history of consistently growing dividends. This ETF is appealing to investors looking to enhance their portfolios with a steady stream of income and the potential for capital gains. The DGRO ETF has an expense ratio of 0.08%.

TipRanks’ AI Analyst has an Outperform rating on the DGRO ETF with a price target of $76, indicating about 10.11% upside potential. The AI Analyst noted that the DGRO ETF gains from strong contributions from holdings like Microsoft and iPhone Maker Apple (AAPL). However, weaker holdings such as AbbVie (ABBV), with valuation concerns and financial leverage risks, impact the AI Analyst’s overall score for the DGRO ETF.