Amazon-Backed Anthropic Drops $50B Bomb: AI Data Center Arms Race Heats Up

Big Tech's AI gold rush just got a nuclear warhead.

Anthropic—the Amazon-funded AI lab—plans to incinerate $50 billion building data centers, betting the farm on the AI boom's staying power. That's enough to buy every GPU on Earth... twice.

Silicon Valley's High-Stakes Poker Game

This isn't infrastructure—it's a territory grab. Every hyperscaler from Microsoft to Google now scrambling to match this play, while Wall Street traders place side bets on which cloud provider blinks first.

The Fine Print

No mention of ROI timelines, naturally. Just the classic 'spend now, figure out profitability later' strategy that made crypto bros and WeWork famous. At least the data centers will have concrete floors—unlike some vaporware metaverse projects.

One thing's certain: Nvidia's quarterly earnings just got another bump. Your move, Altman.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company, known for its Claude chatbot, says it plans to start by developing custom data centers in Texas and New York. The facilities will support Anthropic’s enterprise growth and its long-term research.

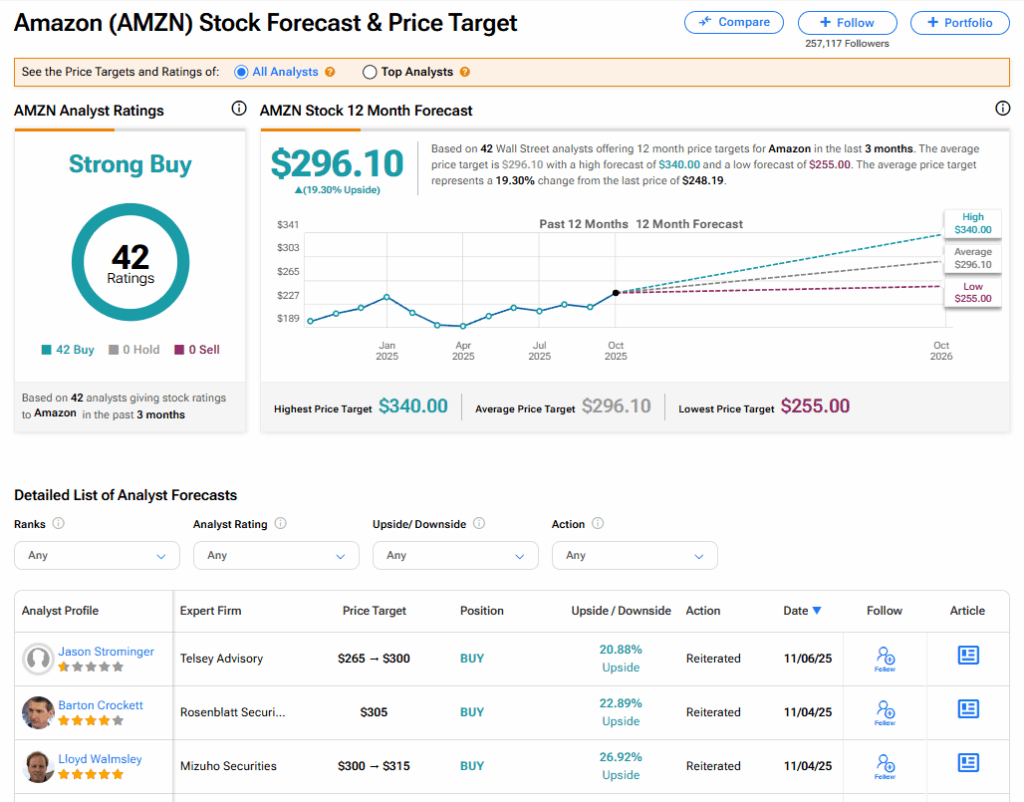

Is AMZN Stock a Buy?

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $296.10 implies 19.30% upside from current levels.