Foxconn Soars as AI Server Demand Crushes iPhone Revenue—Tech’s New Cash Cow?

Foxconn's stock surges as AI infrastructure eats Apple's lunch.

The AI Gold Rush Pays Off

While analysts obsess over iPhone sales cycles, Foxconn quietly pivots to the real moneymaker: AI server racks. The manufacturing titan’s shares jumped as demand for AI hardware outpaces its legacy smartphone business—because why assemble pocket-sized gadgets when you can build the brains behind ChatGPT?

Wall Street’s Late Epiphany

Investors finally noticed the margins hiding in plain sight. AI servers aren’t just a side hustle; they’re Foxconn’s hedge against the commoditization of consumer tech. Meanwhile, hedge funds still pretending Apple’s 'next big thing' will save their portfolios. Spoiler: It won’t.

The Bottom Line

Foxconn’s betting on silicon brains over shiny rectangles. Smart move—until the AI bubble bursts and everyone remembers hardware is a low-margin game. But hey, enjoy the rally while it lasts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company credited the gain to strong demand for AI servers. Foxconn said revenue from its cloud and networking business, which includes AI servers, has now passed its revenue from smart consumer electronics for the second straight quarter. That group includes iPhones, which Foxconn also assembles.

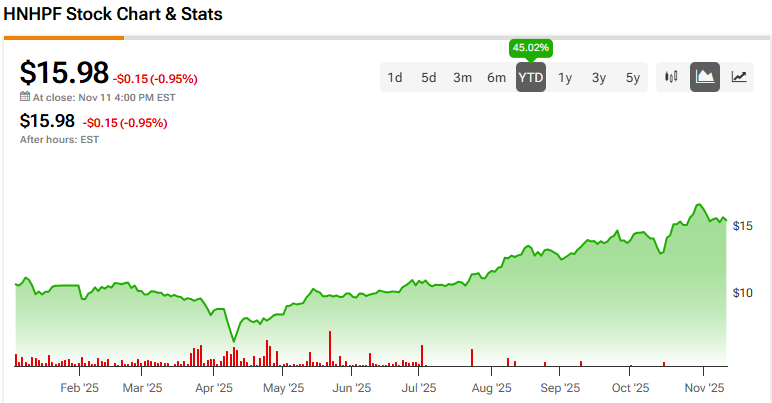

Meanwhile, HNHPF shares dropped by 0.95% on Tuesday to close at $15.98.

AI Servers Now Lead Business Mix

AI servers are now the company’s biggest business line, accounting for 42% of its total revenue. Foxconn said it expects AI server sales to grow again in the next quarter. The company did not provide full revenue figures for the full year but said it still expects growth compared to last year.

Foxconn manufactures AI server racks for big names like Amazon (AMZN) and Nvidia (NVDA). The company said its total revenue from AI servers has now reached $31 billion. In October, Foxconn’s chairman met with OpenAI’schief executive, though no deal was announced. After that meeting, the stock reached a record high.

Expansion and Manufacturing Shifts

While most iPhones are still built in China, Foxconn has been moving some assembly to India. The bulk of iPhones sold in the U.S. now comes from there. The company is also building new factories in Mexico and Texas to make AI servers for Nvidia. These moves are part of a plan to spread production across multiple locations and shorten delivery times.

Foxconn is also active in the electric vehicle space. In August, the company agreed to sell a former car plant in Ohio for $375 million. It bought that site in 2022 to try to build electric vehicles, but has since shifted direction.

Is Foxconn Stock a Buy?

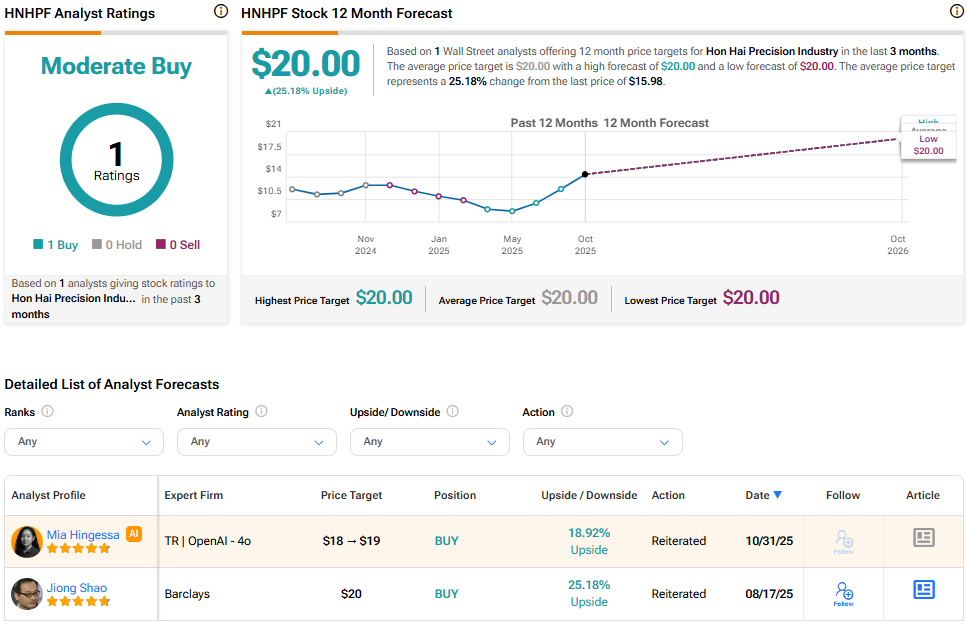

Foxconn is thinly followed by the Street’s analysts. Based on one rating, the stock boasts a Moderate Buy consensus. The average HNHPF stock price target is $20, implying a 25.18% upside from the current price.