Circle Internet (CRCL) Q3 Earnings Drop Today – Will Stablecoin Giant Beat Expectations?

All eyes on CRCL as earnings hit the tape.

Stablecoin titan Circle Internet Financial (CRCL) reports Q3 earnings today—just as crypto markets show signs of life. Will USDC’s resurgence fuel a beat, or will Wall Street’s spreadsheet jockeys find another reason to short crypto-adjacent stocks?

Key metrics to watch:

- USDC market cap growth (or lack thereof)

- Institutional adoption trends

- That mysterious ‘other revenue’ line item

Analysts expect the usual corporate kabuki theater: carefully worded guidance, vague blockchain buzzwords, and at least one cringeworthy attempt to ‘connect with Web3 youth.’ Meanwhile, traders will parse every syllable for hints about Circle’s long-rumored IPO—because nothing says ‘decentralized future’ like a traditional S-1 filing.

Closing thought: If stablecoins are the ‘safe’ part of crypto, why does every earnings call feel like riding Tether on a choppy day?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Circle Internet is best known as the largest issuer of thestablecoin, a key player in the digital payments ecosystem. The company’s shares surged over 235% following its June 2025 IPO but have since cooled, declining 8.7% year-to-date as investor enthusiasm has leveled off. Circle’s strong brand reputation, regulatory tailwinds, and growing stablecoin adoption provide solid growth potential, but valuation pressures and competitive risks continue to weigh on sentiment.

Catalysts Impacting Q3 Results

Circle’s Q3 performance is expected to benefit from clearer regulatory frameworks and increasing global demand for stablecoins such as USDC. Stronger adoption across payment networks, growing institutional interest, and expansion of its network partnerships could provide additional revenue momentum.

Investors will look closely at key metrics including transaction volume, market share in the stablecoin sector, and updates on new product launches or strategic partnerships. Profitability trends will also be under scrutiny as Circle faces rising competition from Tether and emerging decentralized payment solutions.

What Analysts Are Saying About Circle

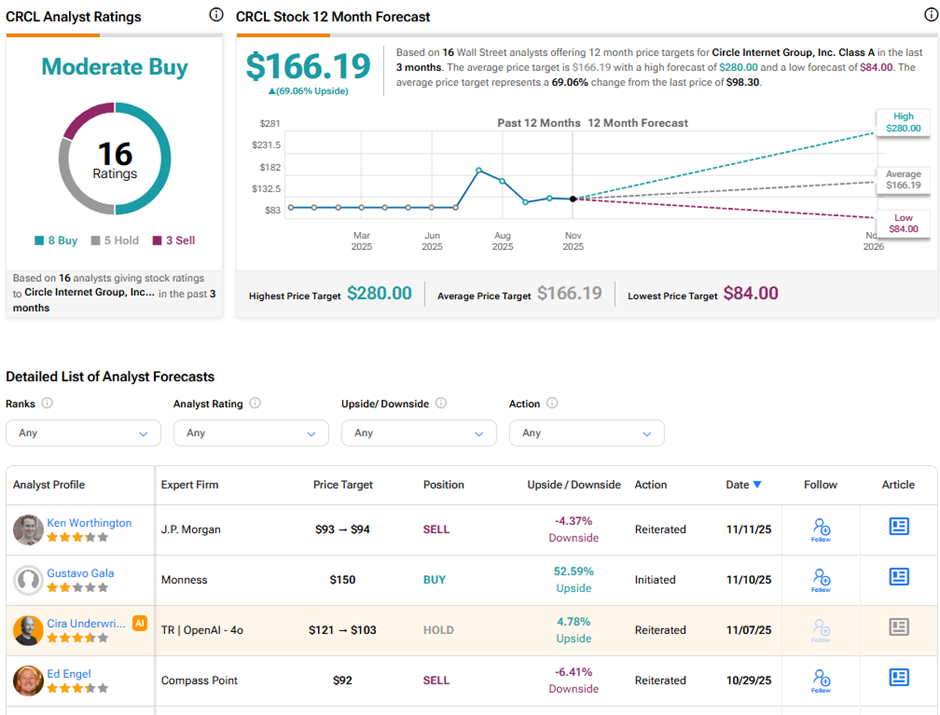

Ahead of the Q3 print, J.P. Morgan analyst Ken Worthington reiterated his “Sell” rating on CRCL stock, while raising the price target modestly from $93 to $94, implying 4.4% downside potential. Worthington believes Circle remains overvalued compared to its fundamentals and that investor Optimism may have already priced in near-term growth.

In contrast, Monness Crespi Hardt analyst Gustavo Gala recently initiated coverage with a “Buy” rating and $150 price target, implying an impressive 52.6% upside potential. Gala believes that Circle is well positioned to gain a large share of the on-chain money supply because its stablecoin, USDC, helps strengthen the U.S. dollar’s dominance and makes global transactions more efficient. He pointed out that Circle’s valuation is lower than rival Tether’s, suggesting there is potential for price growth. He expects margin expansion and stronger dollar-denominated revenues in the NEAR term.

Is CRCL a Good Stock to Buy?

Analysts remain divided on Circle’s long-term outlook. On TipRanks, CRCL stock has a Moderate Buy consensus rating based on eight Buys, five Holds, and three Sell ratings. The average Circle Internet price target of $166.19 implies 69.1% upside potential from current levels.