IonQ Locks DARPA Phase B Funding – Quantum Computing’s 2033 Breakthrough Blueprint Revealed

Quantum computing just got a major vote of confidence. IonQ, the trapped-ion quantum pioneer, secured its Stage B contract under DARPA's quantum benchmarking program—effectively mapping its path to commercial viability by 2033.

Why it matters: While Wall Street bets on quantum vaporware, DARPA’s stamp of approval separates lab experiments from deployable tech. IonQ’s roadmap now has Pentagon-grade validation.

The cynical take: Another ‘moonshot’ absorbing R&D dollars that could’ve gone into, say, fixing classical blockchain scaling. But unlike crypto’s circular token economics, quantum actually moves the needle on computational impossibility.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

IonQ had already completed Stage A, which focused on outlining what a practical quantum computer might look like. Now, in Stage B, the company will develop a detailed roadmap through 2033. That plan will include designs, hardware targets, and performance goals. The last stage, Stage C, will aim to confirm whether such a machine can be built and used for real-world needs.

Meanwhile, IONQ shares climbed 3.20% on Friday, closing at $59.27.

IonQ Targets 2 Million Qubits by 2030

This comes as IonQ works toward its goal of delivering a utility-scale system by 2030. The company aims to target 2 million physical qubits and 80,000 logical qubits by that time. It also recently hit #AQ 64 on its IonQ Tempo system, a key metric based on accuracy and qubit count.

The company’s hardware is already available on Amazon Web Services (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOGL) (GOOG). That access gives IonQ a head start in testing quantum tools for use in health, energy, and national security.

Revenue is Picking Up, But Expenses Are Still Heavy

In its latest report, IonQ posted third-quarter revenue of $20.7 million, beating its own forecast by 15%. Growth came from deals with clients like Amazon Web Services and AstraZeneca (AZN). The company also secured $1 billion in fresh capital to help expand its team and research.

Still, net losses widened to $177.5 million, up from $37.6 million a year earlier. That shift came mostly from higher stock-based pay and the cost of building larger systems.

For now, the focus remains on research progress and new partnerships, not on near-term profits. Investors tracking the space will likely keep watching which firms gain traction with government buyers and cloud platforms.

Is IONQ Stock a Buy?

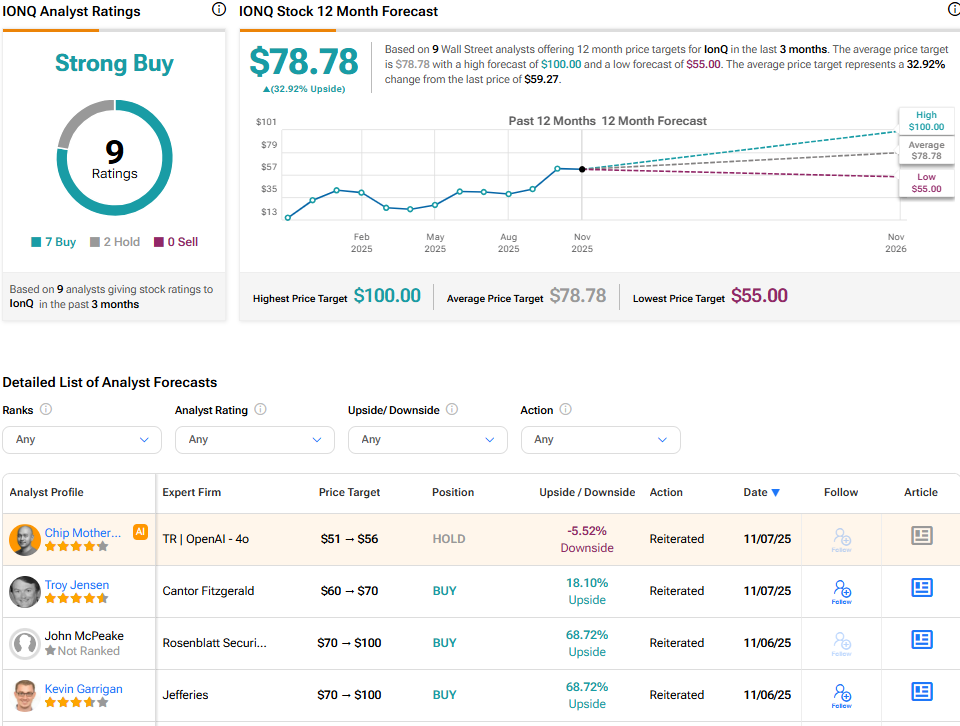

On the Street, IonQ holds a Strong Buy consensus rating. The average IONQ stock price target stands at $78.78, implying a 32.92% upside from the current price.