Cisco (CSCO) Q1 Earnings Preview: What Wall Street Isn’t Telling You

Tech giant Cisco’s earnings drop is looming—will it be a beat or another ‘guidance adjustment’ special?

Subheading: The Networking Elephant in the Room

CSCO bulls are praying for a repeat of last quarter’s surprise upside, while bears whisper about supply chain ghosts haunting the numbers. No one’s mentioning the elephant in the server room: enterprise budgets are tighter than a hyperscaler’s profit margins.

Subheading: Whisper Numbers vs. Reality

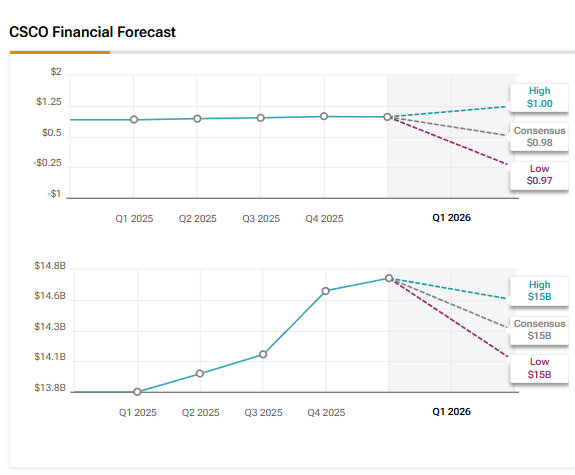

Analysts expect $0.82 EPS like it’s scripture, but let’s be real—Cisco’s been playing hide-and-seek with forecasts longer than Bitcoin’s been volatile. The real play? Watch for cloud infrastructure spending hints. That’s where the smart money’s lurking.

Closing thought: If Cisco misses, expect the usual CFO ballet—‘macro headwinds’ choreography with ‘long-term growth’ pirouettes. Because nothing says ‘stable tech stock’ like blaming the economy while quietly cutting R&D.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, revenue is expected to grow nearly 7% year over year to $14.78 billion.

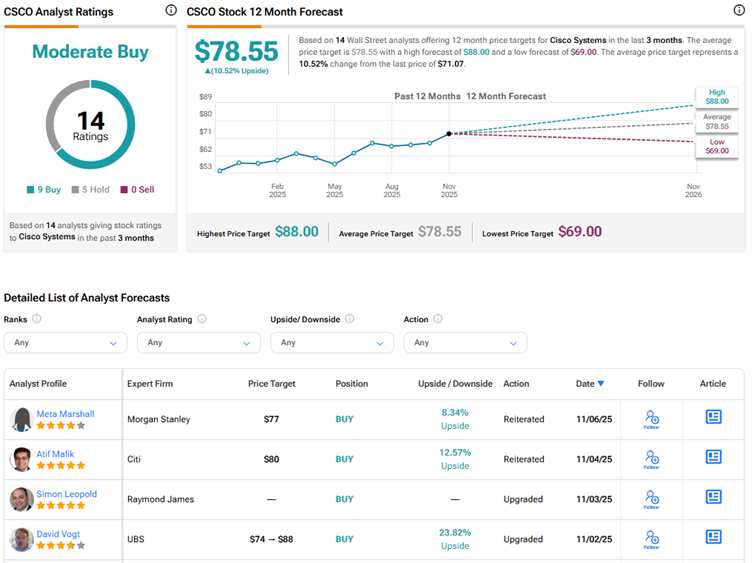

Analysts’ Views Ahead of Cisco’s Q1 Earnings

Heading into Q1 earnings, UBS analyst David Vogt upgraded Cisco stock to Buy from Hold and raised the price target to $88 from $74. The 5-star analyst cited a multi-year growth cycle driven by AI infrastructure demand, a large-scale Campus refresh cycle (including upgrades to AI-enabled smart switches), and strength in the security business from the Splunk acquisition. Vogt highlighted $2 billion in AI orders in Fiscal 2025 and growing enterprise and sovereign demand.

In fact, enterprise orders are nearing $1 billion, up sharply from a “couple hundred million” in the most recent quarter, positioning Cisco for continued AI-induced growth in Fiscal 2026 and Fiscal 2027, noted Vogt.

Meanwhile, Morgan Stanley analyst Meta Marshall reiterated a Buy rating on Cisco stock with a price target of $77. The 4-star analyst expects the company to exceed Q1 revenue expectations, but cautioned that Q2 FY26 guidance could be a “little soft” due to the federal government shutdown and elevated component costs, which were highlighted by rival Extreme Networks (EXTR) last month.

Consequently, Marshall doesn’t expect the Q1 earnings to be a major upside catalyst for CSCO stock, “barring a major upside surprise on AI orders.” The analyst noted that in Q4 FY25, Cisco’s AI orders surpassed $800 million. Commenting on concerns about an AI bubble, Marshall contended that data center spending remains strong, supporting his bullish stance on CSCO stock. “The stock is a low-multiple way to play the AI data center boom, as Cisco grows its business serving the so-called hyperscalers,” concluded Marshall.

AI Analyst Is Bullish on Cisco Stock Ahead of Q1 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Cisco stock with a price target of $79, indicating about 11.2% upside potential. The AI analyst’s rating is based on Cisco’s solid financial performance and positive earnings call insights, highlighting strong growth in AI infrastructure and strategic innovation. Additionally, technical analysis supports a stable outlook, while valuation concerns are mitigated by a decent dividend yield.

Overall, TipRanks’ AI Analyst concluded that Cisco’s strategic focus on AI and innovation positions it well for growth in the years ahead, despite challenges in some segments.

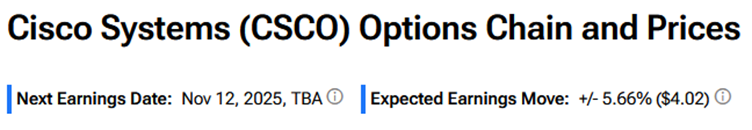

Here’s What Options Traders Anticipate

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings MOVE is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 5.7% move in either direction in CSCO stock in reaction to Q1 FY26 results.

Is Cisco Stock a Good Buy?

Currently, Wall Street has a Moderate Buy consensus rating on Cisco stock based on nine Buys and five Holds. The average CSCO stock price target of $78.55 indicates 10.5% upside potential.