TSM’s October Sales Dip—But AI Boom Keeps Taiwan Semiconductor’s Growth Engine Running Hot

Slowing sales? No problem when AI demand won't quit.

Taiwan Semiconductor (TSM) just posted softer October numbers—but don't tell the algo-traders. The chip giant's AI-driven pipelines are still printing money faster than a Fed balance sheet.

Behind the headline dip: The real story is in the silicon trenches. While consumer electronics sputter, hyperscalers keep shoveling cash into AI accelerators. TSM's 3nm and 5nm fabs? Running at utilization rates that'd make a crypto miner blush.

Wall Street's take: 'Temporary blip' says one analyst—while quietly trimming price targets. Because nothing says conviction like a downgrade disguised as optimism.

The bottom line: In the semiconductor game, you either ride the AI wave or get wiped out. And TSM? They're still the best surfboard in the business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Growth Slows but Demand Stays Strong

On a monthly basis, sales rose about 11%, showing that demand for AI and high-performance chips remains firm even as growth eases. Despite the slower pace, TSMC shares have gained about 37% this year, fueled by ongoing orders from key AI client Nvidia (NVDA).

The results come amid a pullback in Asia’s tech stocks, reminding investors that the strong AI rally could face short-term pauses. Some market watchers, including Michael Burry’s Scion Asset Management, have recently warned that the surge in semiconductor shares may be due for a correction.

Analysts Stay Upbeat on Long-Term Outlook

Even with softer growth, analysts remain positive on TSMC’s long-term story. The company continues to lead in advanced chipmaking and benefits directly from growing AI investment. Meta (META), Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT) together plan to spend over $400 billion next year to build AI systems, a 21% jump from 2025 levels.

Such large-scale spending is expected to support steady demand for TSMC’s 3-nanometer and 2-nanometer chips, which are used in AI servers and data centers.

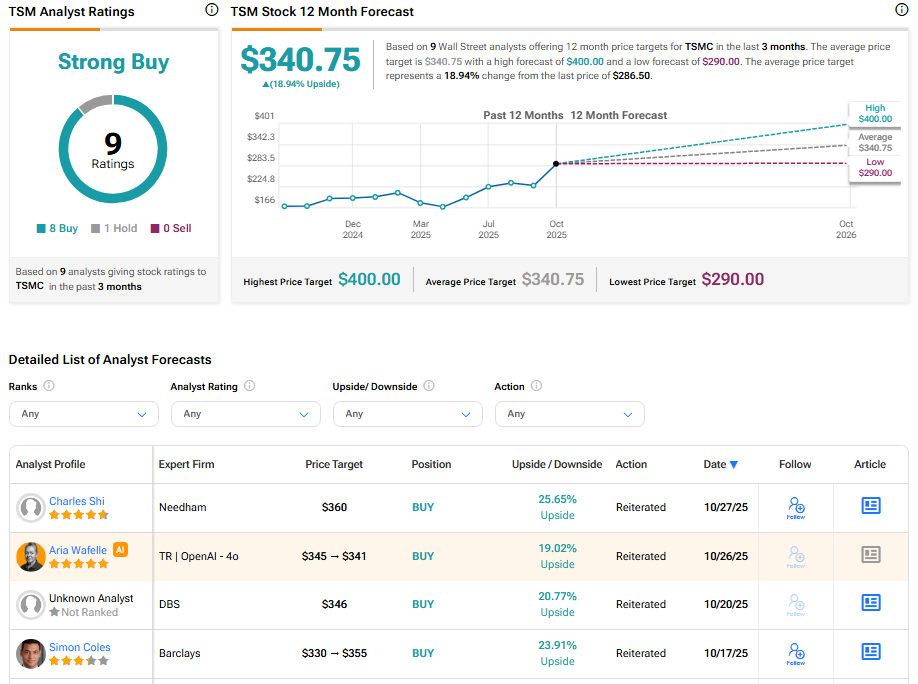

Is TSM a Buy, Sell, or Hold?

Turning to Wall Street, TSM has a Strong Buy consensus rating based on eight Buys and one Hold assigned in the last three months. At $340.75, the average TSMC price target implies 18.94% upside potential.