Coinbase Demands Regulatory Clarity for GENIUS Act Compliance

Coinbase fires warning shot at Treasury Department over crypto regulation ambiguity

Regulatory Showdown Looms

Coinbase isn't mincing words about the GENIUS Act implementation. The exchange demands Treasury officials stick to the legislation's original intent—no creative reinterpretations allowed. They're pushing for crystal-clear compliance frameworks that won't leave crypto businesses guessing.

Compliance Chess Match

The crypto giant argues regulatory uncertainty creates unnecessary friction for legitimate operators while doing little to curb actual bad actors. They want rules written in plain English, not bureaucratic jargon that requires three lawyers and a decoder ring to understand.

Industry-Wide Implications

This isn't just about Coinbase—the outcome affects every US crypto business. Clear regulations could finally provide the legitimacy institutional investors keep demanding while somehow still waiting for "the right moment" to enter the space.

Watchdog or Roadblock?

Treasury faces mounting pressure to deliver practical guidance that protects consumers without strangling innovation. The department's next move will signal whether they truly understand blockchain technology or just see dollar signs they'd rather tax than comprehend.

Because nothing says financial innovation like waiting for government permission to innovate.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon responded that outside AI agents can harm the shopping experience. It stated that they often provide incorrect prices, delivery times, or product details. Chief Executive Officer Andy Jassy added on a recent earnings call that these agents lack personalization and data from user history, which can make their results unreliable.

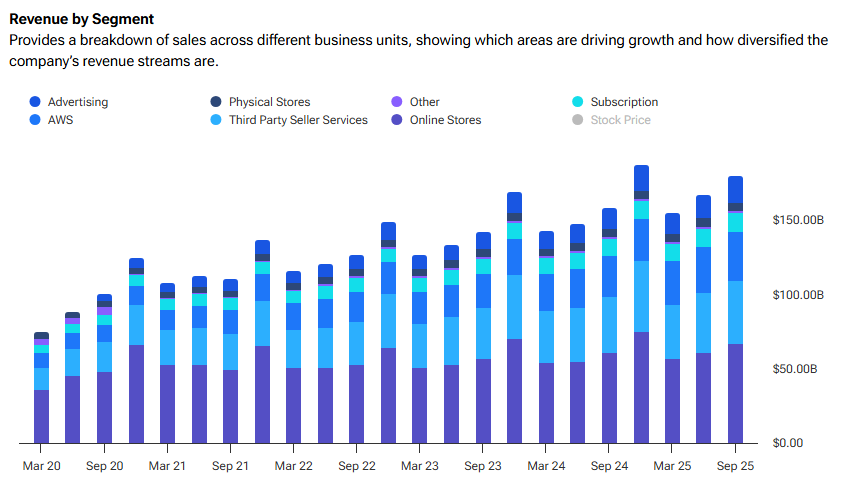

Although Amazon’s reply was measured, the conflict highlights a deeper issue. AI tools like Perplexity’s agent could cut into Amazon’s ad business, which generates tens of billions of dollars each year. When shoppers let an AI handle buying, they skip ads and sponsored listings that drive a major share of Amazon’s profit.

Why It Matters for E-Commerce

AI agents are designed to shop on behalf of users, comparing prices and placing orders automatically. That could make online buying faster and easier, but it also threatens how marketplaces make money. If AI agents choose what to buy based only on price and reviews, paid listings lose value.

As a result, Amazon wants to control how AI interacts with its site. Instead of letting outside agents browse freely, it may offer approved access through official tools or partnerships. This approach WOULD keep user data and the buying process inside Amazon’s ecosystem while it builds its own agent, called Rufus.

Other large tech firms like Alphabet (GOOGL) and Alibaba Group Holding (BABA) are taking similar steps. Each wants to manage how AI assistants handle commerce to avoid losing ad income or customer loyalty.

Potential Winners and Losers

If AI agents become common, companies ready to work with them could gain. Shopify (SHOP) and Salesforce (CRM) are building AI tools for sellers that help with pricing and product listings. These could make them key players in an agent-driven market.

Meanwhile, smaller retailers that depend on ad clicks or discovery traffic could lose. Their sales may fall if users rely on agents that skip ads. Platforms that do not allow SAFE and clear AI connections may also see lower engagement over time.

In banking, the shift could favor fintech firms and open-API banks that allow secure AI access for payments and transfers. Traditional banks that stay closed to automation may find it harder to attract younger, digital-first users.

The Bottom Line

Amazon’s dispute with Perplexity is about more than one shopping bot. It shows how AI is beginning to change the way people buy and pay online. For now, Amazon is protecting its platform and its ad revenue. Over time, though, both tech and finance firms will need to decide whether to block AI agents or learn how to work with them.

Is Amazon Stock a Buy, Sell, or Hold?

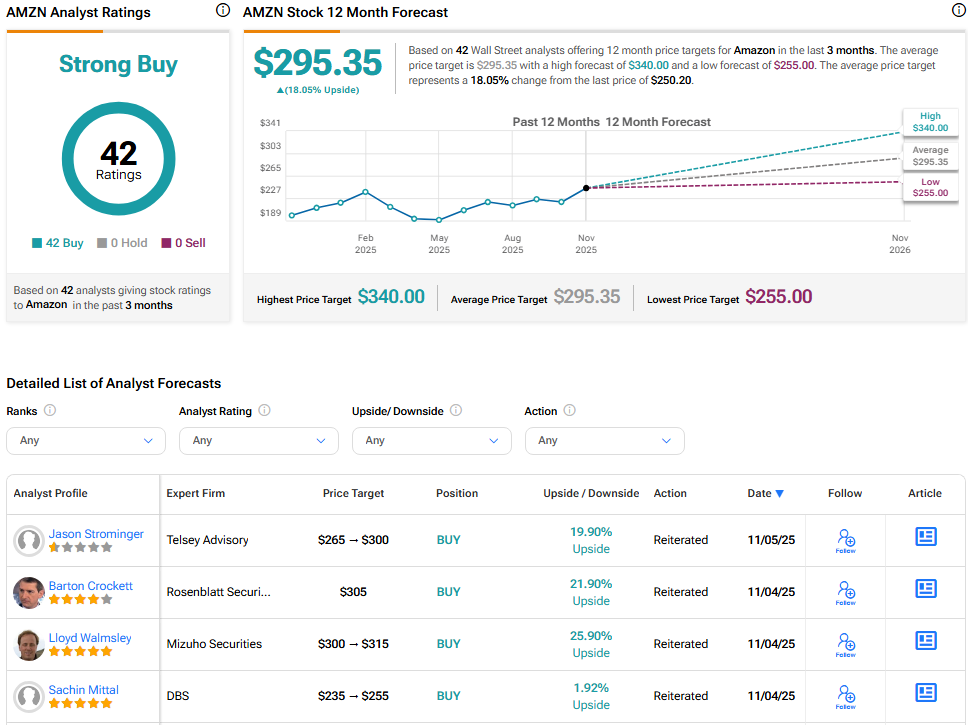

On the Street, Amazon boasts a Strong Buy consensus based on 42 assigned ratings. The average AMZN stock price target stands at $295.35, implying an 18.05% upside from the current price.