Netflix’s New Metric Exposes Shocking Number of Users Watching Ads - Here’s What It Reveals

Netflix pulls back the curtain on ad-supported viewership with groundbreaking new metric

The Streaming Giant's Transparency Play

Netflix just dropped a bombshell that's shaking up the streaming world. The platform introduced a revolutionary metric that finally reveals exactly how many users are actually watching those pesky ads. No more guessing games about who's tolerating commercial breaks versus who's paying for premium ad-free access.

Ad-Supported Tier Under the Microscope

The numbers don't lie - and Netflix just handed advertisers the ultimate truth serum. This new measurement tool exposes viewer behavior in unprecedented detail, showing exactly how many subscribers are opting for the cheaper, ad-supported version. It's a goldmine for marketers and a wake-up call for competitors still hiding behind vague engagement metrics.

Wall Street's New Favorite Toy

Analysts are salivating over this data transparency - finally, they can calculate exactly how much revenue those 30-second spots are generating. Though let's be honest, in the grand tradition of corporate metrics, this probably tells investors exactly what Netflix wants them to hear. Another brilliant move to make subscription numbers look healthier than they actually are.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Previously, Netflix used a different metric called monthly active users (MAUs), which counted how many accounts were active but didn’t show how many actual people were watching. For example, one account could have several people watching together, which made the data less accurate for advertisers. As a result, the company’s head of advertising, Amy Reinhard, explained that the new viewer-based measurement gives advertisers a clearer and more complete picture of who their ads are reaching.

It’s also worth noting that five-star JPMorgan analyst Doug Anmuth expects ad revenue to more than double from $1.4 billion in 2024 to $2.9 billion in 2025, and then rise another 45% to $4.2 billion in 2026. In addition, Netflix has improved its ad tools by partnering with companies like Amazon (AMZN), Google (GOOGL), The Trade Desk (TTD), and Yahoo in order to give advertisers more ways to reach viewers.

Is NFLX Stock a Good Buy?

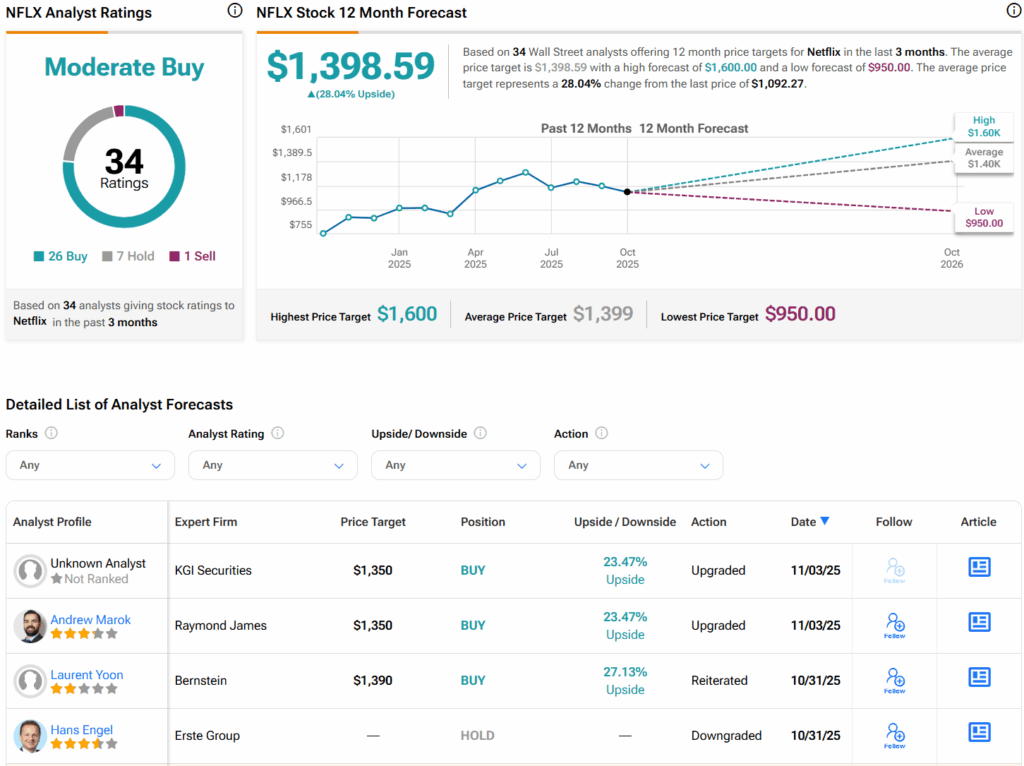

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 26 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NFLX price target of $1,398.59 per share implies 28% upside potential.