Quantum Stocks IONQ, QBTS, RGTI Surge as Quantinuum Announces Game-Changing Breakthrough

Quantum computing stocks skyrocket after Quantinuum's latest leap forward—because nothing pumps valuations like impenetrable tech buzzwords.

IONQ, QBTS, and RGTI lead the charge as investors pile into the quantum gold rush. Never mind that most can't explain qubits—the hype train waits for no one.

Wall Street's latest flavor of FOMO? Buying tickets to the quantum future with other people's retirement funds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Is Quantinuum’s Helios?

Quantinuum was created in 2021 through the merger of Cambridge Quantum Computing and Honeywell Quantum Solutions, a spin-off from industrial giant Honeywell (HON). Earlier this year, Quantinuum raised $600 million in equity funding at a $10 billion pre-money valuation, making it one of the most valuable private firms in the quantum computing space.

Notably, Helios features 98 physical and 48 logical, error-corrected qubits—a 2:1 ratio that marks a major leap in scale and performance. In simple terms, 98 qubits (the basic units of information in quantum computing) enable the system to process vast possibilities simultaneously, making it far more powerful than traditional computers.

Overall, Quantinuum’s breakthrough with Helios highlights real progress in quantum computing. It boosts investor confidence across the sector, as success from a leading player like Quantinuum suggests the entire industry is moving closer to commercial viability.

Earnings Season Adds to the Quantum Momentum

The ongoing earnings season has added to the sector’s growing momentum. Stronger-than-expected results and upbeat guidance have reignited investor optimism, signaling that the quantum race may be inching closer to commercial viability.

In particular, IonQ reported record third-quarter revenue on Wednesday and raised its full-year guidance, further boosting investor confidence in the quantum sector. Meanwhile, D-Wave Quantum is scheduled to announce its Q3 earnings on Thursday, November 6, while Rigetti and Quantum Computing Inc. are expected to release their results next week.

Overall, quantum stocks remain highly speculative and volatile, as the industry is still in its early and largely unproven phase. Wall Street investors are still struggling to determine the fair value of pure-play quantum names, fueling sharp swings in these stocks.

RGTI, QBTS, IONQ, QUBT: Which Quantum Stock Offers Higher Upside, According to Analysts?

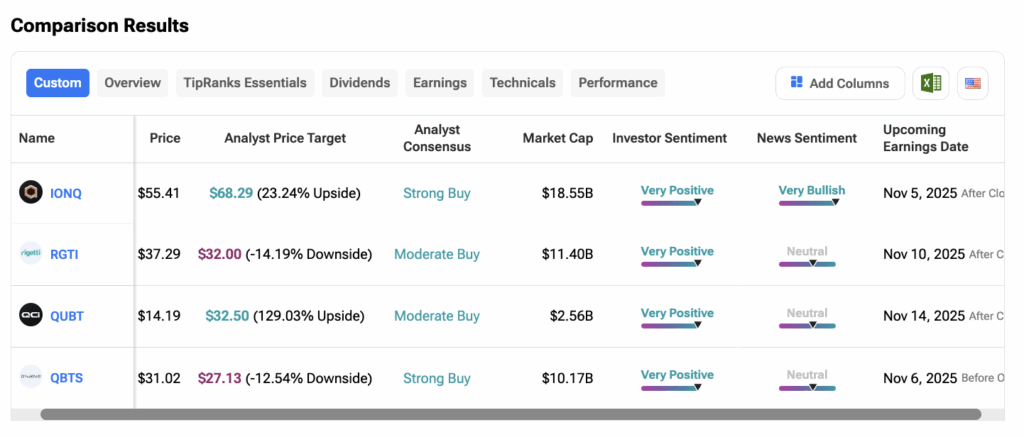

Using TipRanks’ Stock Comparison Tool, we have compared quantum stocks to see which stock offers higher upside to investors.

Among these four, IONQ and QBTS stocks have Strong Buy ratings from analysts. In terms of share price growth, QUBT stock offers an upside of almost 130% at an average price target of $32.50. Below is a screenshot for reference.