Cathie Wood’s Bold Pivot: Dumps Biotech for Veracyte Ahead of Earnings Surprise

ARK Invest makes shock sector rotation as traditional healthcare plays get sidelined

The Veracyte Gambit

Wood's flagship funds executed a massive position shift—pouring fresh capital into molecular diagnostics firm Veracyte while simultaneously slashing exposure to struggling biotech holdings. The move comes just days before Veracyte's earnings report smashed analyst expectations.Biotech Bloodbath

ARK's biotech liquidation spree hit multiple positions across its ETF lineup. The timing suggests Wood sees more immediate upside in precision medicine than in speculative drug development—a sobering reality check for an industry that's been bleeding cash faster than a clinical trial dropout.Earnings Beat Fuels Momentum

Veracyte's quarterly results delivered the catalyst Wood anticipated, with revenue growth and margin expansion driving the stock's post-earnings surge. The diagnostic specialist's execution stands in stark contrast to biotech peers still burning through cash with questionable pipelines.When a star stock picker abandons an entire sector right before earnings season, it's either genius intuition or desperate portfolio triage—on Wall Street, they call that a coin flip with other people's money.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to recent SEC filings, Ark offloaded large holdings in companies focused on gene sequencing and therapy development. The sales included 2 million shares of 10X Genomics (TXG), 395,620 shares of Crispr Therapeutics (CRSP), 1.1 million shares of Intellia Therapeutics (NTLA), 2.2 million shares of Strata Critical Medical (SRTA), and 5.3 million shares of Pacific Biosciences of California (PACB).

These firms specialize in diagnostics and gene editing, sectors that have seen heightened volatility this year. The heavy divestment suggests Wood may be rotating out of longer-horizon biotech bets into companies with stronger near-term growth drivers.

Ark Bets Big on Veracyte ahead of Results

Despite the sell-off, Ark made a significant MOVE into Veracyte (VCYT), purchasing over 665,690 shares for roughly $22.8 million at an average price of $34.33 per share. The buy lifted Ark’s total holdings to more than 4.4 million shares.

Days later, Veracyte announced third-quarter earnings that beat expectations, with adjusted EPS of $0.51, up from $0.33 last year and well ahead of the consensus estimate of $0.32. Revenue reached $131.8 million, surpassing forecasts of $124.7 million. The stock surged 16% in premarket trading following the results.

CEO Marc Stapley credited the strong performance to growing test adoption and margin expansion. “We delivered another outstanding quarter of testing revenue growth and adjusted EBITDA margin expansion, enabling us to raise both our revenue and profitability guidance,” he said.

Trimming Other Positions Amid Market Rebalancing

Ark also reduced its stake in Roku (ROKU), selling more than 1.1 million shares as part of a steady trimming strategy that began in mid-2024. Roku continues to face legal scrutiny related to data privacy and patent claims, which may have influenced Ark’s decision.

In addition, Ark sold 694,510 shares of 908 Devices (MASS), a company whose stock has soared more than 250% year to date. Despite the strong gains, the fund appears to be locking in profits amid a broader shift toward more predictable growth sectors.

Key Takeaway

Cathie Wood’s recent trades point to a clear change in strategy. She is moving away from volatile biotech stocks and putting more money into diagnostics companies that are already showing steady growth. The stronger focus on Veracyte shows she prefers businesses with solid performance rather than those driven by speculation.

Is Veracyte a Good Stock to Buy?

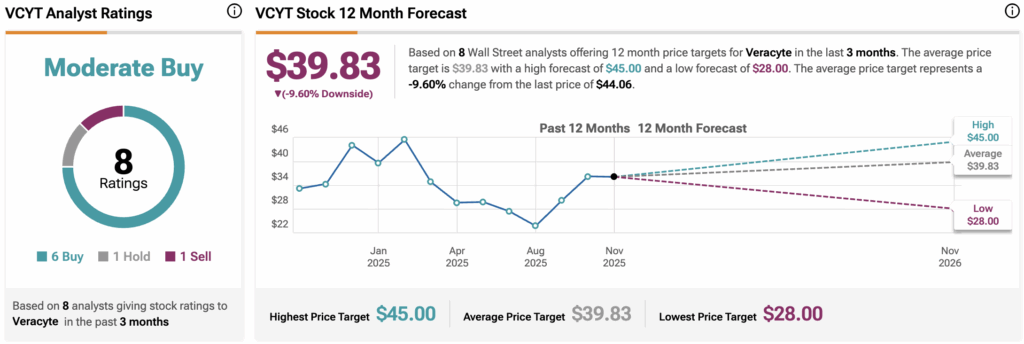

Analysts maintain a Moderate Buy consensus on Veracyte (VCYT) based on 8 Wall Street ratings over the past three months. The breakdown includes six Buy ratings, one Hold, and one Sell.

The average 12-month VCYT price target stands at $39.83, suggesting a potential 9.6% downside from the last closing price.