Elon Musk’s $878 Billion Tesla Compensation Package Heads for Critical Shareholder Decision

Tesla investors prepare to vote on the most ambitious executive pay package in corporate history

The Billion-Dollar Gamble

Elon Musk's unprecedented compensation deal faces its ultimate test as shareholders gather to decide whether to approve the $878 billion package. The vote represents more than just numbers—it's a referendum on Musk's leadership and Tesla's future direction.Market-Moving Implications

Wall Street watches closely as the outcome could trigger significant volatility in Tesla stock. Institutional investors remain divided, with some calling the package excessive while others argue it's necessary to retain Musk's visionary leadership.Corporate Governance Crossroads

The vote challenges traditional compensation structures, pushing the boundaries of what's considered reasonable executive pay. Critics question whether any individual deserves such astronomical rewards, while supporters point to Tesla's market transformation under Musk's guidance.Because nothing says 'democratic capitalism' like letting billionaires vote on whether to make another billionaire slightly richer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The plan WOULD give Musk large blocks of Tesla stock over ten years if the company hits major performance targets. To unlock the full package, Tesla’s market value would need to reach $8.5 trillion. Even if only some goals are met, Musk would still earn tens of billions in stock.

Meanwhile, TSLA shares fell 5.15% on Tuesday, closing at $444.26.

Supporters and Critics Divide

Some investors back the plan because they believe Musk can deliver new growth through Tesla’s work on robotaxis and humanoid robots. They say that if the stock rises, all shareholders benefit, no matter how much Musk earns.

However, others see the plan as too risky and too large. Critics argue that it ties Tesla’s future too closely to one leader and gives Musk more control than any board should allow. Several big investors, including the California Public Employees’ Retirement System and Norway’s sovereign wealth fund, have said they will vote against the proposal. They warn that Musk’s influence creates what is known as “key person risk,” since Tesla relies so heavily on his role.

A Question of Control

Musk holds about 15% of Tesla shares and could use those votes to help pass the plan. The company’s board says keeping Musk is vital for Tesla’s future value, but governance experts disagree. They note that Musk already owns enough stock to benefit greatly if Tesla’s price rises, even without more compensation.

The vote follows a past pay dispute. A Delaware judge threw out Musk’s 2018 compensation plan, calling it excessive and poorly managed by the board. Tesla has since moved its legal base to Texas, where it is harder for small shareholders to sue.

The outcome will show whether investors see Tesla’s success as tied to Musk or ready to stand on its own. A vote for the deal could secure his leadership for years. A vote against it could test how much of Tesla’s worth depends on its CEO’s presence. Either way, Thursday’s decision will shape how Tesla balances growth, governance, and investor trust in the years ahead.

Is Tesla Stock a Buy, Hold, or Sell?

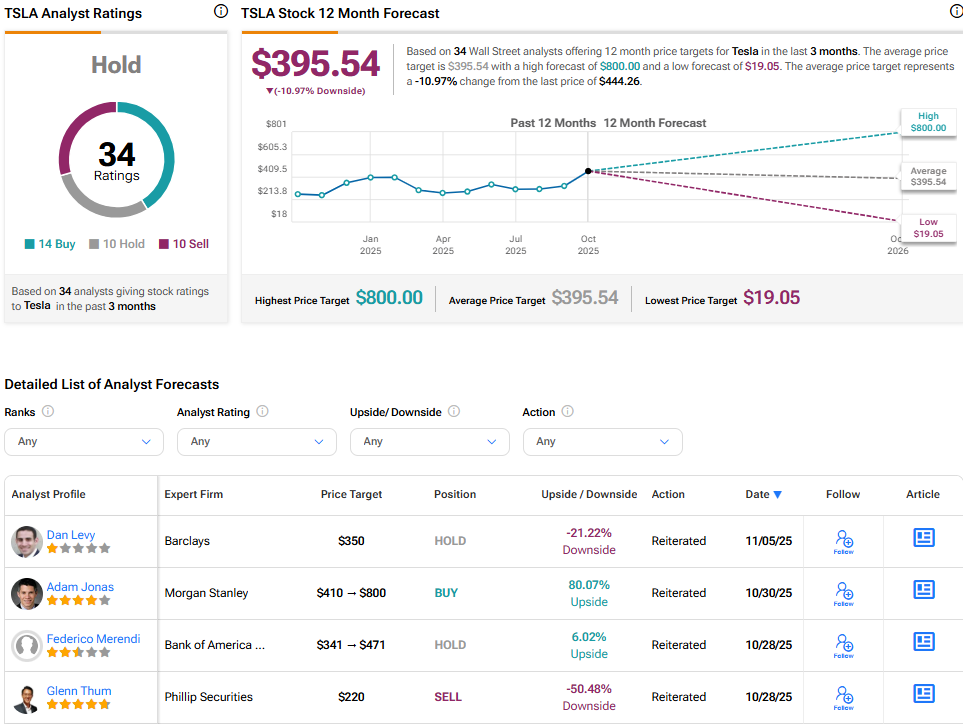

Tesla continues to divide opinions among the Street’s analysts with a Hold consensus rating. The average TSLA stock price target stands at $395.54, implying a10.97% downside from the current price.