U.S. Bitcoin Reserve: Senator Lummis Declares It the ’Only Real Solution’ for National Strategy

Washington draws its line in the digital sand—and it's encrypted.

The Crypto Mandate

Senator Cynthia Lummis just dropped a policy bombshell that's shaking Capitol Hill corridors. Her verdict? America needs a Bitcoin reserve, and there are no alternatives on the table. This isn't just another political suggestion—it's being framed as the definitive path forward for U.S. financial sovereignty.

Breaking from Traditional Reserves

While gold bars gather dust in vaults, Lummis argues digital assets represent the new frontier of economic security. The move would position Bitcoin alongside traditional reserves, creating what supporters call a 'hybrid fortress' for the nation's wealth. Critics in traditional finance circles are already clutching their pearls—apparently diversification only counts when it involves century-old instruments.

The Sovereignty Play

This push for a national Bitcoin stash isn't just about investment returns. It's a strategic maneuver in the global chess match for financial dominance. As other nations explore digital reserves, America faces a simple choice: lead the charge or watch from the sidelines while the rules get rewritten without them.

Because when the music stops on fiat currencies, you'll want to be holding the keys to something that can't be printed into oblivion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

VTI ETF’s Latest Performance

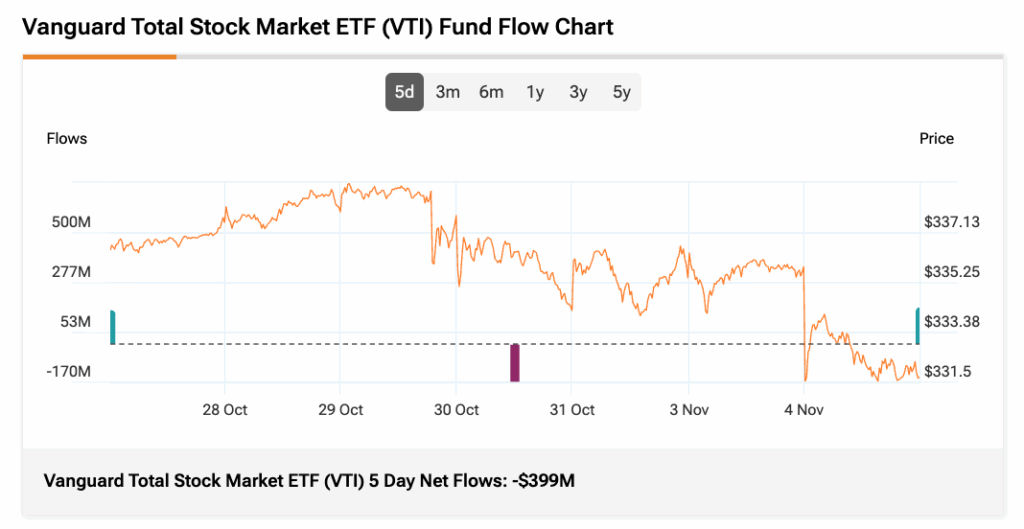

The VTI ETF declined by 1.21% on Tuesday. Likewise, the Nasdaq Composite was down by 2.04%, and the S&P 500 lost 1.17%. U.S. stocks were dragged down by AI-related names like Palantir (PLTR), as investors grew increasingly concerned about high valuations.

VTI’s three-month average trading volume is 4.04 million shares. Meanwhile, its 5-day net flows totaled $399 million, showing that investors added capital to VTI over the past five trading days.

VTI’s Technical Snapshot

From a technical standpoint, VTI remains above its 50-day moving average. Notably, VTI is trading at $331.74, compared to its 50-day exponential moving average of $326.44, indicating a bullish trend and a potential Buy signal.

According to TipRanks Technical Analysis, VTI has a Buy rating based on the overall summary as well as the moving average consensus.

VTI’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VTI is a Moderate Buy. The Street’s average price target of $386.34 implies an upside of 16.5%.

VTI’s top three holdings are chipmaker Nvidia (NVDA) at 6.69%, followed by tech giants Microsoft (MSFT) at 5.98% and Apple (AAPL) at 5.87% of the fund’s total weight.

Currently, VTI’s five holdings with the highest upside potential are FibroBiologics (FBLG), BioAtla (BCAB), Cibus (CBUS), Clearside Biomedical (CLSD), and NRX Pharmaceuticals (NRXP).

Meanwhile, its holdings with the greatest downside potential are LiveOne (LVO), Opendoor Technologies (OPEN), GoPro Inc. (GPRO), and eGain Communications Corporation (EGAN).

Notably, VTI ETF’s Smart Score is eight, implying that this ETF is likely to outperform the broader market.