Goldman Sachs Crowns AMD an AI Champion - But Warns Upside Looks Limited After Q3 Earnings

Wall Street's gold standard just placed its bet on the AI arms race.

The Verdict Is In

Goldman Sachs delivers the ultimate Wall Street endorsement - branding AMD a definitive artificial intelligence winner. The semiconductor giant's third-quarter performance sealed the designation.

Reality Check

Despite the glowing AI credentials, analysts see constrained growth potential moving forward. The Q3 numbers apparently failed to justify more aggressive projections.

Glass Half Full

Being called an AI winner by Goldman still carries weight - just don't expect the typical champagne celebrations on the trading floor. Sometimes 'solid' means your stock won't crash, not that it will moon.

Another day, another Wall Street firm telling investors the good news isn't quite good enough to actually make money. Some things never change.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AI Momentum Powers AMD’s Beat

Goldman said AMD delivered a strong quarter across key segments. Revenue came in at $9.2 billion, well ahead of Wall Street’s $8.76 billion estimate and Goldman’s $8.92 billion forecast. The firm highlighted that Datacenter revenue reached $4.34 billion, a sign that AI-related demand remains strong. Gaming revenue also impressed at $1.30 billion, easily topping expectations, while Embedded sales came in lighter at $857 million.

The analyst said that investors were already optimistic going into the print, thanks to AMD’s recent OpenAI partnership and the upcoming Analyst Day on November 11, which could provide fresh insight into the company’s AI roadmap.

Margins Dip Slightly, But Outlook Stays Bright

Goldman noted that while sales growth was strong, profit margins were a touch softer. AMD’s gross margin of 54.0% was in line with the Street but just below Goldman’s 54.2% view, while the operating margin slipped to 24.2%. The firm said operating EPS of $1.20, just under its $1.23 forecast, still showed solid execution amid heavy investment in AI products.

Looking ahead, AMD guided fourth-quarter revenue to $9.6 billion at the midpoint, ahead of both Goldman’s and the Street’s forecasts. The company also expects a non-GAAP gross margin of 54.5%, roughly matching consensus.

Goldman said the upbeat guidance reflects “continued AI tailwinds” and steady demand in the Datacenter segment. Still, with investor Optimism already high and margins under pressure, the firm expects the stock to consolidate in the near term as the market awaits fresh catalysts, including new updates at AMD’s Analyst Day next week.

Is AMD a Buy, Sell, or Hold?

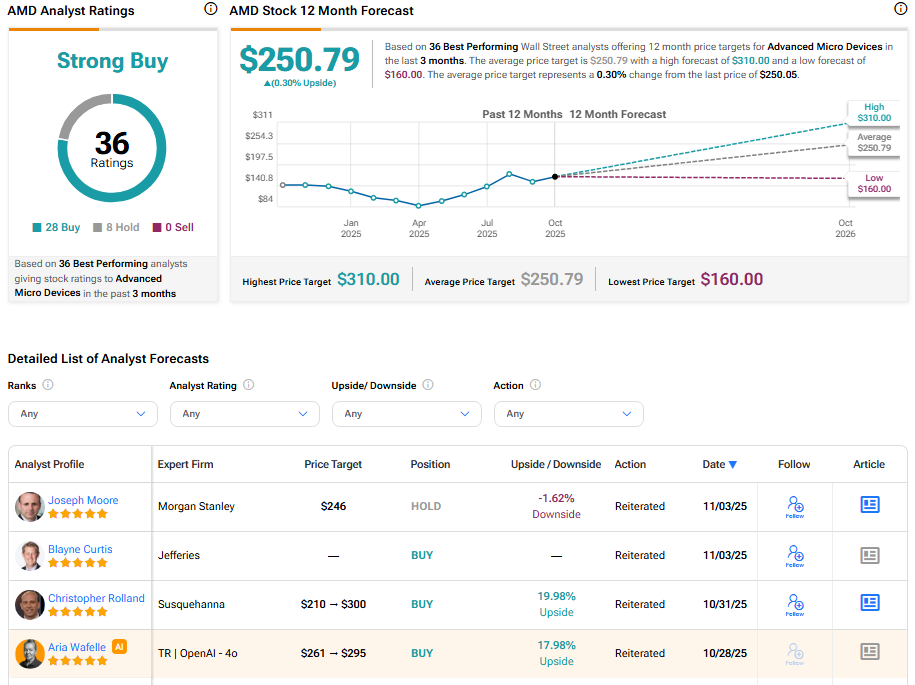

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMD stock based on 29 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMD price target of $250.79 per share implies that shares are near fair value.