Tesla’s October China EV Shipments Slump Sparks TSLA Stock Decline

Tesla hits a speed bump in the world's largest EV market.

October Delivery Dip

Shipments from Tesla's Shanghai gigafactory dropped significantly last month—the numbers don't lie. This isn't just a minor correction; it's a concerning trend that has investors watching closely.

Market Reaction

TSLA shares immediately felt the pressure, dipping as the news broke. The market's response was swift and unforgiving, proving once again that automotive stocks react to shipment data like crypto reacts to Elon's tweets—instantly and dramatically.

Competitive Landscape

Chinese EV makers aren't sitting idle while Tesla stumbles. Local manufacturers continue gaining ground with aggressive pricing and features tailored specifically for domestic consumers.

Looking Ahead

All eyes now turn to November numbers. Can Tesla recover lost momentum, or is this the beginning of a longer-term shift in China's EV hierarchy? Either way, Wall Street's watching—and probably shorting something.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla’s October China-Made EV Sales Slump

The 9.9% year-over-year decline in Tesla’s October China-made EV sales reversed the 2.8% rise in September. The EV giant manufactures Model 3 and Model Y vehicles at its Shanghai gigafactory for the domestic market and exports to Europe, India, and other markets. The October figure indicates that the launch of Model Y L, which began deliveries in China in early September, failed to boost demand.

The update also raises concerns about a challenging fourth quarter for Tesla. It is worth noting that Tesla’s China-made EV sales have declined in eight out of the first ten months of 2025 on a year-to-year basis.

Tesla’s Chinese rival BYD (BYDDF) also had a tough month, with October deliveries falling 12% year-over-year and marking the second consecutive month of decline amid stiff competition in the domestic market. Likewise, Li Auto (LI) reported a significant 38.3% plunge in its October deliveries. In contrast, Nio (NIO) and XPeng (XPEV) reported 92.6% and 76% year-over-year rise in October deliveries.

Meanwhile, Tesla is set to unveil its Cybercab robotaxi at the China International Import Expo (CIIE), marking the Asia-Pacific debut of the EV maker’s driverless model.

Is Tesla a Good Stock to Buy?

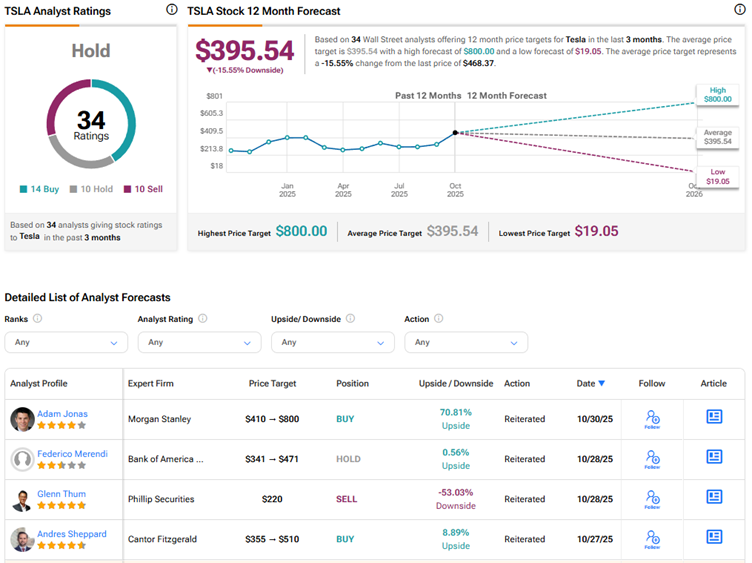

Tesla is facing demand uncertainty in the U.S. market following the expiry of the $7,500 EV tax credit and intense competition in China and Europe. Amid a challenging EV backdrop, Wall Street has a Hold consensus rating on Tesla stock based on 14 Buys, 10 Holds, and 10 Sell recommendations.

The average TSLA stock price target of $395.54 indicates 15.6% downside risk from current levels. TSLA stock has risen about 16% year-to-date, driven by Optimism about the company’s robotaxi business and Optimus humanoid robot.