Standard Chartered CEO Declares Cash Obsolete: ’All Money Will Be Digital’

The financial world just got its biggest validation yet—Standard Chartered's CEO has officially called time on physical currency.

Digital Domination Accelerates

Traditional cash systems are hitting their expiration date faster than anyone predicted. Banking executives now openly acknowledge what crypto pioneers have known for years—digital assets represent the inevitable future of global finance.

Institutional Tipping Point

When legacy banking giants start sounding like Bitcoin maximalists, you know we've reached a watershed moment. The shift isn't coming—it's already here, and traditional finance is scrambling to catch up.

The New Financial Reality

Physical wallets? Ancient history. Bank branches? Becoming museums. The infrastructure for a fully digital financial ecosystem is being built right now—and it's bypassing the old guard entirely.

Meanwhile, Wall Street analysts are still trying to price in the disruption—proving once again that traditional finance moves at the speed of bureaucracy while digital assets move at the speed of innovation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoundHound AI focuses on voice recognition and natural language processing, delivering AI-driven solutions across multiple industries.

Why SoundHound AI Stock Still Has Room to Run

It might not be too late to bet on SoundHound AI’s next big move. The company holds one of the most valuable assets in AI —the data. With over 1 billion voice queries processed every month, SoundHound continuously refines and strengthens its Polaris AI model. Earlier this year, management even noted that its voice recognition accuracy slightly outperformed models from competitors.

In the AI race, data is everything. Therefore, with two decades of real-world user interactions under its belt, SoundHound may be hitting an inflection point. Looking ahead, this could power lasting growth and make SOUN stock a strong long-term play.

For context, SoundHound AI’s Polaris is a key part of its voice technology. It is a multilingual, multimodal AI model that supports nearly 30 languages.

Additionally, rising demand for SoundHound’s voice AI solutions supports its strong long-term growth potential. Looking ahead, the company expects full-year revenue between $160 million and $178 million, slightly above analysts’ estimate of $161.2 million.

What Analysts Expect from SoundHound’s Q3 Earnings

Wall Street analysts expect SoundHound to report a loss of $0.09 per share in Q3 as compared to $0.06 in the same quarter a year ago. Meanwhile, revenue is projected to climb over 60% year over year to $40.5 million.

Wainwright Stays Bullish on SOUN

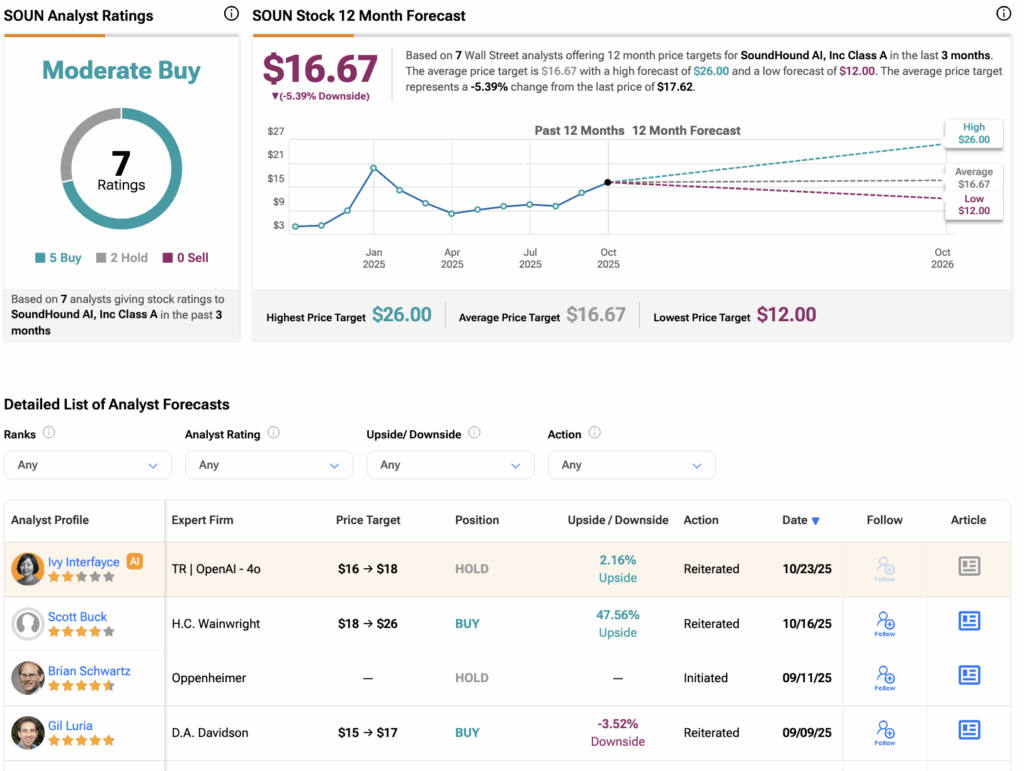

Last month, four-star-rated analyst Scott Buck of H.C. Wainwright raised his price target from $18 to a Street-high of $26. He believes SOUN shares could climb more than 40% from current levels, even if the stock seems expensive right now.

Buck expects SoundHound’s real growth story to unfold as more industries adopt its voice AI technology, helping the company scale, increase revenue, and MOVE toward profitability. He also noted that the upcoming Q3 earnings report could be a key catalyst for further upside.

What Is the Price Target for SOUN?

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $16.67, suggesting a potential downside of 5.4% from the current level.