Nvidia CEO Jensen Huang Warns Ignoring Huawei Is ’Foolish’ as China Forges Independent AI Chip Dominance

Tech titan sounds alarm on China's semiconductor sovereignty push

Nvidia's visionary leader drops truth bomb about Huawei's rising threat

While Wall Street analysts debate chip stocks, China builds its own silicon empire—cutting reliance on Western technology faster than you can say 'geopolitical tension.'

Huang's warning echoes through boardrooms: Underestimating Chinese innovation could cost billions in missed opportunities and market share.

The AI arms race just got real—and the playing field is tilting eastward whether traditional investors like it or not.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, Huang said Huawei Technologies continues to grow fast in AI hardware. He pointed to Huawei’s strength in 5G and chip design, noting that the company builds “amazing systems.” Huawei’s newest CloudMatrix AI computer uses 384 of its Ascend 910C chips and claims a speed of 300 petaFLOPs. That figure is more than double the output of Nvidia’s GB200 NVL72 supercomputer.

Nevertheless, Nvidia remains the global leader in AI chips, thanks to its software tools and broad user base. Yet the CEO said that cutting off China also hurts U.S. firms, since many AI developers are based there. He warned that “forfeiting half the world’s developers” could slow innovation and limit market reach over time.

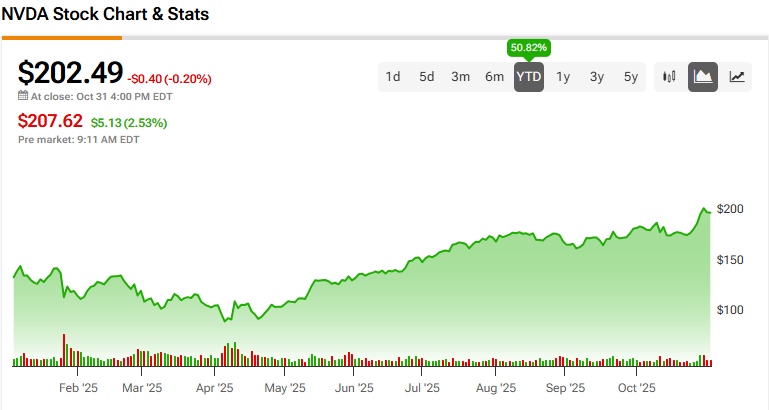

Meanwhile, NVDA shares are climbing in pre-market today, rising 2.53% at the time of writing.

China’s Chip Push Accelerates

China has made chip independence a top priority. The country’s AI chipmakers are gaining both funding and scale. Analysts expect that by the end of 2025, about 40% of AI server chips used in China will be made domestically. The MOVE is meant to reduce reliance on Nvidia and other U.S. suppliers.

Huawei leads the push, but other local players like Cambricon Technologies are also growing fast. Cambricon’s revenue ROSE 43 times to $404 million in the first half of 2025 after winning major orders from local firms. These gains show how the U.S. export rules have fueled a homegrown chip industry instead of stopping it.

Meanwhile, President Donald TRUMP said he did not discuss lifting the chip ban with Chinese President Xi Jinping during recent talks. He told reporters, “We’re not talking about the Blackwell,” referring to Nvidia’s latest AI chip. The statement suggests the restrictions are likely to stay in place for now.

Even so, Chinese tech firms are adjusting. Alibaba Group (BABA) is developing AI systems that use up to 82% fewer GPUs to train models. As these companies adapt, China’s domestic AI sector is moving toward self-reliance.

The Bigger Picture

Huang said China’s AI chip market could reach $50 billion this year and grow much larger by decade’s end. Despite U.S. export limits, that expansion signals strong long-term demand for AI computing.

For investors, Nvidia’s global position stays strong, but the loss of China marks a major gap in future growth. At the same time, Huawei and its local peers are building full AI systems without U.S. parts. The split could shape two separate chip ecosystems over the next few years, each advancing on its own track.

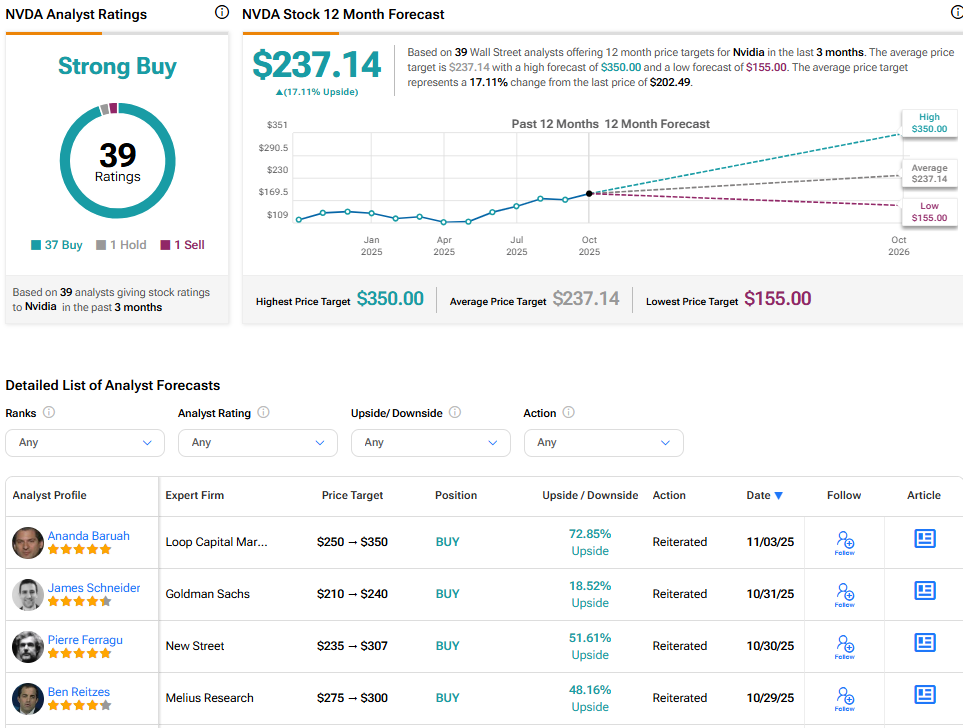

Is Nvidia Stock a Buy?

Nvidia continues to hold the Street’s endorsement with a Strong Buy consensus rating. The average NVDA price target is $237.14, implying a 17.11% upside from the current price.