AMTD Digital Stock (HKD) Skyrockets 45% - Here’s What’s Fueling the Meteoric Rise

Digital asset markets just witnessed another explosive move as AMTD Digital shares surged a staggering 45% in single-day trading.

The Catalyst Behind the Rally

While traditional finance analysts scramble for explanations, the surge demonstrates growing institutional confidence in digital infrastructure plays. AMTD's strategic positioning at the intersection of traditional finance and blockchain technology appears to be paying dividends.

Market Mechanics in Play

Trading volumes exploded as both retail and institutional players piled into the stock. The move highlights how digital asset-adjacent companies continue capturing investor imagination—and capital—in today's rapidly evolving financial landscape.

Broader Implications

This isn't just about one stock's performance. It signals deepening market conviction that digital transformation plays will dominate the next decade of financial services. Traditional banks might want to take notes—or better yet, actually innovate for once.

Whether this surge represents sustainable momentum or another case of market euphoria remains to be seen. But one thing's clear: digital finance isn't just coming—it's already rewriting the rules.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AMTD Digital attributed its large revenue gain to a few factors, including $10 million in fashion, arts, and luxury media advertising, and marketing services income, compared to $4.4 million in the same period of the year prior. The company also noted that hotel operations, hospitality, and VIP services income increased 172.4% year-over-year to $13.6 million, as well as net fair value changes on financial assets at fair value through profit or loss that represented a $47.9 million gain.

Looking ahead, AMTD Digital Chief Financial Officer Xavier Zee said, “Our team’s dedication and innovative approach have driven exceptional results, reaffirming our commitment to excellence and growth in these vibrant industries. We look forward to expanding our footprints in different parts of the world, developing IP related businesses and reaching new heights together.”

AMTD Digital Stock Movement Today

AMTD Digital stock was up 47.43% on Friday but was still down 15.2% year-to-date. The stock has also fallen 45.48% over the past 12 months.

Today’s earnings news brought with it heavy trading of HKD stock, as more than 3.6 million shares changed hands. To put that in perspective, the company’s three-month daily average trading volume is about 434,000 units.

Is AMTD Digital Stock a Buy, Sell, or Hold?

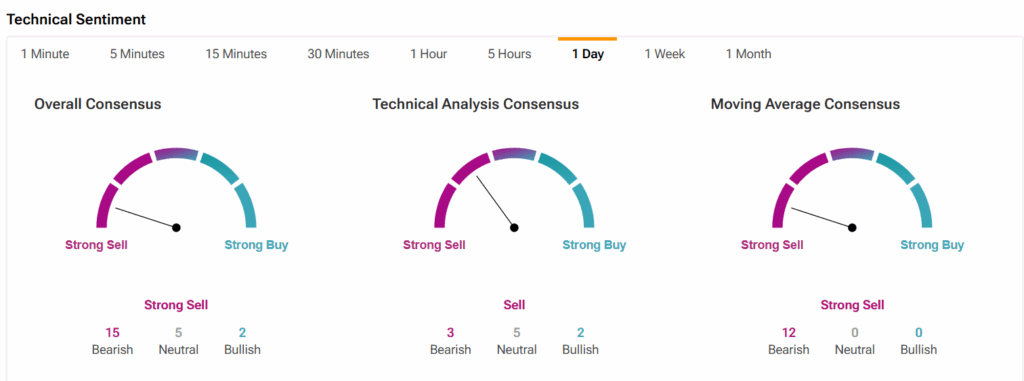

Turning to Wall Street, analyst coverage of AMTD Digital is lacking. Instead, let’s see how the TipRanks technical sentiment looks. The overall consensus is Strong Sell, the technical analysis consensus is Sell, and the moving average consensus is Strong Sell.