XRP ETF Approval Timeline Emerges As October Closes - Here’s What’s Next

XRP ETF approval enters critical phase as regulatory calendar flips to November

The Waiting Game

Market watchers tracking XRP exchange-traded funds now have fresh timeline expectations as October concludes. Regulatory hurdles remain the primary focus, with institutional adoption hanging in the balance.

Regulatory Chess Match

SEC deliberations continue shaping the approval pathway. Industry analysts point to precedent-setting decisions from other cryptocurrency ETF approvals as potential roadmap indicators.

The Institutional On-Ramp

An XRP ETF would create unprecedented mainstream access to the digital asset—bypassing traditional crypto exchange complexities that typically deter conservative investors. The product would cut through regulatory uncertainty surrounding direct XRP ownership.

Timeline projections suggest approval could trigger massive capital inflows—because nothing says 'mature asset class' like needing government permission to buy something that's been trading for years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TipRanks’ Smart Score rates the stocks on a scale from 1 to 10, with 10 being the highest. The score is based on eight key market factors, including Wall Street analyst ratings, insider transactions, financial blogger opinions, and more. Additionally, the Top Smart Score Stocks list offers a comprehensive selection of stocks rated a perfect 10, along with advanced filtering options.

Let’s dive into the details.

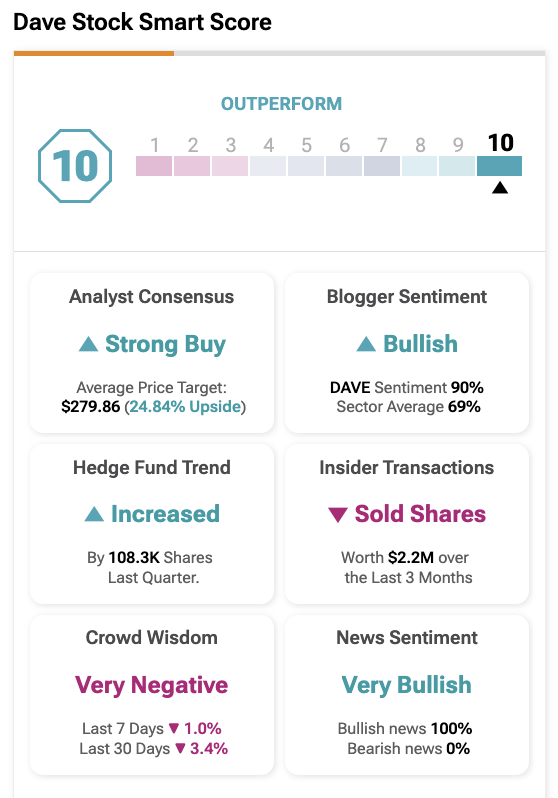

What Is the Price Target for Dave?

Dave is a fintech company offering digital banking services, including cash advances, budgeting tools, and side-income opportunities, aimed at helping users improve their financial health. Year-to-date, DAVE stock has gained over 150%.

Looking ahead, Wall Street analysts remain bullish on its upside potential. All seven analysts covering DAVE stock rate it as a Buy. Meanwhile, Dave’s average stock price target of $279.86 suggests a potential upside of 25% from current levels.

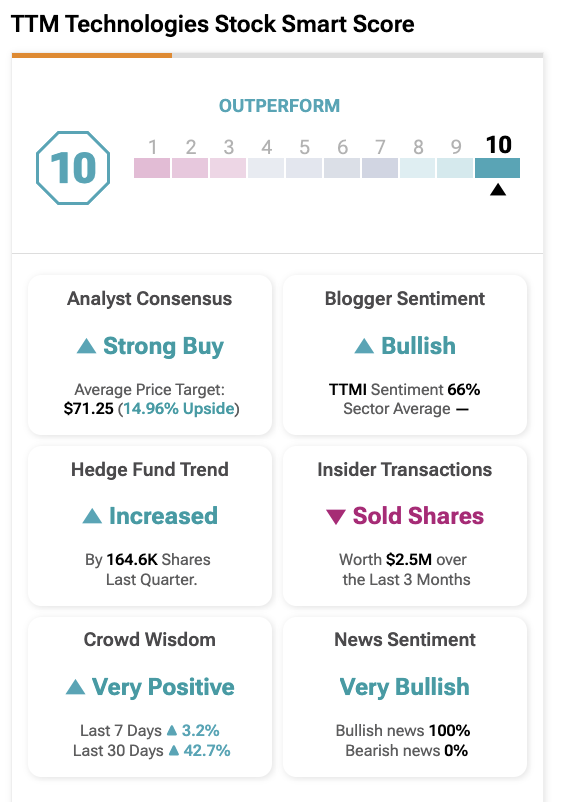

TTM Technologies Stock Price Target

TTM Technologies is a global manufacturer of printed circuit boards and radio-frequency components used in electronics, aerospace, and defense.

Year-to-date, TTMI stock has gained more than 150%. Wall Street analysts remain bullish, with all four covering analysts giving it a Buy rating. According to TipRanks, TTM Technologies’ stock has a price target of $71.25, implying 15% upside from current levels.

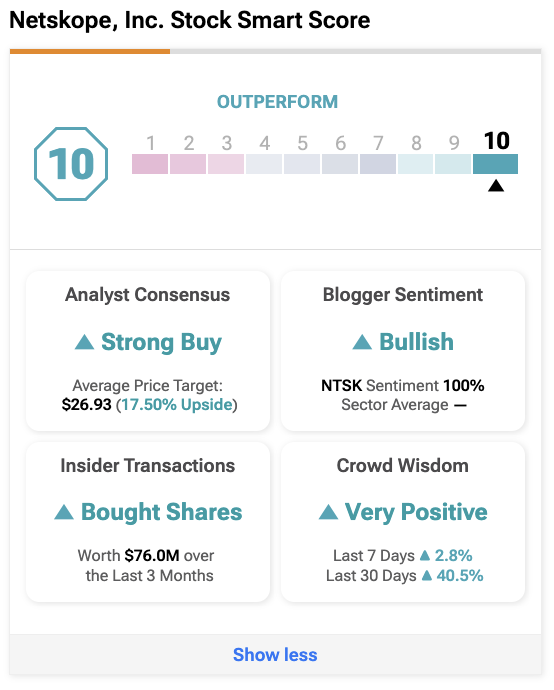

Is Netskope a Good Investment?

Netskope is a cybersecurity company that provides cloud-based solutions to protect data, users, and applications across the internet and cloud services. So far in 2025, NTSK stock has gained 2%.

NTSK stock carries a Strong Buy rating, with 15 Buys assigned in the past three months. The average stock price target of Netskope is $26.93, which implies a potential upside of 17.5%.