Home Depot Stock (HD) Surges on AI Integration Breakthrough

Wall Street's latest darling? Hardware stores with silicon brains.

Home Depot's stock just ripped higher after revealing their new AI-powered supply chain system—proving even hammer-and-nail retailers can't resist the AI gold rush.

The Numbers Don't Lie

HD shares climbed steadily throughout Thursday's session as institutional investors piled into the home improvement giant's tech transformation play. The move signals growing confidence that traditional retailers can leverage artificial intelligence to optimize inventory management and customer experience.

AI or Die Trying

While legacy retailers scramble to stay relevant, Home Depot's strategic pivot demonstrates how even the most brick-and-mortar businesses are finding value in machine learning algorithms. Their system reportedly predicts local demand patterns with frightening accuracy—though whether it can forecast the next housing market crash remains to be seen.

Another day, another company discovering that adding 'AI' to their investor presentations works better than actual innovation. The market's buying it—literally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Home Depot is getting together with Kai, an AI-powered tool that lets users identify just what a house needs before it can be put on the market for the best possible effect. It takes pictures and video, and then converts these into “…SKU-level material specifications and cost estimates.” That in turn makes home renovations a somewhat simpler process.

Granted, with the housing market the way it is these days, you could put a cardboard box on a postage-stamp-sized lot and still get offers. But for the best shot at a sale with the best payday, the combination of Kai and Home Depot could be exactly what is needed to get the job done. The tool reportedly works on everything from interior doors to furnaces, which pretty much covers the waterfront.

“…A Monumental Mistake”

Home Depot’s cofounder Ken Langone is no stranger to speaking up around political matters, and he recently did so once more. He came out about the New York mayoral election, and declared that “New York is on the verge of making a monumental mistake.” Here, Langone seems to refer to current mayoral frontrunner Zohran Mamdani, a common sticking point for a growing number of wealthy people with New York City connections.

And in Langone’s defense, it is reasonable. Langone is worth around $9.3 billion. Mamdani has been heard to say that billionaires should not exist. Thus, Langone’s distaste for Mamdani is less political and more a matter of personal survival. But Langone also brought out one more barb, this time aimed at a much larger population: “I have a simple recommendation for anyone who has problems with America. Why don’t you leave?”

Is Home Depot a Good Long-Term Buy?

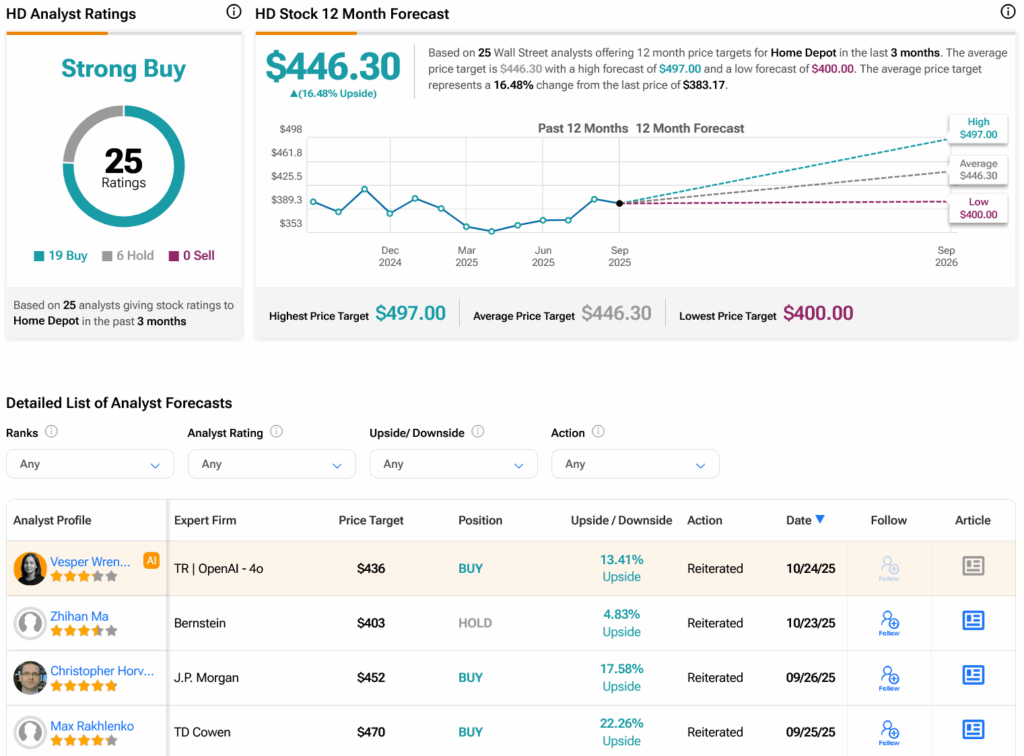

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 19 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 3.99% loss in its share price over the past year, the average HD price target of $446.30 per share implies 16.48% upside potential.

Disclosure