Korean Investors Ditch Crypto for Nvidia & Samsung - Smart Move or Missed Opportunity?

Seoul's retail army pivots from digital assets to blue-chip tech stocks

The Great Rotation

Korean day traders are swapping crypto wallets for traditional brokerage accounts in what analysts call 'the great derisking.' Nvidia's AI dominance and Samsung's semiconductor rebound are drawing capital away from volatile digital assets.

Regulatory Heat Meets FOMO

With the Financial Services Agency tightening crypto oversight, retail investors are chasing proven performers rather than gambling on meme coins. The shift reflects growing institutional acceptance of tech stocks versus regulatory uncertainty in digital assets.

Bull Market Blues

While Wall Street celebrates the inflow to traditional equities, crypto maximalists warn this could be classic 'weak hands' behavior - selling digital gold for fiat-era relics. Because nothing says financial innovation like chasing last quarter's earnings report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

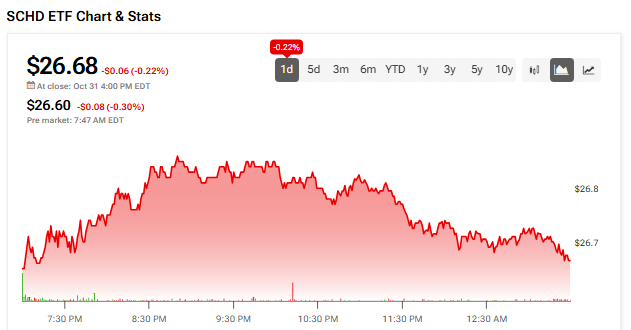

Meanwhile, the SCHD is down 1.39% in the past five days but up 0.45% year-to-date.

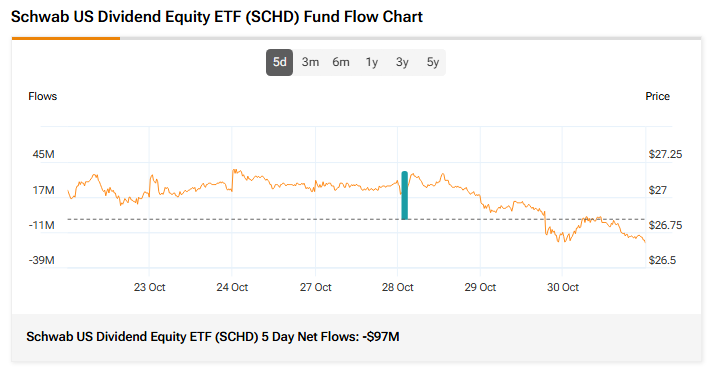

Fund Flows and Sentiment

The SCHD ETF tracks the performance of high-dividend U.S. stocks from the Dow Jones U.S. Dividend 100 Index. According to TipRanks data, SCHD recorded 5-day net flows of about -$97 million, indicating that over the last five trading days, investors withdrew more money from the SCHD ETF than they added.

SCHD’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, SCHD is a Moderate Buy. The Street’s average price target of $30.46 implies an upside of 14.17%.

Currently, SCHD’s five holdings with the highest upside potential are Coterra Energy (CTRA), FMC Corp. (FMC), AMERISAFE, Inc. (AMSF), Kforce (KFRC), and Inter Parfums (IPAR).

Meanwhile, its five holdings with the greatest downside potential are Murphy Oil Corp. (MUR), Best Buy Co. (BBY), Carter’s (CRI), Western Union (WU), and Ford Motor (F).

Revealingly, SCHD ETF’s Smart Score is seven, implying that this ETF will likely perform in line with the market.

Disclosure