Michael Burry Breaks Silence with Explosive ’Bubble’ Warning - Is He Shorting the Market Again?

Legendary investor Michael Burry just dropped a market bomb after two years of radio silence.

The Big Short architect's ominous 'bubble' warning sends shivers through traditional finance circles

Burry's Track Record Speaks Volumes

The man who famously predicted the 2008 housing collapse doesn't issue warnings lightly. His latest cryptic market message has everyone scrambling to decode the implications.

Short Selling Suspicious Mount

Market watchers are digging through filings, searching for clues about whether Burry's putting his money where his mouth is. The timing couldn't be more provocative - just when Wall Street thought they'd heard the last from him.

Traditional finance never learns - they keep cycling between irrational exuberance and panic while crypto builds the actual future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

His post read, “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” Burry also changed his profile name to “Cassandra Unchained,” referencing the Greek mythological figure cursed to make true predictions that no one WOULD believe, a fitting parallel to Burry’s history of issuing ignored but accurate warnings.

Is Michael Burry Shorting the Market?

Burry ROSE to fame for shorting the U.S. housing market in the mid-2000s, earning billions for himself and his investors when the bubble burst in 2008. He analyzed the risky subprime mortgages and used credit default swaps to bet against the housing market. This contrarian bet was famously depicted in the book and film The Big Short.

Although Burry has not specified which “bubble” he sees now, much speculation points to the technology sector and its massive bets on artificial intelligence (AI). His latest comments suggest that he is currently neither shorting nor buying the market, opting instead to remain on the sidelines.

The surging demand for AI chips has boosted Nvidia’s (NVDA) market capitalization to over $5 trillion as of October 29, greater than the GDPs of countries like India, Japan, and Germany. Several experts have warned that an “AI bubble” may be forming as companies pour billions into data centers and AI infrastructure.

Bulls vs. Bears

Burry’s warning comes amid heated debate over whether the big AI-driven boom in tech stocks is real progress or just a risky bubble. Critics say inflated valuations could trigger a sharp correction, while others argue that strong revenues and cash flows justify current pricing.

The three major U.S. indexes are also witnessing massive rallies. Year-to-date, the S&P 500 (SPX) has gained nearly 16%, the Dow Jones Industrial Average (DJIA) is up 11.7%, and the tech-heavy Nasdaq 100 (NDX) has surged 24.3%.

What Are Burry’s Current Portfolio Holdings?

This year, Burry’s investment approach has shifted from outright bearishness to a more balanced stance. Scion Asset Management, his investment firm, liquidated nearly all its holdings in the first quarter before taking new positions later.

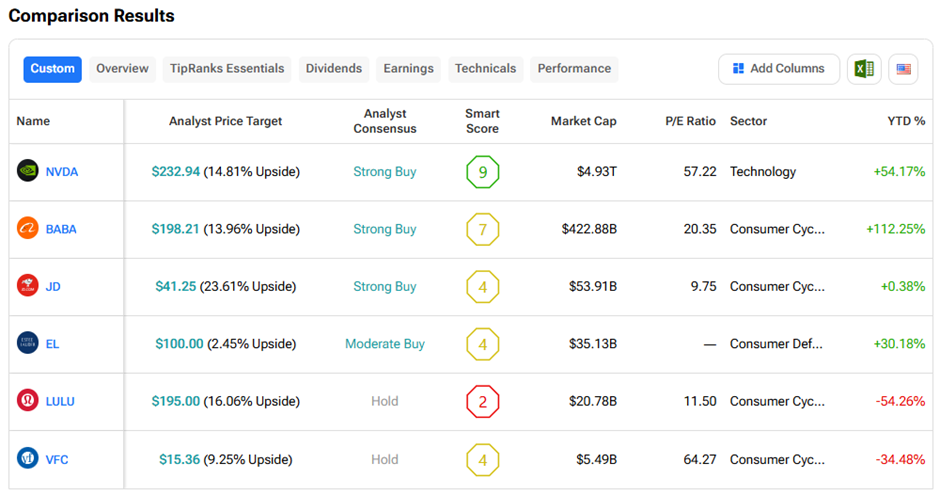

At the end of March, Scion held seven positions, including bets against Alibaba (BABA), JD.com (JD), and Nvidia (NVDA), along with shares in Estée Lauder (EL). By the end of the June quarter, its holdings had expanded to 15, with positions in Estée Lauder, Lululemon (LULU), Alibaba, JD.com, and VF Corp. (VFC).

Let’s see how these stocks perform on TipRanks Stock Comparison Tool: