LivLive ($LIVE) Surges: The Crypto Primed to Challenge TON and SHIB in Race to $1

Forget the usual suspects—LivLive is rewriting the crypto playbook this month.

The Underdog's Ascent

While TON and SHIB dominate headlines, LivLive's infrastructure quietly positions it as the dark horse in the race toward that magical dollar mark. The project's tokenomics bypass traditional inflation traps that plague meme coins.

Market Mechanics Unleashed

LivLive's protocol cuts through blockchain congestion with efficiency that makes established players look like dial-up in a fiber-optic world. The burn mechanism systematically reduces supply while demand accelerates—basic economics that somehow still surprises Wall Street analysts.

The $1 Horizon

With trading volume exploding and developer activity hitting unprecedented levels, LivLive demonstrates what happens when utility meets market timing. The project's governance model gives holders actual influence—unlike those 'community-driven' tokens where whales call all the shots.

Another day, another crypto promising to revolutionize finance while traditional bankers still struggle with PDF attachments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Schneider said investor expectations are high after a series of AI announcements and product updates from Nvidia’s recent GTC event, but strong data center growth and rising demand for AI systems should help the company deliver another solid performance.

Analyst Highlights What to Watch on November 19

The analyst said investors will look for more detail during the earnings call on Nvidia’s $500 billion data center forecast, the timing of OpenAI’s chip deployments in 2026, and the rollout of next-generation Rubin chips, which are expected to drive growth in 2026 and beyond. These updates, he said, will show how Nvidia plans to maintain its lead in the fast-moving AI chip market.

Schneider also noted that investors will be watching for any update on Nvidia’s business in China, which remains affected by U.S. export limits. Any sign of recovery in that region could add to future growth.

Overall, the analyst said Nvidia continues to lead the AI chip industry, supported by its scale, innovation, and strong customer base across enterprise and cloud computing.

What Is the Target Price for Nvidia Stock?

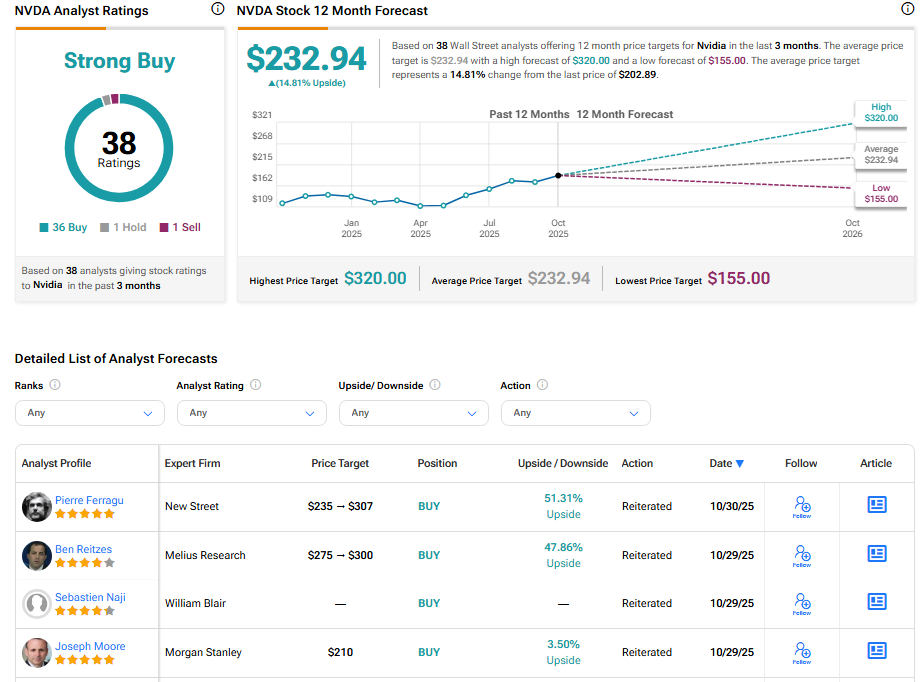

On TipRanks, NVDA stock has received a Strong Buy consensus rating, with 36 Buys, one Hold, and one Sell assigned in the last three months. The average Nvidia stock price target is $232.94, suggesting an upside potential of 14.81% from the current level.