Guardant Health Stock (GH) Explodes 30% - Here’s What Rocketed This Biotech Play

Biotech stunner Guardant Health just delivered the kind of single-day surge that makes traditional finance guys spill their morning coffee.

The Catalyst Unleashed

GH shares ripped higher by exactly 30% - a move that would take most blue-chips three years to achieve. The surge came on volume that dwarfed typical trading activity, signaling institutional money chasing the momentum.

Breaking Down the Rocket Fuel

While the precise trigger remains officially undisclosed, market participants point to developments that could reshape the cancer diagnostics landscape. The company's liquid biopsy technology represents the bleeding edge of medical innovation - exactly the kind of disruptive play that gets growth investors salivating.

Street Reaction and What's Next

Analysts scrambled to update models while short sellers nursed brutal mark-to-market losses. The 30% gain puts GH in rarified air among mid-cap biotechs, though skeptics note this smells suspiciously like the kind of volatility that gives CFOs ulcers.

One thing's certain - when a stock moves this much this fast, you're either witnessing genius or gambling disguised as investing. In today's market, sometimes the line gets blurrier than a doctor's handwriting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Jumps 39%

Guardant Health posted a strong Q3 performance, with revenue up 39% year-over-year to $265.2 million. Segment-wise, Oncology revenue grew 31% to $184.4 million, driven by a 40% increase in test volume, while Shield screening revenue came in at $24.1 million, reflecting growing demand for early cancer detection.

Importantly, the company achieved positive free cash FLOW in its core business one quarter ahead of schedule.

Coming to the bottom line, the company reported a net loss of $0.74 per share compared with analysts’ expectations of a loss of $0.79.

Guidance Raise Fuels Optimism

Guardant Health lifted its full-year revenue guidance to a range of $965 million to $970 million, up from the prior range of $915 million to $925 million. The new guidance represents an annual growth of nearly 31%.

The upbeat outlook signals continued strength across its oncology, screening, and biopharma businesses.

UBS Analyst Assigns New Street-High Price Target

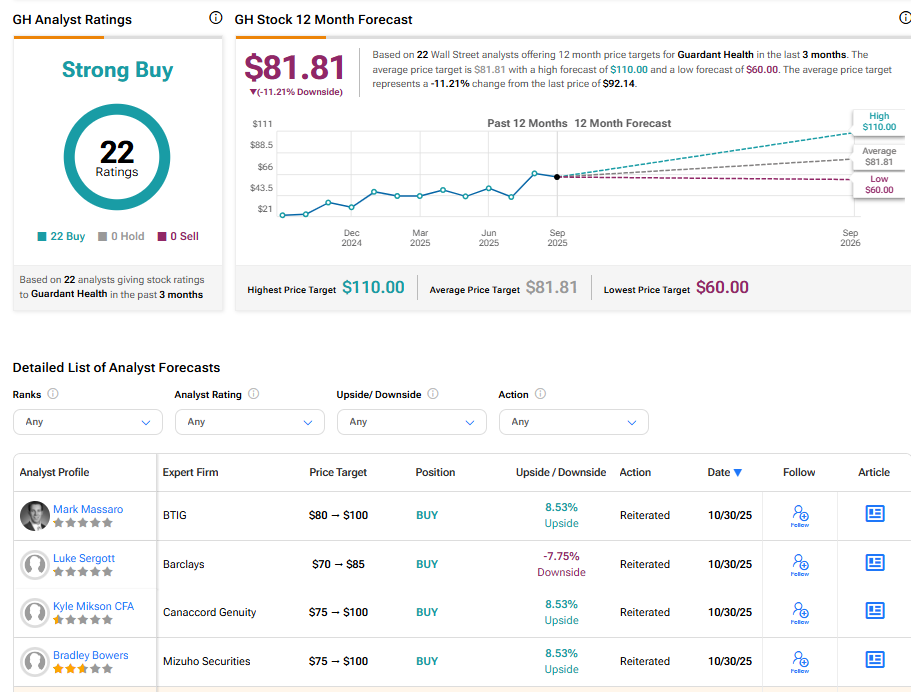

Following the news, UBS analyst Dan Leonard raised Guardant Health’s price target to a new Street-high of $110 (19.4% upside) from $80 and kept a Buy rating. After another strong quarter, the Top analyst sees several growth drivers ahead for the company.

Is GH Stock a Good Buy?

Currently, Wall Street has a Strong Buy consensus rating on GH stock based on 22 unanimous Buys assigned in the past three months. The average Guardant Health stock price target of $81.81 indicates an 11.21% downside risk from current levels.