SharpLink Shakes Crypto Markets: $200 Million Ethereum Exodus to This Altcoin!

Massive whale movement rocks cryptocurrency space as SharpLink announces strategic pivot.

The Great Migration Begins

SharpLink's bombshell announcement sends shockwaves through DeFi circles—$200 million worth of Ethereum poised for transfer to an undisclosed altcoin. Market analysts scramble to decode the implications of this monumental portfolio reallocation.

Strategic Shift or Desperate Gamble?

The timing couldn't be more provocative. While traditional finance wrestles with quarterly earnings reports and Azure outages, crypto's big players continue rewriting the rulebook. Two hundred million dollars doesn't just change wallets—it potentially reshapes entire ecosystems overnight.

Market Impact and Speculation

This isn't just another token swap. When institutional money moves this decisively, the entire altcoin market holds its breath. The question isn't whether prices will fluctuate—but which projects will survive the resulting tidal wave of capital reallocation.

Another day, another nine-figure bet that traditional finance will keep pretending blockchain is just for buying coffee loyalty points.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Users on social media worldwide are reporting problems accessing Microsoft sites and services, and the company’s website was down at noon hour. Management at Microsoft acknowledged on social media that issues are occurring with both Azure and 365 ahead of the Q3 print.

“We’re investigating an issue impacting several Azure services,” said Microsoft, adding that “customers may experience issues when accessing services. Updates are provided via the Azure status… More information will be provided within 60 minutes or sooner.”

Other Outages

The problems at Microsoft come a week after rival Amazon Web Services (AMZN) reported a major outage that temporarily took down its cloud-computing infrastructure and numerous websites associated with the e-commerce company. On Oct. 20, Amazon Web Services experienced “increased error rates” for customers when trying to access the popular cloud portal.

Amazon Web Services leads in cloud infrastructure with a 32% share of the market. Microsoft’s Azure is second at 23%, followed by Google’s (GOOGL) cloud unit at 10%. Azure and Google Cloud have been growing at a fast clip in recent years, driven by a boom in artificial intelligence (AI) workloads.

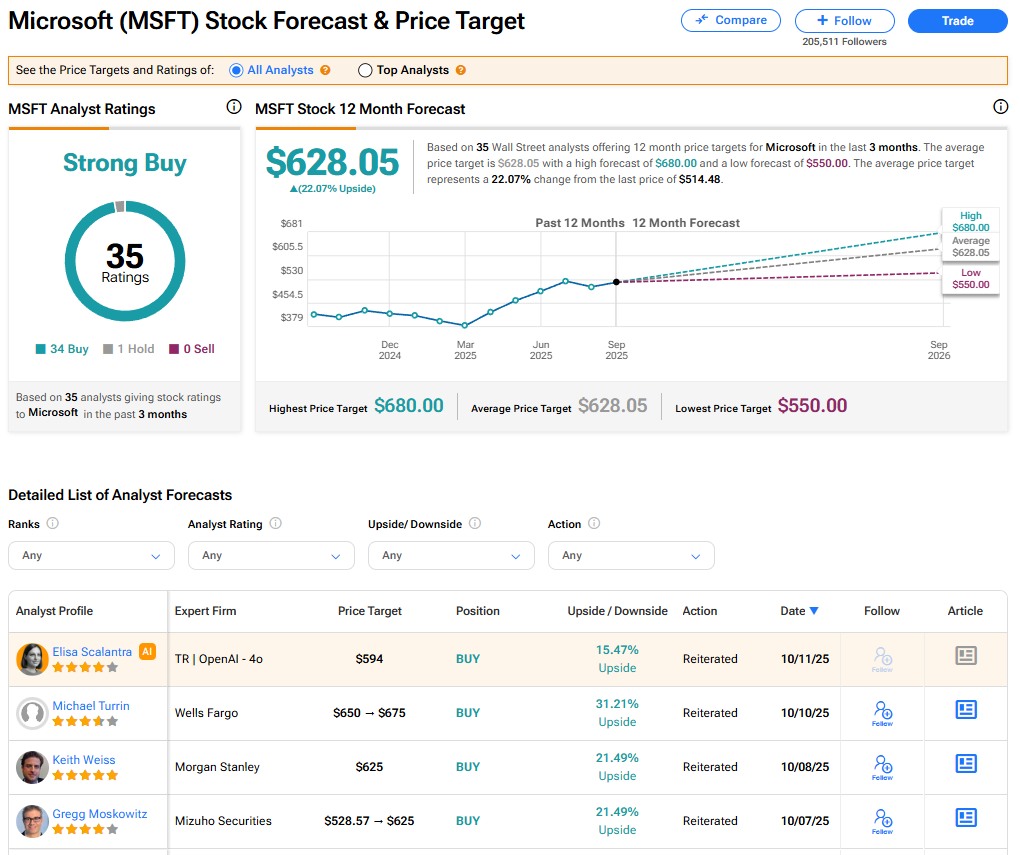

Is MSFT Stock a Buy?

Microsoft’s stock has a consensus Strong Buy rating among 35 Wall Street analysts. That rating is based on 34 Buy and one Hold recommendations issued in the last three months. The average price target on MSFT stock of $628.05 implies 22.07% upside from current levels.