Meta’s $25 Billion Bond Blitz Fuels AI Arms Race Spending Spree

Zuckerberg bets big on artificial intelligence—and Wall Street's footing the bill.

The AI Gold Rush

Meta's tapping debt markets for a whopping $25 billion just as the company doubles down on artificial intelligence infrastructure. They're not just dipping toes—they're diving headfirst into the computing arms race that's consuming Silicon Valley.

Bond Market Bonanza

While tech giants battle for AI supremacy, traditional financing gets a workout. Corporate debt becomes the fuel for the algorithm wars—because why use your own cash when investors will happily fund your moonshot?

Wall Street's apparently decided that funding Meta's AI dreams beats actually understanding what the technology does—classic finance move of throwing money at buzzwords and hoping something sticks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Bloomberg, Meta’s bonds could be issued in as many as six parts, with terms ranging from five to 40 years. Notably, the 40-year bond may yield about 1.4% more than Treasury bonds, with proceeds going toward general business needs. It’s also worth mentioning that Meta’s growing investment in AI is being used to improve its major platforms like Facebook and Instagram. To support this, the company needs to build a lot of infrastructure, particularly data centers.

Therefore, on Wednesday, Meta stated it expects to spend up to $72 billion on capital expenses in 2025 and that this spending will increase even further in 2026. However, despite these investments, Meta’s stock tanked on Thursday due to investor worries over rising costs and lower near-term returns. Separately, Meta also raised about $30 billion for a data center project in rural Louisiana, with help from Blue Owl Capital (OWL) and Pimco. Interestingly, Blue Owl owns 80% of the project, while Meta owns the rest.

Is Meta a Buy, Sell, or Hold?

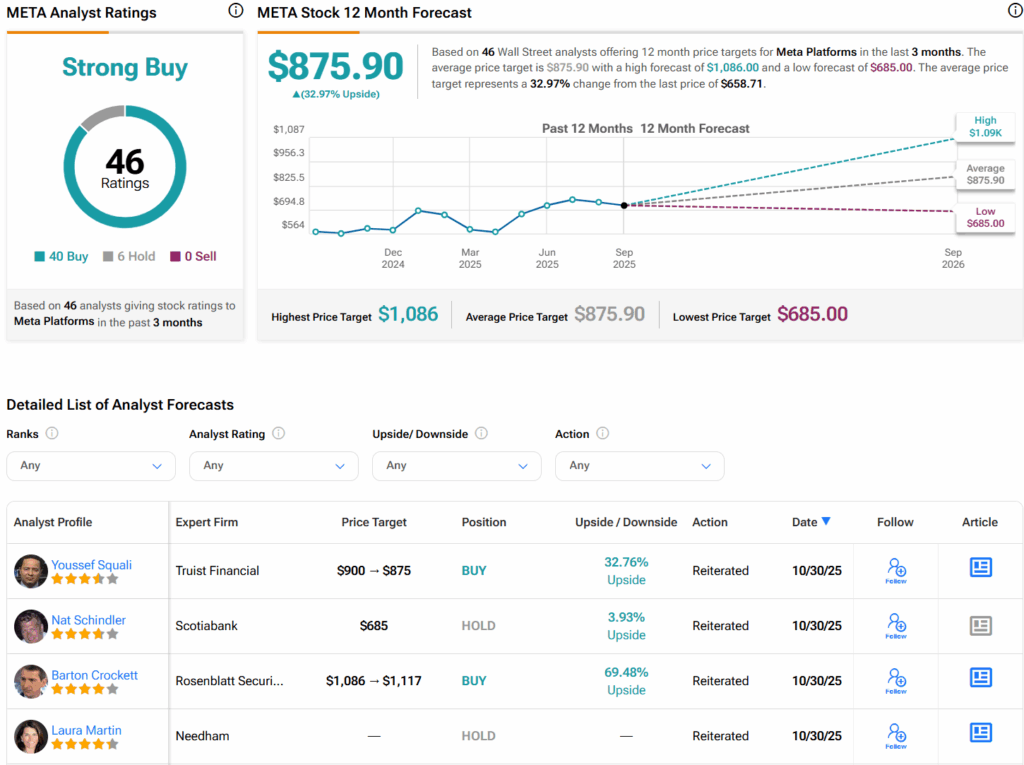

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 40 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $875.90 per share implies 33% upside potential.